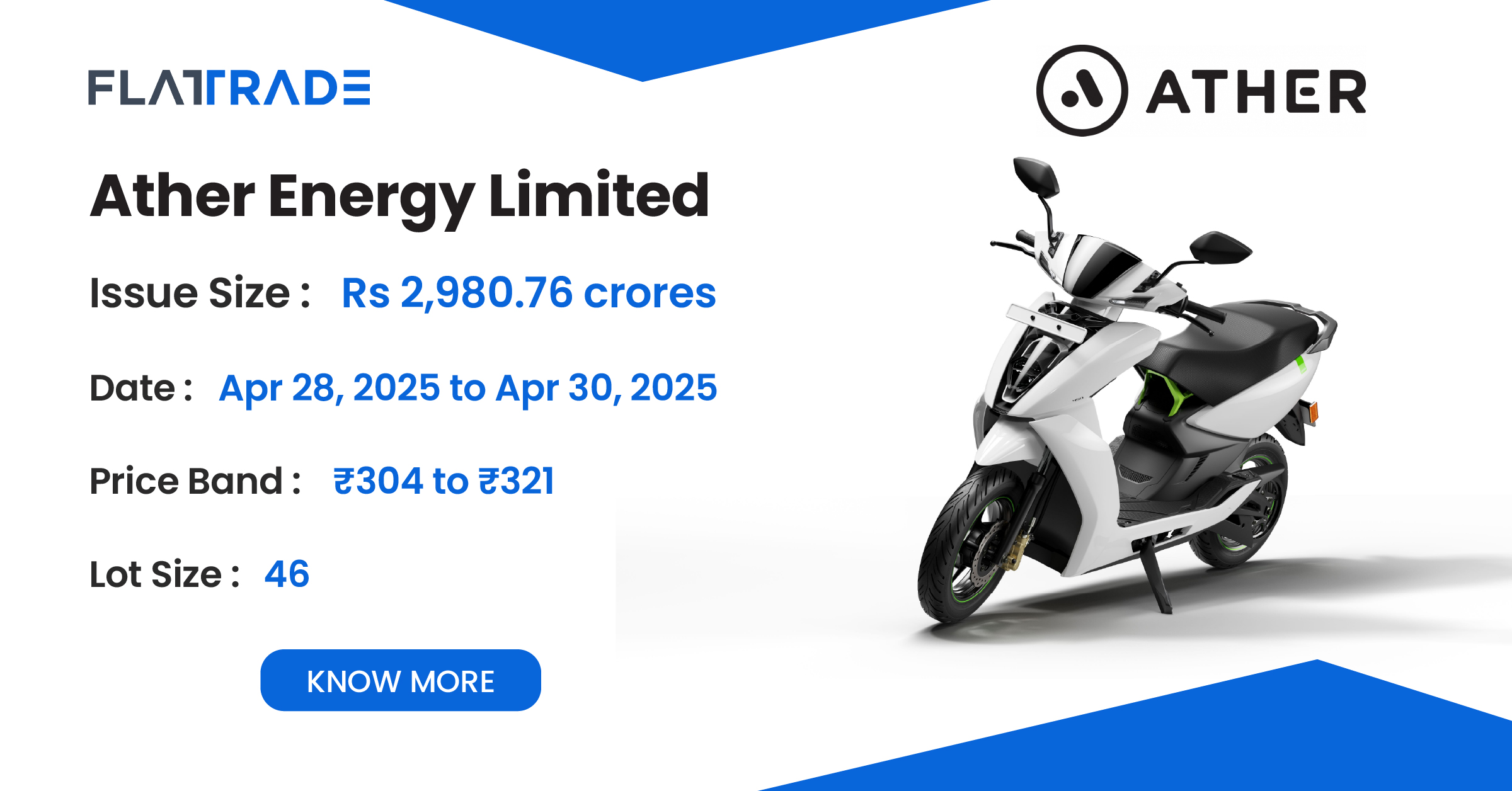

Ather Energy IPO is a book-built issue of Rs 2980.76 crores. It combines a fresh issue of 8.18 crore shares aggregating Rs 2,626.00 crores and an offer for sale of 1.11 crore shares aggregating Rs 345.76 crores.

