POST-MARKET REPORT

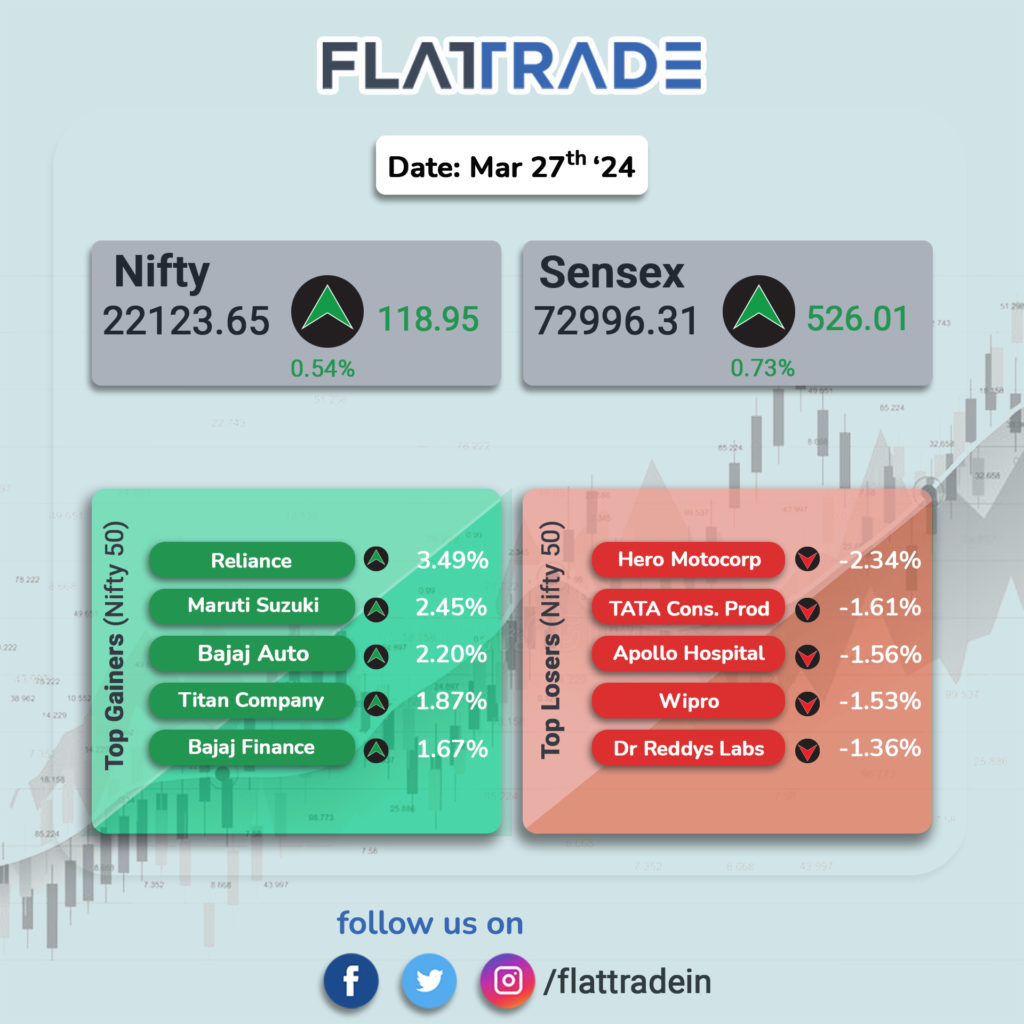

The market ended higher amid buying in heavyweights and auto, realty, power, and capital goods stocks on March 27. At close, the Sensex was up 526.01 points, or 0.73 percent, at 72,996.31, and the Nifty was up 119 points, or 0.54 percent, at 22,123.70.

Biggest gainers on the Nifty were Reliance Industries, Maruti Suzuki, Bajaj Auto, Bajaj Finance, and Titan Company, while losers included Hero MotoCorp, Tata Consumer Products, Apollo Hospitals, Dr. Reddy’s Labs, and Wipro.

Among sectors, auto, bank, capital goods, power, realty, and telecom were up 0.5-1 percent, while metal, IT, and media were down 0.3-0.5 percent.

Considering Broader markets, the BSE midcap index ended on a flat note and the smallcap index gained 0.7 percent.

The Indian rupee declined by 7 paise to close at 83.36 against the US dollar.

STOCKS TODAY

Maruti Suzuki: Auto major Maruti Suzuki India Ltd (MSIL) on March 27 became India’s 19th listed company to cross the Rs 4 lakh crore market capitalization milestone after its shares surged over 23 percent so far in 2024. The stock hit a record high of Rs 12,725 on BSE and gained as much as 4 percent.

Adani Power: Shares of Adani Power Limited traded more than 4 percent higher in the early trade on March 27 after the fair trade regulator Competition Commission of India (CCI) approved the company’s proposed acquisition of Lanco Amarkantak Power. Adani Power proposes to acquire 100 percent share capital and control of Lanco Amarkantak Power, under the corporate insolvency resolution process (CIRP) initiated under the Insolvency and Bankruptcy Code, 2016 (IBC).

Coal India: Shares of Coal India traded in the red intraday after making some early gains on March 27. The movement in the share price of the coal miner was seen hours after a large containership crashed into the Baltimore bridge, shutting down the second largest exit point for coal shipments from the US for now.

Shyam Metalics & Energy: The company’s share price rose 2 percent in early trade on March 27 after the company received a composite license for the Surjagad-1 iron ore block in Maharashtra. The joint venture company, Natural Resources Energy Private Limited (NREPL), received the Letter of Intent. Dorite Tracon Private Limited, a promoter company of Shyam Metalics and Energy Limited, holds 49% of the economic interest in NREPL.

ICICI Bank: ICICI Bank is under fire for reportedly trying to sway minority shareholders into voting for the delisting of ICICI Securities. The bank is looking to merge its 75 percent subsidiary ICICI Securities with itself. The lender is offering investors 0.67 shares of ICICI Bank for every share in ICICI Securities.

AstraZeneca Pharma: Shares of AstraZeneca Pharma India jumped over 4 percent on March 27, a day after the company informed that it has received permission to import, for sale and distribution, Trastuzumab deruxtecan lyophilized powder concentrate for solution for infusion 100mg (Enhertu) from the Central Drugs Standard Control Organisation. Trastuzumab deruxtecan is indicated for the treatment of adult patients with breast cancer.