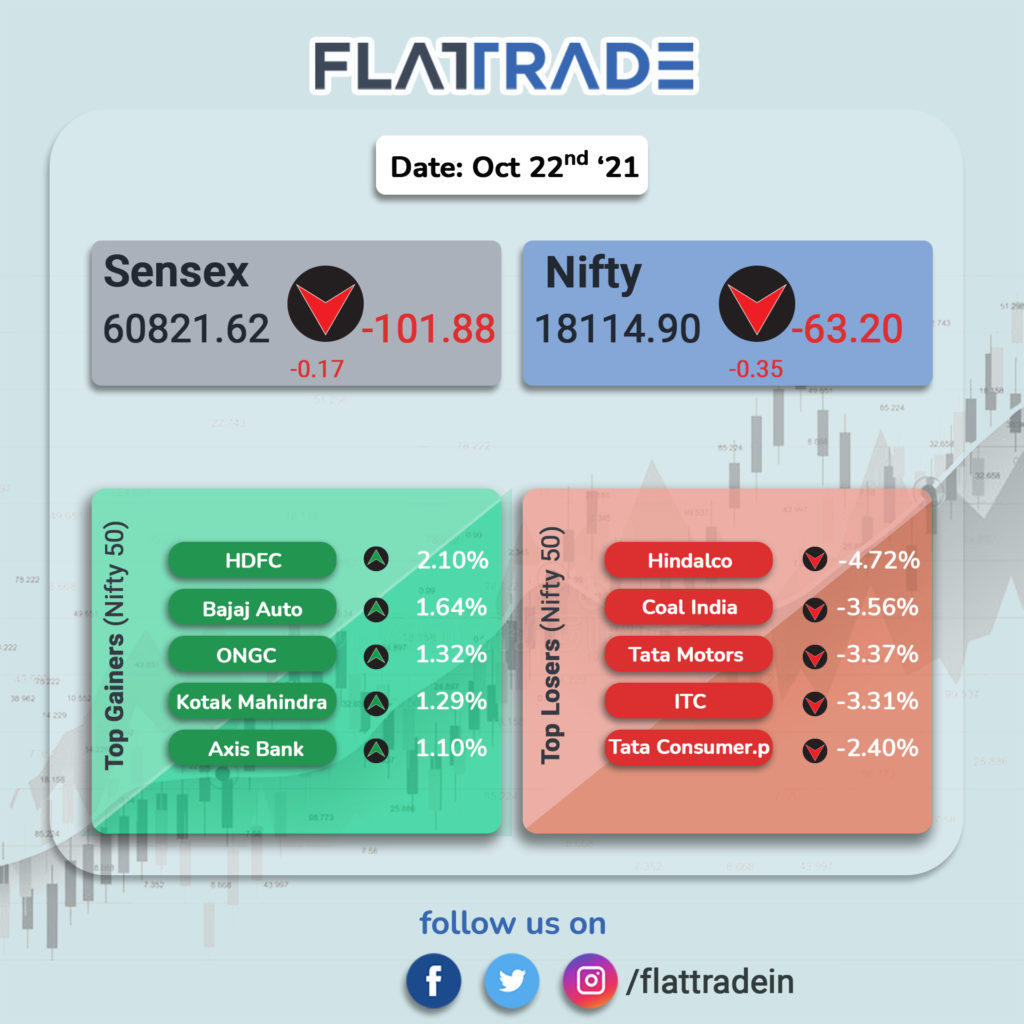

Benchmark equity indices extended losses and closed lower, weighed by metal, pharma, IT, FMCG stocks. The Sensex ended 0.17% lower at 60821.62 and Nifty closed 0.35% down at 18114.90.

Top 3 laggards among sectors were Nifty Metal (-3.04%), Phama (-1.55%), IT (-1.44%). Top gainers were Nifty Private Bank (0.99%), Nifty Bank (0.73%) and Financial Services (0.59%).

