POST-MARKET REPORT

Benchmarks indices Nifty 50 and the Sensex went down on losses led by banking and IT heavyweights, including HDFC Bank, Tech Mahindra, and TCS.

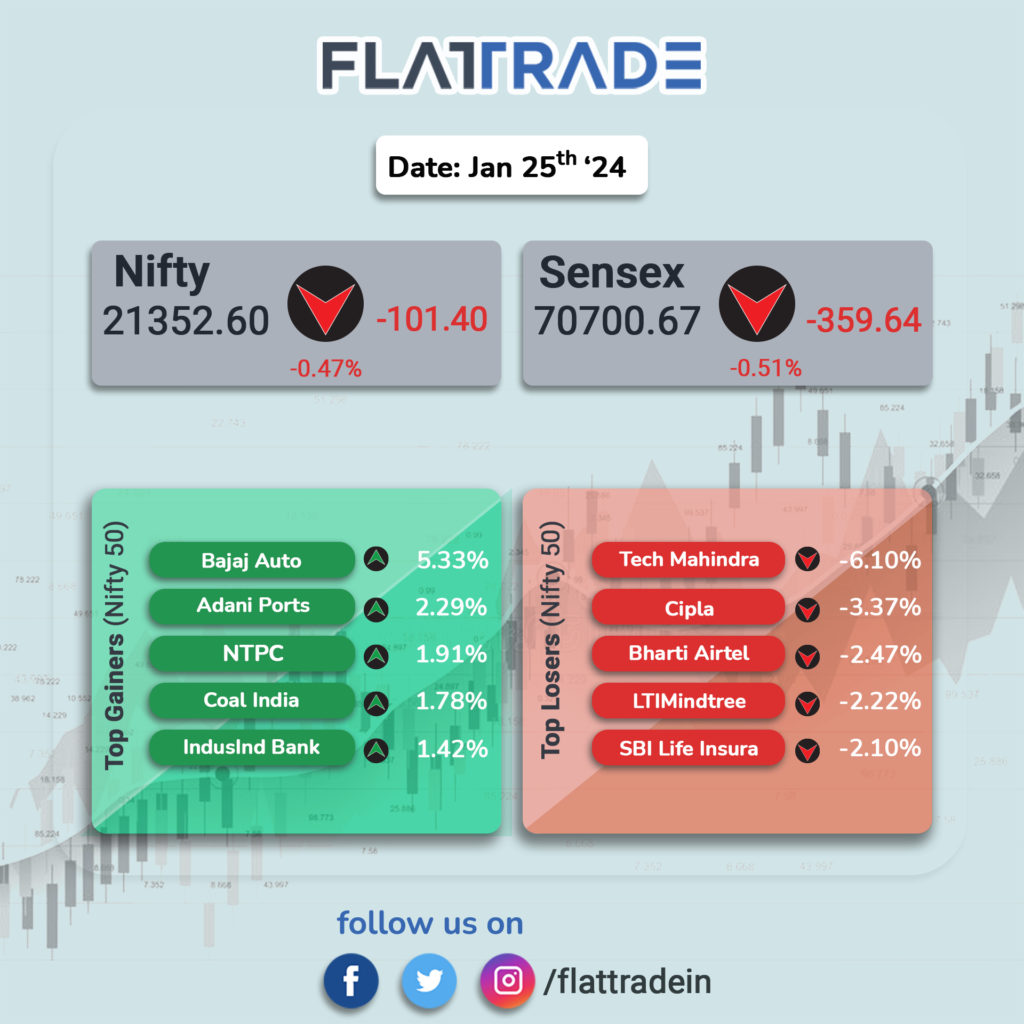

At close, Nifty was 101 points down or 0.47 percent lower and ended at 21,352.60. whereas Sensex ended 360 points down or 0.51 percent lower at 70,319.04.

All sectoral indices, except Nifty Realty, ended in the red. The financial services, pharma, bank, IT, FMCG, and healthcare index dropped a percent.

BSE Power Index was up 1 percent, Nifty IT and Pharma were the biggest losers today with the indices down 1.6 and 1.3 percent.

Mid and smallcaps outperformed the benchmarks. BSE Midcap index ended with a loss of 0.36 percent, the Smallcap index ended with a gain of 0.54 percent.

Shares of Bajaj Auto, Adani Ports, and NTPC closed as the top gainers in the Nifty 50 index, while Shares of Tech Mahindra, Cipla, and Bharti Airtel ended as the top losers.

The Indian Rupee stands at 83.10 per US Dollar.

STOCKS TODAY

Zomato: The Reserve Bank of India (RBI) has granted a payment aggregator (PA) license to Zomato Payments Private Limited, the subsidiary of the food delivery platform Zomato. The approval will allow the firm to facilitate e-commerce transactions through its platform. Last year, the food delivery platform tied up with ICICI Bank to launch its own Unified Payments Interface (UPI) offering–Zomato UPI.

UCO Bank: Shares of UCO Bank fell 3.4 percent after the lender’s net profit plunged 23 percent YoY to Rs 503.83 crore in Q3FY34. The bank’s net interest margin also declined 16 basis points YoY to 3.02 percent.

DLF: Shares of DLF gained 1.42 percent after the real estate company’s net profit grew 26.6 percent to Rs 655.7 crore. DLF saw a 15-year-high quarterly profit, all-time high pre-sales, and Rs 10 billion FCF generation in the third quarter of the current fiscal year.

Laurus Labs: Laurus Labs stock fell 5.59 percent after the pharma company reported a fourth consecutive quarterly decline in profit and revenue. In Q3FY24, the firm’s net profits fell 88.5 percent YoY to Rs 23.34 crore. Profits declined due to a 67 percent on-year fall in the CDMO-synthesis business.

Dalmia Bharat: Dalmia Bharat stock gained 2.21 percent after the company’s net profit increased 22.2 percent to Rs 266 crore. Dalmia Bharat’s revenue from operations grew by 7.3 percent to Rs 3,600 crore, compared to the year-ago period.

Bajaj Auto: Shares of Bajaj Auto surged 4.95 percent after the company’s Q3 net profits increased 37 percent to Rs 2,041.88 crore driven by robust sales of its two-wheelers, price hikes, and higher realizations amid consistent demand.

Railtel: Shares of Railtel Corporation jumped 9.69 percent after the company recorded 94.5 percent on-year growth in net profit at Rs 62.1 crore for the quarter ended December FY24.

PNB Housing Finance: PNB Housing Finance stock fell 4.45 percent despite the company reporting 25.8 percent YoY growth in net profit to Rs 338.4 crore in Q3. Revenue from operations fell 2.3 percent YoY to Rs 1,754.8 crore for the quarter.