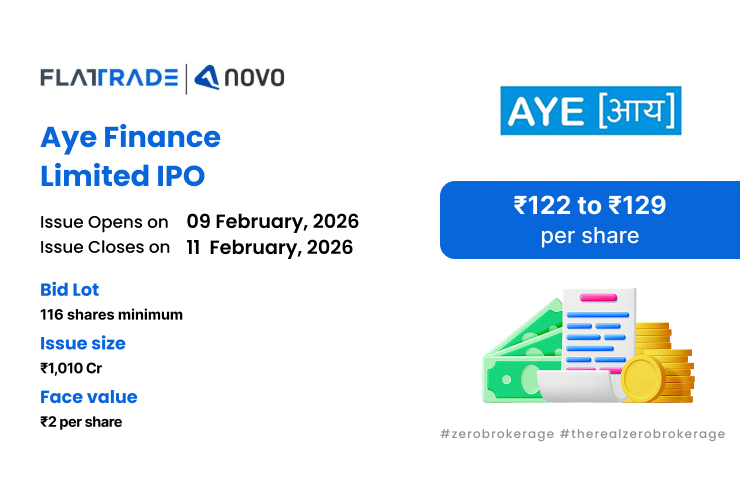

Aye Finance IPO is a bookbuilt issue of ₹1,010.00 crores. It combines a fresh issue of 5.50 crore shares aggregating to ₹710.00 crore and an offer for sale of 2.33 crore shares aggregating to ₹300.00 crore.

The IPO opens for subscription on February 09, 2026 and closes on February 11, 2026. The allotment is expected to be finalised on Thursday, February 12, 2025. The price band for the IPO is set at ₹122 to ₹129 per share, and the minimum lot size for an application is 116 shares.

Company Summary

Incorporated in 1993, Aye Finance Limited is an NBFC that offers secured and unsecured small business loans for working capital, including mortgage loans, ‘Saral’ Property Loans, secured and unsecured hypothecation loans, primarily to micro-scale MSMEs.

The company offers business loans for business expansion, secured by working assets or property, to customers in manufacturing, trading, service, and allied agriculture sectors.

The company is serving 586,825 active customers across 18 states and three union territories with significant assets under management.

In the six months ended September 30, 2025, and September 30, 2024, and Fiscals 2025, 2024, and 2023, the company had 10,459, 8,388, 9,102, 6,82,5 and 5,724 full-time employees, respectively, engaged in the operations in India.

Product Portfolio

- Mortgage Loans

- Saral’s Property Loans

- Secured Hypothecation Loans

- Unsecured Hypothecation Loans

Company Strengths

- Leading Lender of Small-Ticket Loans to Micro Scale MSMEs with Comprehensive Product Offerings and Focus on Serving Large and Unaddressed TAM

- Strong Sourcing Capabilities Supported by a Diversified Pan-India Presence and High Customer Retention

- Effective Underwriting Methodology

- Robust Multi-Tiered Collection Capabilities

- Building Resilience through Technological Prowess

- Access to Diversified Lender Base and Cost-Effective Financing

- Experienced and Professional Management Team backed by Marquee Investors with a Committed Employee Base

Company Financials

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 7,116.01 | 6,338.63 | 5,819.05 | 4,869.59 | 3,126 |

| Total Income | 863.02 | 1,504.99 | 717.05 | 1,071.75 | 643.34 |

| Profit After Tax | 64.6 | 175.25 | 107.8 | 171.68 | 39.87 |

| Net Worth | 1,727.37 | 1,658.87 | 1,593.17 | 1,232.65 | 754.49 |

| Reserves and Surplus | 1,689.58 | 1,621.08 | 1,555.39 | 1,192.72 | 724.04 |

| Total Borrowing | 5,218.5 | 4,526.33 | 4,083.1 | 3,498.99 | 2,296.16 |

| Amount in ₹ Crore | |||||

Objectives of IPO

- Strengthening the capital base to support future business expansion and asset growth of the company

IPO Details

| IPO Date | February 09, 2026 to February 11, 2026 |

| Listing Date | February 16, 2026 |

| Face Value | ₹2 per share |

| Price Band | ₹122 to ₹129 per share |

| Lot size | 116 shares |

| Total Issue size | 7,82,94,572 shares (aggregating upto ₹1010.00 Cr ) |

| Fresh Issue | 5,50,38,759 shares (aggregating upto ₹710.00 Cr ) |

| Offer for Sale | 2,32,55,813 shares of ₹2 (aggregating upto ₹300.00 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 19,17,45,507 shares |

| Share Holding Post Issue | 24,67,84,266 shares |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 116 | ₹14,964.00 |

| Retail (Max) | 13 | 1,508 | ₹1,94,532.00 |

| S-HNI (Min) | 14 | 1,624 | ₹2,09,496.00 |

| S-HNI (Max) | 66 | 7,656 | ₹9,87,624.00 |

| B-HNI (Min) | 67 | 7,772 | ₹10,02,588.00 |

Allotment Schedule

| Basis of Allotment | Thu, 12 Feb, 2026 |

| Initiation of Refunds | Fri, 13 Feb, 2026 |

| Credit of Shares to Demat | Fri, 13 Feb, 2026 |

| Tentative Listing Date | Mon, 16 Feb, 2026 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII Shares Offered | Not more than 15% of the Net Offer |

Source – SEBI, Chittorgarh

To check allotment, click here