The IPO bidding opens for subscription on April 28, 2025, and will close on April 30, 2025. The allotment is expected to be finalized on May 2, 2025. The price band for the IPO is set at ₹301 to ₹321 per share, and the minimum lot size for an application is 46 shares.

Company Summary

Ather Energy Limited, Incorporated in 2013, is involved in the design, development, and in-house assembling of electric scooter battery packs, charging infrastructure, and supporting software systems.

The company’s product portfolio includes Ather Grid, a public fast-charging network for two-wheelers, and Atherstack, a proprietary software platform with 64 connected features as of July 2024.

As of February 28, 2025, globally, the company had 303 registered trademarks, 201 registered designs and 45 registered patents, in addition to pending applications for 102 trademarks, 12 designs and 303 patents.

As of December 31, 2024, we had 265 experience centres and 233 service centres in India, five experience centres and four service centres in Nepal, and ten experience centres and one service centre in Sri Lanka.

As of March 31, 2024, Ather Energy employed 2,454 people, including 1,458 on-roll employees and 996 off-roll staff.

Company Strengths

The company has in-house R&D that helps in delivering innovative features like touchscreen dashboards.

This growing demand and consumer preference for electric vehicles offer good opportunities for companies like Ather Energy to expand their business and gain market share.

The company’s emphasis on quality enables it to be marketed as a premium product and sell it at a premium price as well

Manufacturing has expanded to 2,66,850 E2Ws per year by 2024.

India’s 2w (two-wheeler) market is expected to grow at a CAGR of 7-8% between FY24 and FY31 to reach a market size of up to 3 crore.

Company Financials

Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 2,172 | 1913.5 | 1976.8 | 818.6 |

Revenue | 1,617.4 | 1,789.1 | 1,801.8 | 413.8 |

Profit After Tax | -577.9 | -1,059.7 | -864.5 | -344.1 |

Net Worth | 108 | 545.9 | 613.7 | 224.9 |

Reserves and Surplus | 3,346.6 | 545.1 | 613.1 | 224.2 |

Total Borrowing | 1,121.6 | 314.9 | 485.2 | 298.4 |

Objectives of the issue

The Net Proceeds from the Issue are to be utilized towards the following objects:

- Capital expenditure to be incurred by the Company for the establishment of an E2W factory in Maharashtra, India.

- Repayment/ pre-payment, in full or part, of certain borrowings availed by the Company.

- Investment in research and development.

- Expenditure towards marketing initiatives.

- General Corporate Purposes

IPO details

IPO Date | April 28, 2025 to April 30, 2025 |

Listing Date | May 6, 2025 |

Face Value | ₹1 per share |

Price Band | ₹304 to ₹321 per share |

Lot size | 46 shares |

Total Issue size | 9,28,58,599 shares (aggregating up to ₹2,980.76 Cr) |

Fresh issue | 8,18,06,853 shares (aggregating up to ₹2,626.00 Cr) |

Issue type | Bookbuilding IPO |

Listing at | NSE, BSE |

Lot allocation details

Application | Lots | Shares | Amount |

Retail (Min) | 1 | 46 | ₹14,766 |

Retail (Max) | 13 | 598 | ₹1,91,958 |

S-HNI (Min) | 14 | 644 | ₹2,06,724 |

S-HNI (Max) | 67 | 3,082 | ₹9,89,322 |

B-HNI (Min) | 68 | 3128 | ₹10,04,088 |

Allottment Schedule

Basis of Allotment | Fri, May 2, 2025 |

Initiation of Refunds | Mon, May 5, 2025 |

Credit of Shares to Demat | Mon, May 5, 2025 |

Tentative Listing Date | Tue, May 6, 2025 |

Cut-off time for UPI mandate confirmation | 5 PM on April 30, 2025 |

IPO Reservation

Investor Category | Shares Offered |

QIB Shares Offered | Not less than 75% of the Net Offer |

Retail Shares Offered | Not more than 10% of the Net Offer |

NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

To check allotment, click here