POST-MARKET REPORT

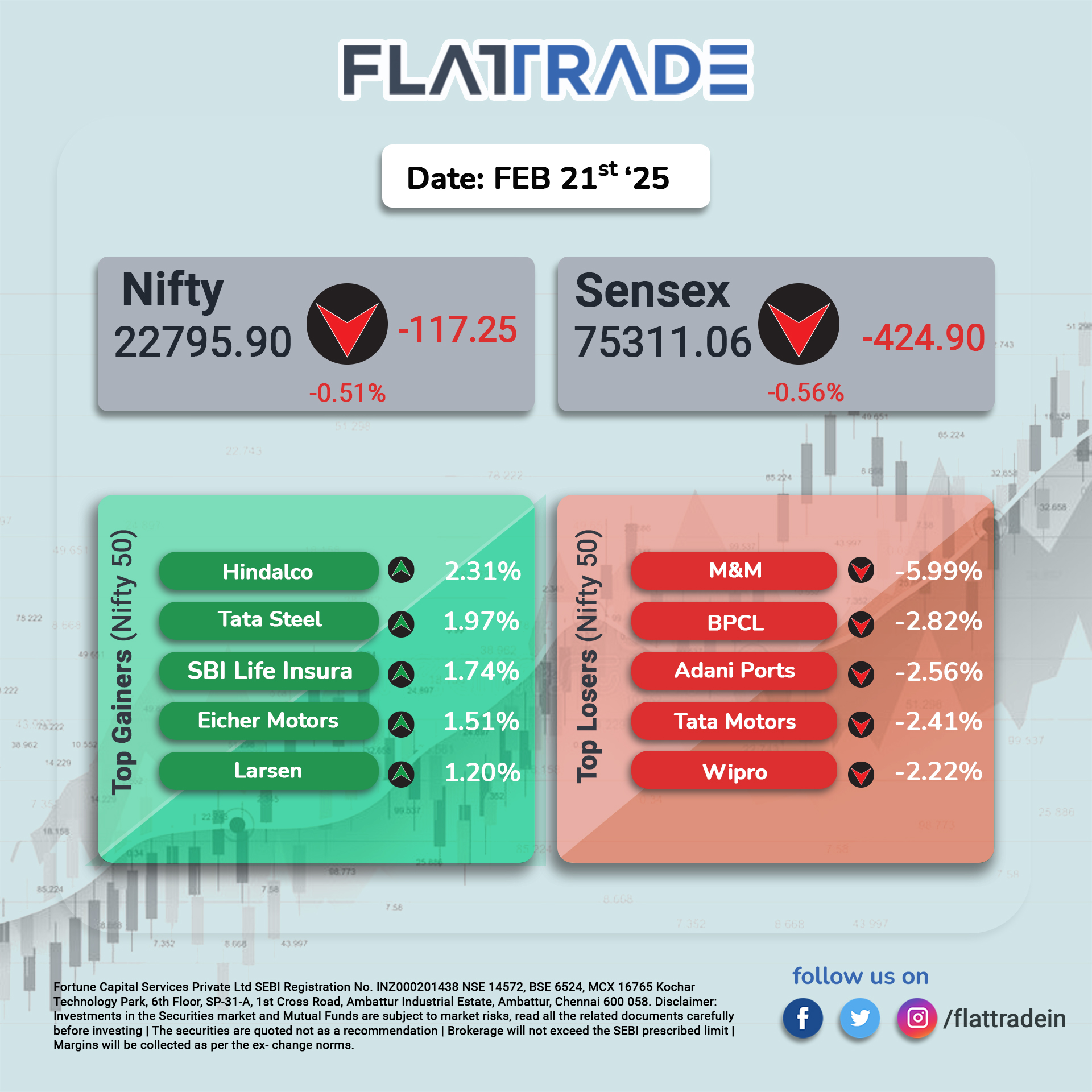

Benchmark indices settled the trading session bearish on February 21 as the Indian stock market faced selling pressure with auto and pharma stocks dragging indices down for the fourth session.

At closing, both Sensex and Nifty stood 0.65% lower, with Sensex reaching 75,247.39 and Nifty at 22,763.20 points.

The shares of Kotak Mahindra Bank were the top loser on the index, falling nearly 2 percent, followed by ICICI Bank. AU Small Finance Bank, Punjab National Bank, Bank of Baroda, and Federal Bank followed, seeing a drop of over 1 percent in their respective share prices.

Among sectoral indices, only Nifty Metal traded in the green. Nifty Auto performed the worst, declining beyond 2 percent. Nifty Pharma, Healthcare, and PSU Bank also fell over 1 percent each.

The Nifty Midcap 100 index wrapped up the session with a drop of 1.32%, closing at 50,486, while the Nifty Smallcap 100 index recorded a fall of 0.70%, settling at 15,636.

STOCKS TODAY

Mahindra and Mahindra: The Shares fell as much as 6 percent, setting it up for the biggest weekly fall in five years. There has been a slew of news flow concerning investors, including increasing competition in the EV space, possible over-valuation of the stock price, and the company’s recent plans of investing in the rights issue of two of its listed subsidiaries.

Alkem Laboratories: The shares fell after a large deal worth Rs 300 crore took place on the exchanges. As much as 6.41 lakh shares of the drugmaker were sold through the large deal at a floor price of Rs 4,680 apiece. The floor price of the large deal reflected a discount from the previous closing price of the stock.

Religare Enterprises: The Shares climbed over 9 percent after the Burman family acquired majority control of the company, getting designated as ‘promoters’. This comes following a Rs 2,116 crore open offer issued by the Burmans for acquiring an additional 26 percent stake in Religare Enterprises received a tepid response.

Bandhan Bank: The Shares were buzzing in trade with a 5 percent surge after global brokerage firm CLSA upgraded the stock to a ‘high-conviction outperform’, foreseeing a massive 61 percent upside potential. The brokerage pegged a price target of Rs 220 for the stock, largely backed by the lender’s outperformance over peers in the current MFI cycle.

BHEL: Shares of Bharat Heavy Electricals fell over a percent for a third consecutive session, falling on the back of a Rs 30 crore arbitration case recently initiated against the company. Ducon Technologies initiated arbitration proceedings for recovering nearly Rs 27 crore, alongside other interests amounting to BHEL.