POST-MARKET REPORT

The Indian benchmark ended higher today with Nifty around 22,200 amid buying seen in the auto, capital goods, IT, and realty.

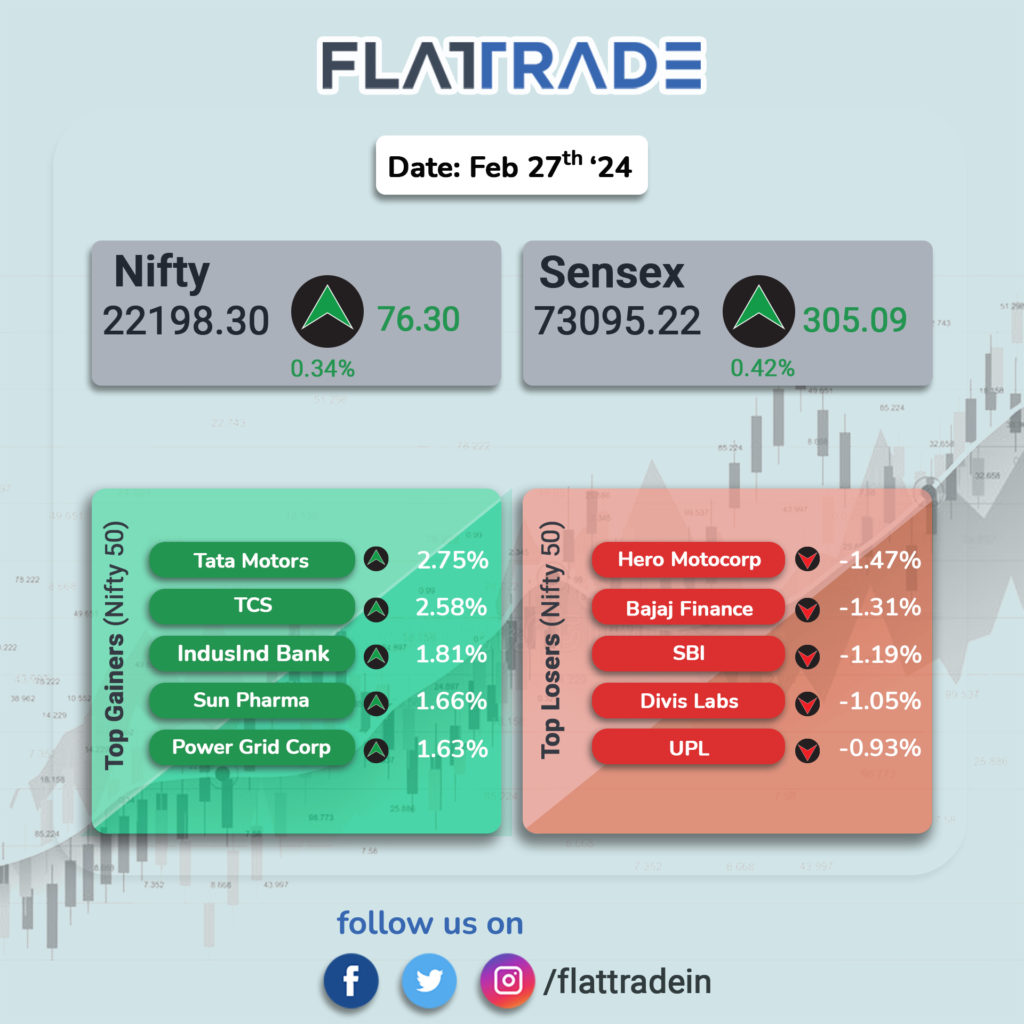

At close, the Sensex was up 305.09 points or 0.42 percent at 73,095.22, and the Nifty was up 76.30 points or 0.34 percent at 22,198.30.

Top gainers on the Nifty included Tata Motors, TCS, IndusInd Bank, Power Grid Corp, and Sun Pharma, while losers were Hero MotoCorp, Bajaj Finance, SBI, Divis Labs, and UPL.

Among sectors, Auto, Capital Goods, Information Technology, Pharma, and Realty were up 0.5-1 percent each, while Oil & Gas index was down one percent. BSE Midcap and Smallcap indices ended marginally lower.

The rupee closed almost flat at 82.89 against the US dollar.

STOCKS TODAY

Marico Ltd: The board of Marico Ltd approved a second interim dividend of Rs 6.50 per share on February 27. Previously, the consumer company announced two dividends in 2023. Those included a Rs 3 per share payout in November 2023 and another interim dividend of Rs 4.50 in March of the same year.

TVS Motor Company Limited: The stock closed 1.46 percent lower after the company announced that its Singapore subsidiary, TVS Motor Pte, acquired an additional 8,000 equity shares in Killwatt GmbH, a company based in Germany.”Under the acquisition as mentioned earlier, the shareholding of TVS Motor (Singapore) Pte Ltd in Killwatt GmbH will be increased from 39.28 percent to 49 percent, by way of newly issued shares of Killwatt GmbH,” the company stated in a stock exchange filing.

HFCL: The share price of HFCL gained more than a percent to scale a 52-week high after the company received purchase orders aggregating to Rs 40.36 crore for the supply of optical fiber cables to one of the leading private telecom operators of the country.

JSW Energy: shares traded 2 percent higher after the company said its wholly owned subsidiary, JSW Neo Energy Limited, received an order for ISTS-connected solar capacity of 700 MW from SJVN.The project is required to supply power of full contracted capacity within 24 months, the company said in a regulatory filing.

Whirlpool: Whirlpool has no plans to exit the Indian market but its recent stake sale in the India unit was due to high valuations and disparity against the global parent, CEO Marc Bitzer has said. The reassurance didn’t seem to have done much as Whirlpool India shares fell 5 percent to sink to a 52-week low.

CMS Info Systems: CMS info Systems stock fell 2.52 percent after 4.2 crore shares changed hands through a block deal on February 27. CNBC Awaaz reported that promoter Sion likely sold its entire stake of 26.7 percent in the company.