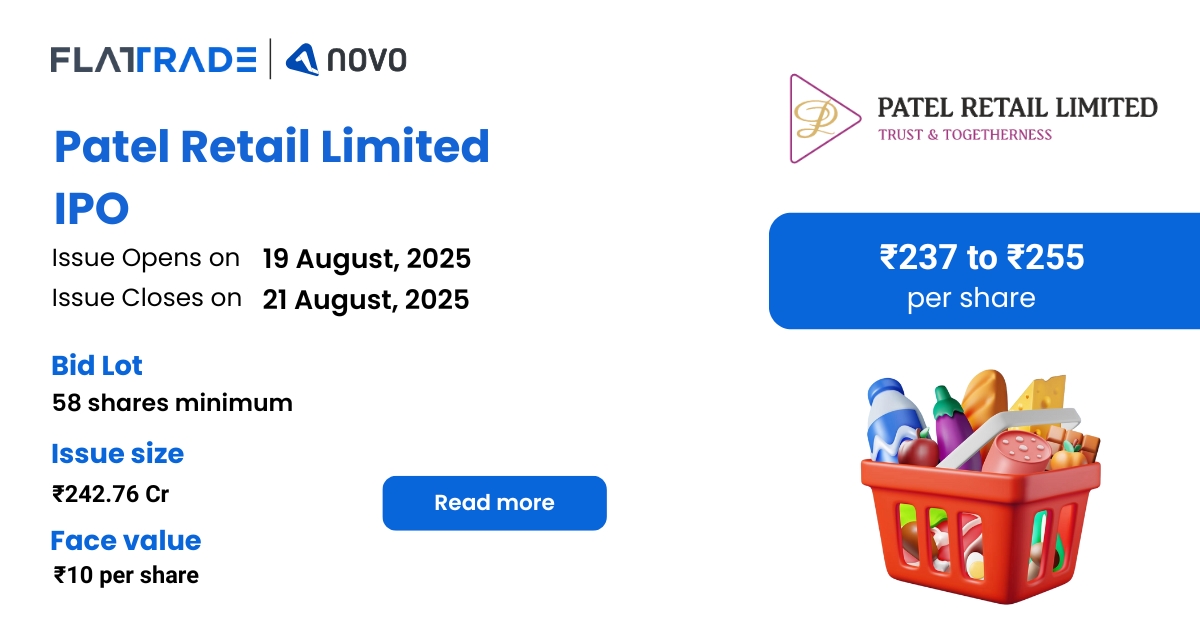

Patel Retail IPO is a bookbuilt issue of ₹242.76 crore. It combines a fresh issue of 0.85 crore shares aggregating to ₹217.21 crore and an offer for sale of 0.10 crore shares aggregating to ₹25.55 crore.

The IPO opens for subscription on August 19, 2025, and closes on August 21, 2025. The allotment is expected to be finalized on Friday, August 22, 2025. The price band for the IPO is set at ₹237 to ₹255 per share, and the minimum lot size for an application is 58 shares.

Company Summary

Incorporated in 2008, Patel Retail Limited is a retail supermarket chain that operates primarily in tier-III cities and nearby suburban areas. The stores offer a wide range of products, including food, non-food (FMCG), general merchandise, and apparel.

The company opened its first store under the brand name “Patel’s R Mart” in Ambernath, Maharashtra. As of May 31, 2025, the company operated 43 stores across the suburban areas of Thane and Raigad districts in Maharashtra, with a total retail area of approximately 1,78,946 sq. ft.

To enhance margins and brand recognition, Patel Retail Limited has launched private label products such as “Patel Fresh” (pulses and ready-to-cook items), “Indian Chaska” (spices, ghee, and papad), “Blue Nation” (men’s wear), and “Patel Essentials” (home improvement items).

Patel Retail Limited positions its stores as neighbourhood supermarkets catering to both daily needs and bulk shopping. In addition to its core retail activity, the company also generates rental income through vendor arrangements within its stores.

