POST MARKET

Indian equity indices ended low, extending their losing streak to the second session as investors continued to sell off as U.S. President Donald Trump’s 50 percent tariff came into effect.

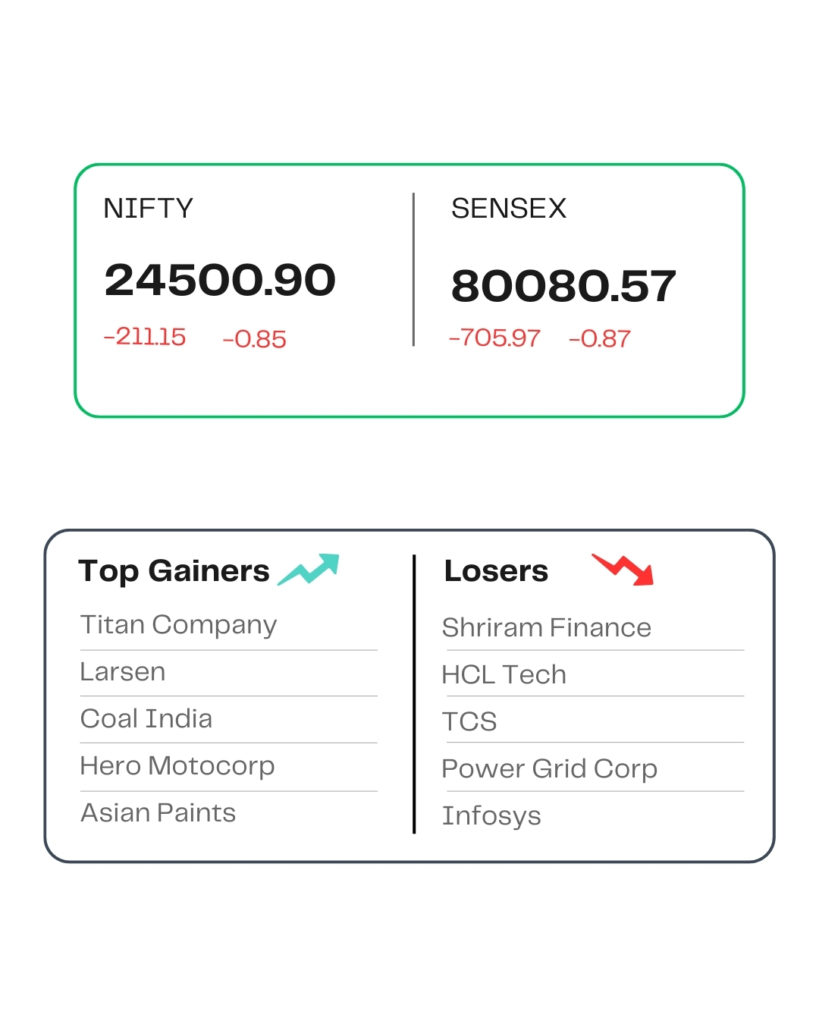

At close, the Sensex was down 705.97 points or 0.87 percent at 80,080.57, and the Nifty was down 211.15 points or 0.85 percent at 24,500.90. About 1409 shares advanced, 2501 shares declined, and 142 shares were unchanged.

Biggest Nifty losers included Shriram Finance, HCL Technologies, TCS, Power Grid Corporation, Infosys, while gainers were Titan Company, L&T, Coal India, Asian Paints, Hero MotoCorp.

Among sectors, except Consumer Durables, all other sectoral indices ended in the red with bank, IT, realty, FMCG, and telecom down 1% each.

Among the broader market indices, the BSE Midcap Index shed 1 percent, and the Smallcap Index declined 0.9 percent.

STOCKS TODAY

Ola Electric

Shares jumped as much as 15 percent after the company said all seven S1 Gen 3 scooters had received PLI certification. Gen 3 models account for over half of its sales, making the approval crucial. With both Gen 2 and Gen 3 scooters now eligible for incentives of 13 to 18 percent of sales value till 2028, the company expects profitability to improve from this quarter as it targets turning its auto business EBITDA positive.

Interglobe Aviation

Shares of the parent of budget airline IndiGo saw their shares sink over 5 percent as the Rakesh Gangwal family likely pared its stake via the block deal route. Earlier, reports noted that the Rakesh Gangwal family plans to sell up to 3.1 percent stake in InterGlobe Aviation through block deals estimated at about Rs 7,020 crore, according to a CNBC Awaaz report citing sources. The block was expected to be at a floor price of Rs 5,808 per share.

Vodafone Idea

Shares extended losses for the third straight day after government ruled out extending any relief package to the struggling telecom operator, and Macquarie gave an ‘underperform’ call. The Department of Telecommunications (DoT) has no plans to offer additional concessions to Vodafone Idea beyond the relief measures already granted, according to Minister of State for Communications Chandra Sekhar Pemmasani.

Dr. Agarwal’s Eye Hospital

The stock price fell as much as 18 percent on August 28, after the company announced a merger with Dr. Agarwal’s Healthcare. The merger is expected to streamline operations and provide unified management focus, driving efficiency and strategic alignment.

SMS Pharmaceuticals

Share price rose over 10 percent before ending over 2 percent lower on August 28 after the company received an Establishment Inspection Report (EIR) with a No Action Indicated status for its Central Laboratory Analytical Services in Hyderabad. The inspection, carried out from June 23 to June 25, 2025, concluded with zero Form 483 observations.

Waaree Energies

The share price hit an eight-month high of Rs 3,366.50 per share on the BSE, gaining 3 percent on August 28. The company, through its wholly owned subsidiary Waaree Solar Americas, received an international order to supply 452 megawatt (MW) solar modules to a leading US-based developer.

Source – Money Control