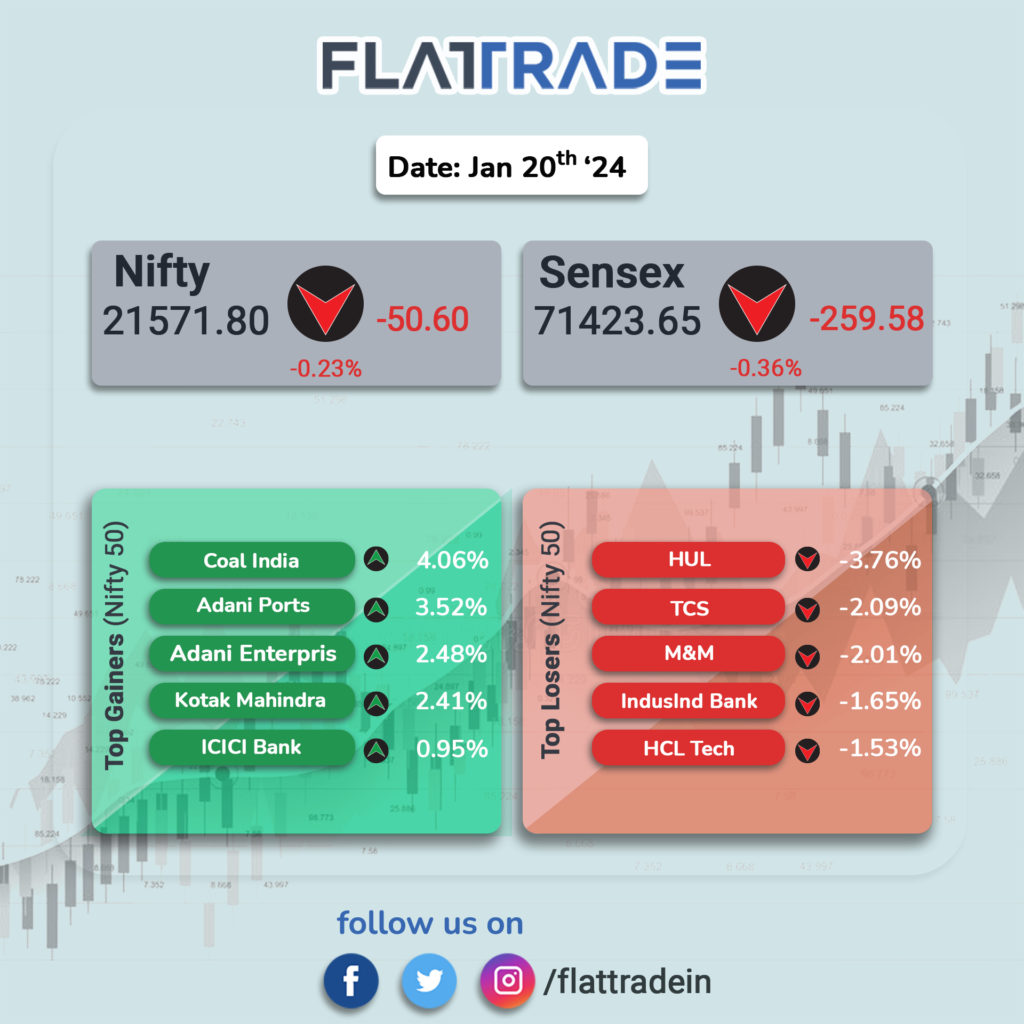

India’s benchmark indices turned red, Nifty 50 closed at 21,583.60, down 39 points, or 0.18 percent while the Sensex fell 260 points, or 0.36 percent, to end at 71,423.65.

Among sectoral indices, bank, metal, and power indices are up 0.5-1 percent, while FMCG, Information Technology, pharma, and realty are down 0.4-1 percent.

Top losers on the Nifty included HUL, M&M, TCS, IndusInd Bank, and HCL Technologies, while gainers were Coal India, Adani Ports, Adani Enterprises, Kotak Mahindra Bank, and ICICI Bank.

BSE Midcap and Smallcap indices gained 0.4 percent each.

STOCKS TODAY

Kotak Mahindra Bank: Kotak Mahindra Bank reported a lower-than-expected 7.6 percent increase in net profit at Rs 3,005 crore for the December quarter of the current financial year. Gross non-performing assets (NPAs) stood at 1.73 percent against 1.91 percent in the year-ago quarter. Net NPA was at 0.34 percent against 0.48 percent.

HUL: The company reported a standalone net profit of Rs 2,519 crore for the December quarter of FY24, an increase of just 0.55 percent from the year-ago period. stock fell on January 20, a day after the FMCG major’s third-quarter earnings came in below the Street’s estimates.

Tejas Networks: The company clocked in a net loss of Rs 44.9 crore during the quarter, deepening from a loss of Rs 15.20 crore in the year-ago period, impacted by higher input costs. However, revenue from operations grew 104 percent on-year to Rs 560 crore for the quarter.

RITES: The stock hit a new 52-week high in the afternoon after the company won a Rs 414-crore Project Management Consultancy (PMC) from IIT- Bhubaneswar.RITES will undertake the construction of various infrastructure works for the institute.

IREDA: Shares of the Indian Renewable Energy Development Agency (IREDA) surged after the company reported strong Q3 results. IREDA reported a 67.2 percent on-year growth in net profit at Rs 335.5 crore. its revenue surged 44.2 percent on-year to Rs 1252.9 crore. The company’s loan book grew 33.5 percent to Rs 50,579.67 crore. While its net NPA went down to 1.52 percent from 2.03 percent last year.

Zee Entertainment: The Enterprise gained after the media and entertainment company reaffirmed its commitment to the $10-billion merger with the Indian arm of Japan’s Sony.