As of May 31, 2025, it has 38 product categories across 10,000 SKUs. Its products are distributed across various states, with the majority of sales originating from Maharashtra and Gujarat.

Manufacturing Facilities

Patel Retail Limited manages three main facilities supporting its retail and private label operations.

- Facility 1 (Ambernath, Maharashtra): This location handles processing, quality checks, and packaging of private label products such as pulses, ready mixes, and select grocery items.

- Facility 2 (Dudhai, Kutch, Gujarat): This production unit processes agri-products like peanuts, coriander seeds, and cumin seeds, serving as a key component of the company’s backward integration strategy.

- Facility 3 (Agri-Processing Cluster, Dudhai, Kutch, Gujarat): Spread over 15.925 acres, this integrated agri-cluster includes five production units, a fruit pulp processing unit, a dry warehouse (3,040 MT capacity), a cold storage facility (3,000 MT capacity), and an in-house testing and research laboratory.

These facilities are collectively referred to as the Manufacturing Facilities, while Facility 2 and the Agri-Processing Cluster together are known as the Kutch Facilities.

Company Strengths

- Deep knowledge and understanding of optimal product assortment and inventory management using IT systems

- Steady footprint expansion using a distinct store acquisition strategy and ownership model

- Logistics and distribution network with its own fleet of 18 trucks

- Diversified product portfolio

- Strategically located manufacturing facilities

Company Financials

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 382.86 | 333.02 | 303.12 |

| Revenue | 825.99 | 817.71 | 1,019.8 |

| Profit After Tax | 25.28 | 22.53 | 16.38 |

| EBITDA | 62.43 | 55.84 | 43.24 |

| Net Worth | 134.57 | 94.4 | 71.87 |

| Total Borrowing | 180.54 | 185.75 | 182.81 |

| Amount in ₹ Crore | |||

Objectives of IPO

- Repayment/prepayment, in full or part, of certain borrowings availed of by the Company.

- Funding of the working capital requirements of the Company.

- General corporate purposes.

Promoters of the company

Dhanji Raghavji Patel, Bechar Raghavji Patel, Hiren Bechar Patel and Rahul Dhanji Patel are the company promoters.

IPO Details

| IPO Date | August 19, 2025 to August 21, 2025 |

| Listing Date | August 26, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹237 to ₹255 per share |

| Lot size | 58 shares |

| Total Issue size | 95,20,000 shares (aggregating upto ₹242.76 Cr ) |

| Fresh Issue | 84,67,000 shares (aggregating upto ₹215.91 Cr ) |

| Offer for Sale | 10,02,000 shares of ₹10 (aggregating upto ₹25.55 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 2,48,82,528 shares |

| Share Holding Post Issue | 3,34,00,528 shares |

Category Reservation

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

| Only RII | Up to Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only employee | Upto Rs 2 lakhs | Yes |

| Employee + RII/NII | 1. Employee limit: Upto Rs 2 lakhs (In certain cases, employees are given a discount if the bidding amount is up to Rs 2 Lakhs) 2. If applying as RII: Up to Rs 2 Lakhs 3. If applying as NII: sNII > Rs 2 Lakhs and up to Rs 10 Lakhs, and bNII > Rs 10 lakhs | Yes for Employee and RII/NII |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 58 | ₹14,790.00 |

| Retail (Max) | 13 | 754 | ₹1,92,270.00 |

| S-HNI (Min) | 14 | 812 | ₹2,07,060.00 |

| S-HNI (Max) | 67 | 3886 | ₹9,90,930.00 |

| B-HNI (Min) | 68 | 3944 | ₹10,05,720.00 |

Allotment Schedule

| Basis of Allotment | Fri, 22 Aug, 2025 |

| Initiation of Refunds | Mon, 25 Aug, 2025 |

| Credit of Shares to Demat | Mon, 25 Aug, 2025 |

| Tentative Listing Date | Tue, 26 Aug, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 21, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 30% of the Net Offer |

| Retail Shares Offered | Not less than 45% of the Net Offer |

| NII Shares Offered | Not less than 25% of the Net Offer |

To check allotment, click here