Indian rupee fell 3 paise to 74.89 against the US dollar.

Stock in News Today

HDFC Life Insurance: The company posted a decline of 15.83% in its consolidated net profit to Rs 275.91 crore in the second quarter of FY22, as against a net profit of Rs 327.83 crore in the year-ago period. Total income of the insurer during the quarter rose to Rs 20,478.46 crore, compared with Rs 16,426.03 crore in the year-ago period. The net premium income increased to Rs 11,445.53 crore in Q2FY22, from Rs 10,056.71 crore in the year-ago period.

LIC Housing Finance Ltd: Shares of the company fell 7.77% as the company reported decline in NII and Net profit in the second quarter of FY22. It consolidated net interest income (NII) was down 5% YoY at Rs 1,212.5 crore, as against Rs 1,277.48 crore. Net profit was down 68% YoY to Rs 249.74 crore in the reported quarter, as against Rs 789.55 crore.

YES Bank: The private-sector lender posted a 74% jump in net profit at Rs 226 crore in Q2FY22, as against Rs 129 crore in the year-go period. Net interest income declined 23% to Rs 1,512 crore in the reported quarter, as against Rs 1,973 crore in the same period last year. Net Non-Performing Assets fell to 5.55% in the quarter, as compared to 5.78% in the previous quarter of FY22.

Future Retail, Reliance Industries: The Singapore-based arbitrator, SIAC, has rejected Future Retail’s request to lift the interim stay on its Rs 24,713-crore deal with Reliance Retail, giving a major relief to the US-based e-commerce company Amazon which is contesting the transaction, according to its regulatory filing. The company added that it would be deciding on its future course of action based on the legal advice and available remedies in law.

Federal Bank: The Kerala-based lender reported a 54.58% rise in its consolidated net profit to Rs 488 crore in Q2FY22, from Rs 315.7 crore in the year-ago period. However, total income (consolidated) during the period fell to Rs 4,013.46 crore, from Rs 4,071.35 crore in the same period last fiscal. Net NPAs rose to 1.15% in the quarter, from 0.99% in the year-ago period. Shares ended 7.77% higher at Rs104.05.

Inox Leisure: The multiplex operator’s net loss increased to Rs 87.66 crore in Q2FY22, from a net loss of Rs 67.83 crore in the year-ago period, due to the impact of film distribution as restrictions were imposed after the second wave of COVID-19. Operating revenue jumped to Rs 47.44 crore in the reported quarter, from Rs 36 lakh in Q2FY21. Last fiscal the theaters were completely closed due to the first wave of the pandemic. Total expenses in the second quarter was Rs 170.22 crore, as against Rs 95.29 crore in the same period last fiscal.

Hindustan Zinc: Shares of the company fell nearly 6% after the company reported lower-than-expected net profit in the quarter ended September. Net profit rose to Rs 2017 crore in Q2FY22 from 1940crore in the year-ago period. Operating revenue increased to Rs 5958 crore in the reported quarter from Rs 5533 crore in the corresponding quarter last year.

KEC International Ltd: Shares of the company closed 5.5% higher after the company said it has bagged orders worth Rs 1,829 crore across its various businesses. It said that its transmission and distribution business secured orders of Rs 656 crore in Europe and Americas, while railways business won orders worth Rs 144 crore in emerging metro segments in India.

Biocon: The biotech company said its consolidated net profit rose 11% to Rs 188 crore in the September-ended quarter, compared to Rs 169 crore in the corresponding period last year. Its consolidated revenue rose 10% to Rs 1,945 crore in Q2FY22 on a year on year basis. The

Adani Green Energy Ltd (AGEL): The company’s subsidiary Adani Renewable Energy Holding Fifteen will set up a 450 MW wind energy project, after it received a letter of award (LOA). The fixed tariff for this project capacity is Rs 2.70/ kWh for 25 years. With this project, AGEL has a total renewable energy project portfolio of 20,284 MWac capacity.