POST-MARKET REPORT

The Indian benchmark indices climbed to record highs and closed in the green in a volatile session, a day ahead of the Reserve Bank of India (RBI) policy announcement.

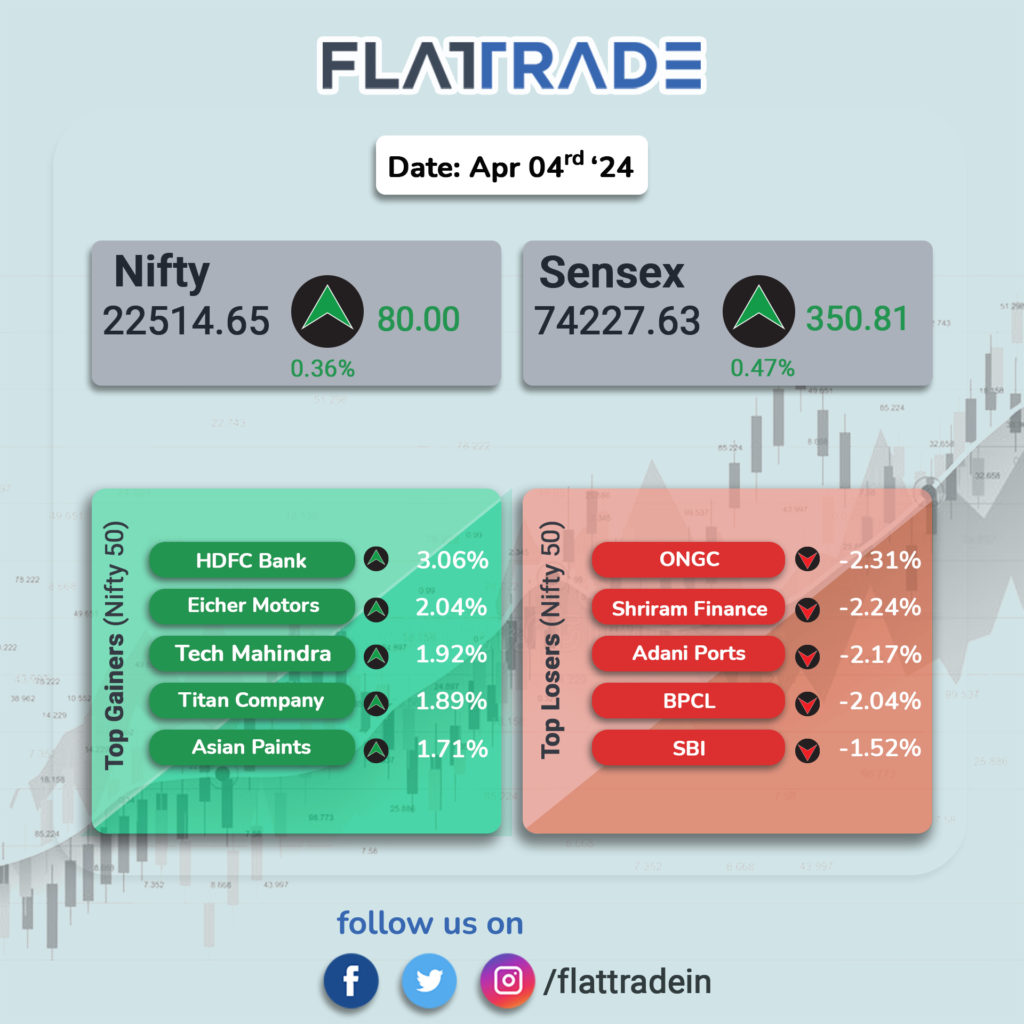

The Sensex ended 350.81 points, or 0.47 percent, higher at 74,227.63, and the Nifty 80 points, or 0.36 percent, at 22,514.70.

Top Nifty gainers were HDFC Bank, Eicher Motors, Asian Paints, Tech Mahindra, and Titan Company, while losers were ONGC, Shriram Finance, Adani Ports, BPCL and Bharti Airtel.

Among sectors, banks, power, and information technology were up 0.5-1 percent, while the PSU bank and oil & gas index were down 0.7-1.6 percent.

Considering broader markets, the BSE midcap index ended flat, while the smallcap index added 0.5 percent.

The Indian rupee ended at 83.4375 against the U.S. dollar.

STOCKS TODAY

HDFC Bank: Foreign investors reduced their stake in HDFC Bank by 4.5 percent to 47.8 percent in the March quarter, according to the latest shareholding pattern on BSE. Meanwhile, mutual funds increased their holdings by 3.72 percent to 23.17 percent, from 19.45 percent a quarter ago.

Vedanta: Shares of Anil Agarwal-led Vedanta Ltd. rose around 3 percent to a 52-week high of Rs 312.50 on the NSE after delivering the highest-ever annual volume across key businesses. In Q4FY24, Vedanta’s Aluminium business recorded an 18 percent surge in volumes at the Lanjigarh unit over the last year. The unit is in focus since Vedanta expanded its refining capacity to 3.5 MTPA.

Som Distilleries Limited: Shares of Som Distilleries Limited advanced 4 percent to Rs 298 in the afternoon of April 4 after the company announced it recorded the highest-ever sales in a month since entering Karnataka almost a decade ago.

Dabur India: Dabur India’s shares fell over 4 percent after the company announced a mid-single-digit revenue growth in the January-to-March quarter. The company’s India business and home and personal care segment is expected to grow in high-single digits, said the company in its Q4FY24 result update.

GE Power India: Shares of GE Power India surged to hit a 52-week high of Rs 369 on NSE on account of the company bagging two orders worth Rs 774.9 crore from Jaiprakash Power Ventures. The orders are for dilation and evacuation, and supply of wet limestone-based FGDs for the Nigrie Super Thermal Power Plant at Nigrie and Bina Thermal Power Plant at Bina in Madhya Pradesh, GE Power said in a regulatory filing.

GM Breweries: Shares of GM Breweries tanked over 4 percent in afternoon trade on April 4 after the company reported a sharp decline in its EBITDA margin for the fourth quarter of FY24. The company’s operating margin in the January-March quarter contracted to 15.8 percent, sharply down from 20.1 percent a year ago. The drag on the company’s operational performance was on account of higher expenses related to changes in inventories.