POST-MARKET REPORT

The Indian benchmark indices extended the fall on the fourth straight session on January 13 amid selling across the sectors, crude oil prices hitting over a 3-month high and weak global markets as investors cut down the US rate cut expectations in 2025.

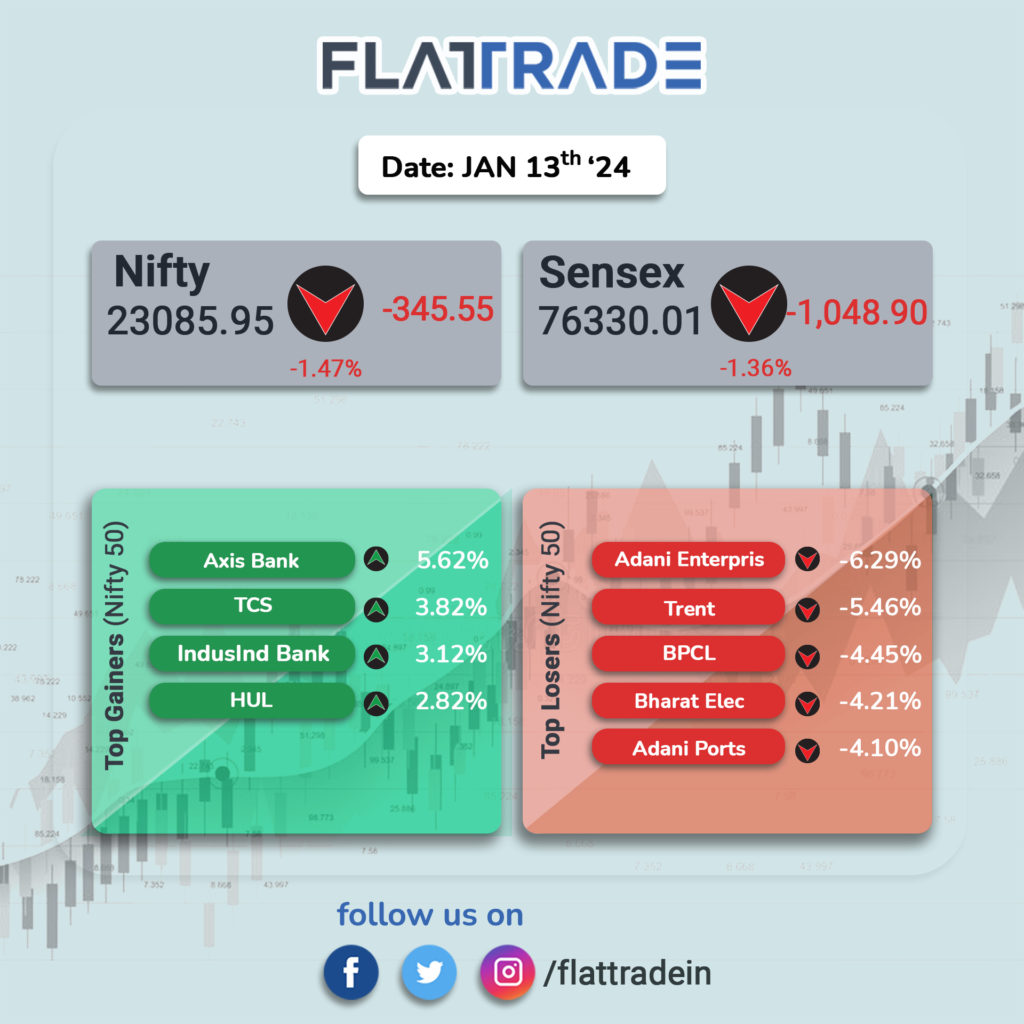

At close, the Sensex was down 1,048.90 points or 1.36 percent at 76,330.01, and the Nifty was down 345.55 points or 1.47 percent at 23,085.95.

The biggest Nifty losers were Trent, Adani Enterprises, Bharat Electronics, BPCL, and Power Grid Corp, while gainers included TCS, IndusInd Bank, Axis Bank, and HUL.

All the sectoral indices ended in the red with the realty index down 6.7 percent and oil & gas, power, PSU, metal, and media down 3-4 percent.

The Nifty Midcap index is down 4 percent, posting the biggest single-day fall since June 2024 and Smallcap Index is also down 4 percent, registering the biggest fall in five months.

STOCKS TODAY

Aditya Birla Capital: Shares of AB Capital rose after Morgan Stanley upgraded the stock to “overweight” from “equal-weight” and set a target price of Rs 247 per share, suggesting an upside potential of over 40 percent from current levels. Over the past three months, AB Capital’s shares have fallen more than 21 percent, compared to a 7 percent drop in the benchmark Nifty 50 index.

IndusInd Bank: Shares of IndusInd Bank surged after its foreign headroom increased in its December shareholding pattern following a foreign institutional investor (FII) sell-off. According to the bank’s latest shareholding details, its FII stake decreased to 46.6 percent in December from 55.5 percent in the September quarter. This reduction means that the foreign headroom now significantly exceeds the 25 percent threshold, with MSCI currently applying a half-float factor.

Biocon: Shares of Biocon soared over 4 percent after the US Food and Drug Administration cleared the arm of Biocon Biologics’ insulin facility in Malaysia, putting an end to a major regulatory bottleneck for the company. The US drug regulator classified the Malaysian unit as a “Voluntary Action Indicated” (VAI), opening the doors for the company to go ahead and file products from that facility.

Tata Consultancy Services: TCS shares extended gains following its positive Q3 earnings show that boosted market sentiment for the IT services player. The management not only exhibited confidence over early signs of demand revival amid strong deal wins in Q3 but also guided for a stronger performance in CY25 and FY26.

Just Dial: Just Dial Ltd sank sharply after reporting a net profit of Rs 131.3 crore in Q3 FY25, marking an increase of 42.7 percent year-over-year. This however marks a fall of nearly 15% from the Rs 154 crore net profit that the company reported in the previous quarter.

PCBL: Shares of PCBL nosedived over 11 percent as investors dumped the stock after the company’s dismal Q3 earnings, marked by a decline in net profit. The company’s net profit dropped 37 percent on year to Rs 93 crore in the October-December quarter, sharply lower than the Rs 148 crore that it clocked in the same period last year. The decline in the company’s bottom line was largely driven by a spike in operating costs.