POST-MARKET REPORT

Indian benchmark indices the Sensex and the Nifty scaled fresh lifetime highs and then dropped as profit booking was done by sellers ahead of the release of key inflation figures for India and the US.

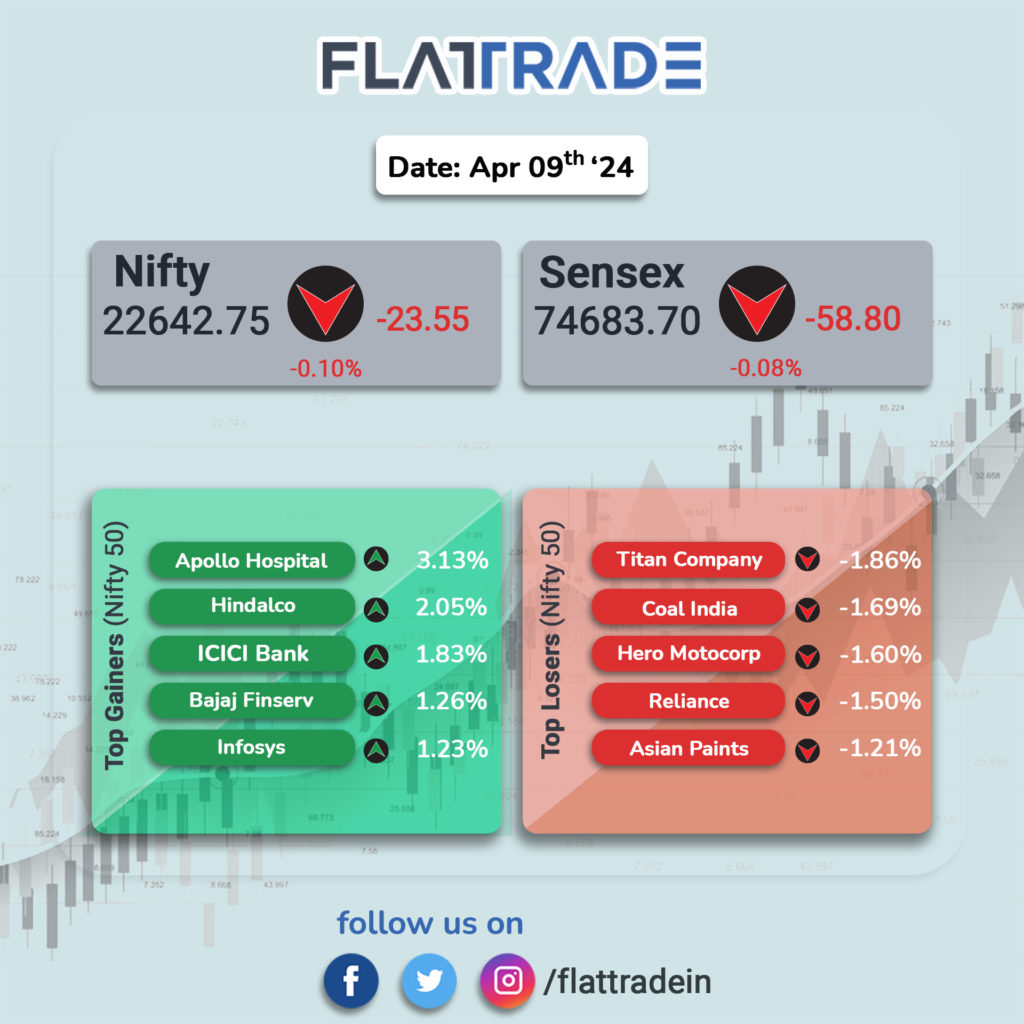

At close, the Sensex settled 58.80 points, or 0.08 percent, lower at 74,683.70, falling from its record high of 75,124.28 touched early morning. The Nifty also pared to slipped from its new peak of 22,768.40 to close 24.50 points, or 0.11 percent lower, at 22,641.80.

Top Nifty gainers were Apollo Hospitals, Hindalco, ICICI Bank, and Infosys, while losers were Titan Co, Hero MotoCorp, Coal India, and Reliance Industries.

Among the sectors, auto, capital goods, FMCG, energy, infra, oil & gas, and pharma closed with 0.3-1 percent losses, while banks, metals, and realty indices rose 0.3-1 percent.

Considering broader market indices, the BSE midcap index also slipped 0.5 percent and the smallcap index shed 0.2 percent.

STOCKS TODAY

Amara Raja Energy and Mobility: Shares of Amara Raja Energy and Mobility surged 3 percent, extending gains for the fourth consecutive session as the brokerages remain bullish on the company’s prospects in lead acid batteries.

Infosys: The Infosys stock gained over 1.39 percent after BofA upgraded the IT services player to “buy” from “neutral”. The global brokerage raised the target price to Rs 1,785 from Rs 1,735 on attractive valuations, implying an 18 percent upside from current levels.

Ajmera Realty: Shares of Ajmera Realty and Infra jumped over 5 percent to hit a fresh 52-week high as the realty player announced it crossed over Rs 1,000 crore of sales in FY24. For the quarter ended March 31, Ajmera Realty saw the value of sales double to Rs 287 crore, up 104 percent from Rs 140 crore in the same quarter in the previous fiscal year. Collections for the quarter came in at Rs 197 crore, up 91 percent on-year.

JTL Industries: Shares of JTL Industries gained more than 2 percent after the company acquired a controlling stake of 67 percent in Nabha Steels and Metals, situated in Mandi Gobindgarh, Punjab. The newly acquired plant has a manufacturing capacity of 200,000 tonnes and focuses on producing steel products, such as coils, and long steel products, such as billets, the company said in a release.

Tata Motors: Tata Motors said retail sales of Jaguar Land Rover surged 11 percent year-on-year (YoY) to 114,038 units in the fourth quarter of FY24, driven by increased production and sustained global demand. The retail sales during the quarter compared to the past year were up 32% in the UK, 21% in North America, and 16% overseas. In China, sales were down 9%, while it fell 2% in Europe for the quarter, according to the filing.

Premiere Explosives: Shares of Premiere Explosives rallied over 17 percent, as the company plans to take up a sub-division of its equity shares. A meeting of the board of directors of Premier Explosives is planned for April 19 to consider and approve a proposal for sub-division/split in the face value of equity shares of the company.