Automotive dealers are expected to witness an increase in revenue by 8-10% in this financial year on the back of 5-7% rise in sales volume, increase in prices by 2-5% by original equipment manufacturers, and customers’ shift towards premium models, according to CRISIL Ratings.

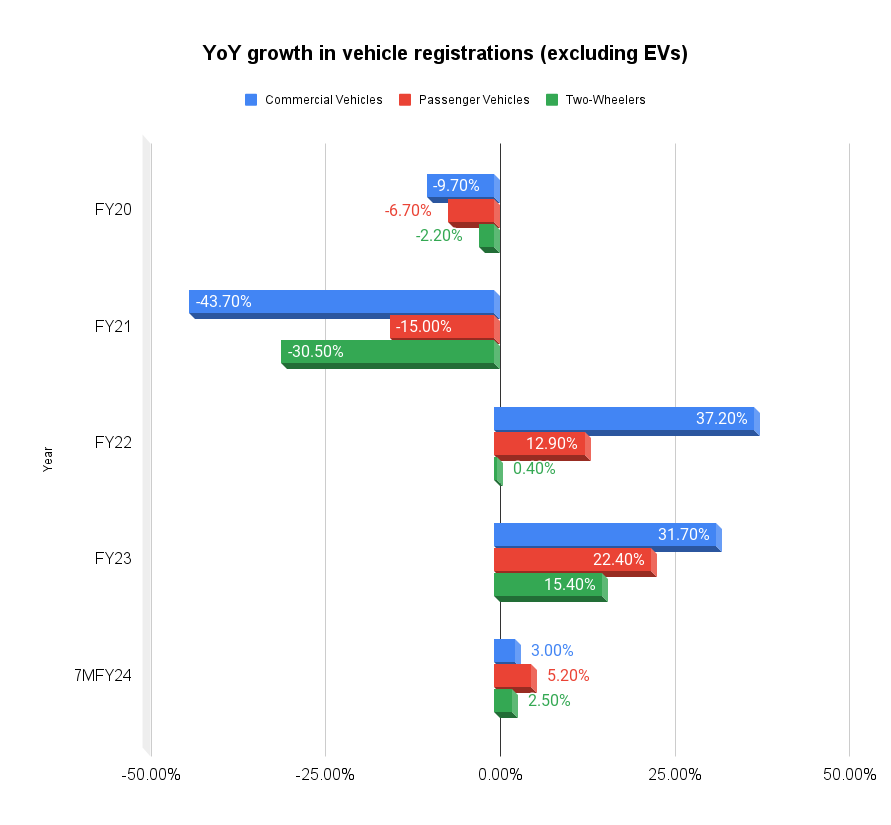

Sales volume growth is expected to soften in this financial year compared to 17.3% rise seen in the previous fiscal due to the high baseline numbers achieved last year, particularly for commercial vehicles (trucks, buses, etc.) and passenger cars, as well as other segment-specific factors. The growth rate this fiscal year will likely align with the pre-pandemic compound annual growth rate of about 7% recorded between fiscal years 2015 and 2019.

Factors contributing to higher sales across different segments

“Passenger Vehicle sales will grow 6-8%, led by improved semiconductor supplies and healthy domestic demand, especially in the fast-growing utility vehicles segment,” Mohit Makhija, Senior Director, CRISIL Ratings. Makhija added that sales volumes for commercial vehicles such as trucks and buses are expected to see moderate growth of 4-6% this fiscal year that will supported by government infrastructure spending initiatives, increased budget allocations, and ongoing replacement demand in the market.

The rating agency further said that two-wheeler sales will rise moderately at 5-6%, driven by higher demand for executive and premium motorcycles despite a low base, subdued demand from rural India and increased competition electric two-wheelers.

Retail vehicle registrations saw modest 3% growth during April-October of FY24, but the registration is expected to accelerate over the remaining five months due to higher sales of passenger vehicles and two-wheelers during festive season, also rise in commercial vehicles sales in the last quarter due to increased mining and infrastructure activities.

Source: CRISIL Ratings

In recent quarters, OEMs have increased prices by 2-5% compared to 5-14% price rise in FY2023, according to CRISIL Ratings. This, along with the full-year impact of previous years’ price increases, will also support automotive dealers’ sales growth this fiscal year. No further price increases are expected soon due to easing input prices, the rating agency noted.

The rating agency said that premiumisation will also contribute to revenue growth this fiscal. It observed that there is an increasing consumer preference for more expensive utility vehicles, motorcycles, and scooters that come equipped with premium safety features.

Stable profitability

CRISIL stated that the operating profit margins for automobile dealers are expected to remain stable at 3.5-4.0%, supported by moderate growth in revenue as well as the ongoing contribution from more lucrative ancillary sales activities like service, spare parts, and insurance. Ancillary sales are expected to contribute 10-15% of the revenue.

“Steady operating performance leading to healthy cash accrual, combined with moderate debt, will strengthen debt protection metrics of auto dealers this fiscal,” said Snehil Shukla, Associate Director, CRISIL Ratings. Shukla added that interest coverage is projected at 3.3-3.5 times compared with about 3.3 times in FY23. In addition, gearing is expected to improve to about 1 time at the end of FY24, compared with 1.2 times in FY23. However, any slow down in rural demand and inventory with dealers are key monitorables.