PRE-MARKET REPORT

Indian markets erased most gains and closed flat, tracking mixed global equities ahead of key rate decisions from the Bank of Japan and the United States Federal Reserve this week.

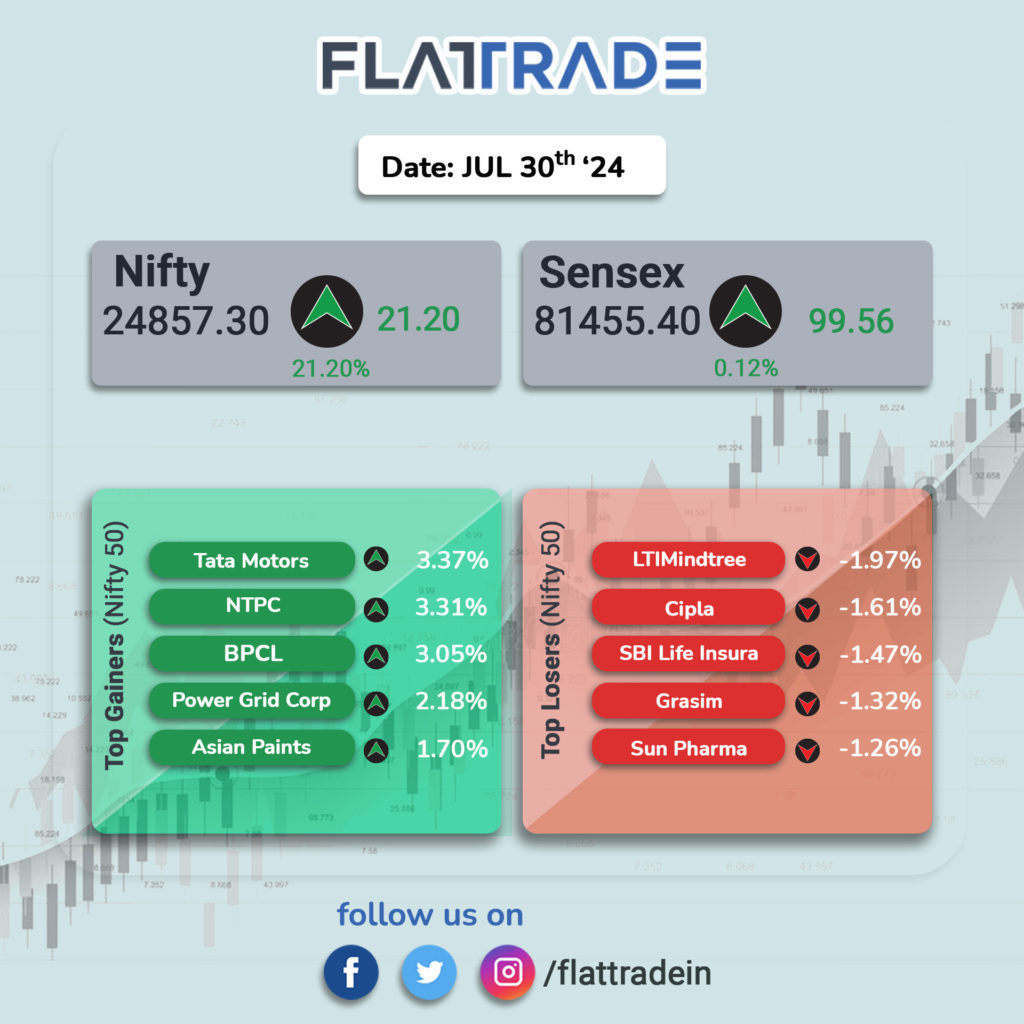

At closing, India’s benchmark Sensex rose 0.12 percent or 99.56 points while Nifty settled at 24857.30, up 0.09 percent or 21.2 points. Intraday, the Sensex gained 459 points, while the Nifty jumped 136 points.

Among sectoral indices, Nifty Consumer Durables was the top gainer, rising 1.1 percent, followed by Nifty Oil & Gas and Auto, which increased by 0.6 percent and 0.5 percent, respectively. On the losing side, Nifty FMCG was the top loser, down 1.1 percent, followed by Nifty Pharma, which fell 0.68 percent.

The broader market managed to hold on to its gains through the session and outperformed the two benchmarks. The BSE Smallcap and the BSE Midcap index closed the session, 0.9 percent and 0.3 percent higher, respectively.

STOCKS TODAY

PNB Housing Finance: Shares fell 2 percent after private equity firm Carlyle Group’s Quality Investment Holdings PCC likely offloaded a stake worth Rs 2,642 crore through a block deal. As much as 3.40 crore shares, representing a 13.1 percent stake in the housing finance company changed hands on the exchanges at an average price of Rs 778 apiece.

Suzlon Energy: Shares rose 5 percent, extending gains to the seventh session in a row. The stock has now surged over 23 percent since it released Q1FY25 earnings last week. The wind energy company reported a 200 percent on-year surge in its net profit to Rs 302 crore in the June quarter. The revenue too rose 50 percent to Rs 2,016 crore in the first quarter of the current fiscal, up from Rs 1,348 crore in the year-ago period.

Power Grid Corporation of India: Shares soared over 2 percent after the company guided for an increased capital expenditure outlay for FY25. The company’s management has guided for Rs 18,000 crore capex for FY25, up from its previous guidance of Rs 15,000 crore. As for FY26 and FY27, the company has assigned a capex outlay of Rs 25,000 crore and Rs 30,000 crore, respectively.

Colgate Palmolive: Shares rose nearly 2 percent after the company’s all-around beat with its April-June earnings garnered praise from across the Street. Brokerages were especially impressed with the company’s better-than-expected volume growth, driven by a recovery in rural demand. Brokerage firm Nomura remains positive over Colgate’s volume growth of 6-7 percent in Q1 of FY25, more so as it topped the brokerage’s expectation of a 2 percent increase.

TPC: The stock rallied over 3 percent to touch an all-time high of Rs 412.7 per share on July 30 after it clocked a strong April-June quarter (Q1FY25) results. Brokerages largely remained bullish on the counter as they expect thermal and nuclear power businesses to drive further growth ahead. Jefferies maintained its ‘buy’ call on NTPC and raised the target price to Rs 485 from Rs 445 apiece, expecting execution of orders to pick up pace.

Kansai Nerolac: The stock soared over 7 percent on July 30, following management’s optimistic outlook for strong demand in the upcoming quarters due to favorable monsoon trends, despite the company having a subdued performance in the April-June quarter (Q1FY25).