POST MARKET REPORT

Indian equity indices ended on a weak note with the worst crash in 10 months.

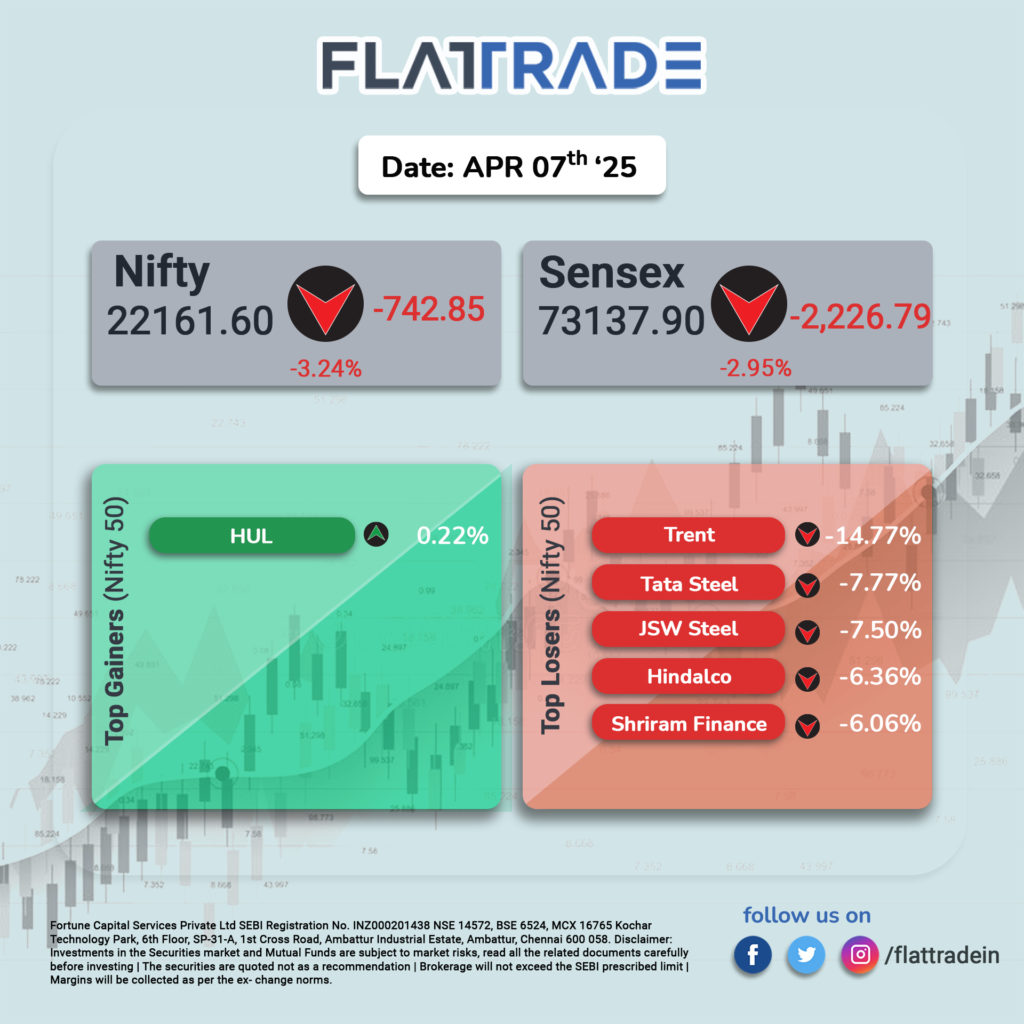

At close, the Sensex was down 2,226.79 points or 2.95 percent at 73,137.90, and the Nifty was down 742.85 points or 3.24 percent at 22,161.60. About 327 shares advanced, 3299 shares declined, and 93 shares were unchanged.

The major losers of the market include Trent, Tata Steel, JSW Steel, Hindalco Industries, Shriram Finance, and L&T, while the top gainer is Hindustan Unilever.

All the sectoral indices ended in the red, with the Metal index shedding 6.7 percent, the Realty Index down 5.6 percent, and media, PSU Bank, Auto, Energy, and IT down 2.5-4 percent.

Broader indices underperformed the benchmark, with BSE Midcap and Smallcap indices both shed by 3.4 percent and 4 percent, respectively.

STOCKS TODAY

Siemens

The energy company’s stocks rose over 20 percent as the capital goods major went ex-demerger after the spin-off of its energy business in India. Shareholders will get one share of Siemens Energy India for every Siemens India share they own. The stock plunged 40 percent as part of price discovery for Siemens Energy and later rose 20% to trade above Rs 3,000.

Delhivery

E-commerce player Delhivery shares gained four percent in a sour market, as the Street was bullish on the firm’s latest acquisition of logistics firm Ecom Express. The company’s stock was quoting Rs 267.6 per share, higher by 3.4 percent on the NSE compared to the previous session’s closing price.

Bajaj Housing

The company’s shares declined 5 percent on Monday, April 7, even after strong performance in its Q4FY25 business updates. The company reported a 26% year-on-year jump in assets under management and healthy loan disbursements of Rs 14,250 crore for the March quarter. The company’s stocks are trading at Rs 115 per share, which marks a decline of 4.87 percent.

DLF

A leading real estate company saw its stock price down by nearly 8 percent. These concerns negatively impacted the realty sector, with DLF’s valuation being downgraded. The other firms in the sector also declined, with Anant Raj down by 8 percent, Sobha down by over 7 percent, and Godrej Properties down by nearly 7 percent.

Tata Motors

The automobile giant also saw a significant decline of 12 percent after its subsidiary, Jaguar Land Rover, announced a pause in shipments to the US in response to the automobile import tariffs announced by US President Donald Trump. The move sparked concerns about future export disruptions and margin pressures.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks, read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI prescribed limit | Margins will be collected as per the exchange norms.