POST-MARKET REPORT

The Indian equity market extended the previous session losses on January 9 with Nifty finishing below 23,550 amid selling across the sectors baring FMCG.

Despite mixed global markets, benchmark indices opened flat, but soon bears took charge and dragged the Nifty near 23,500, intraday before closing near the day’s low.

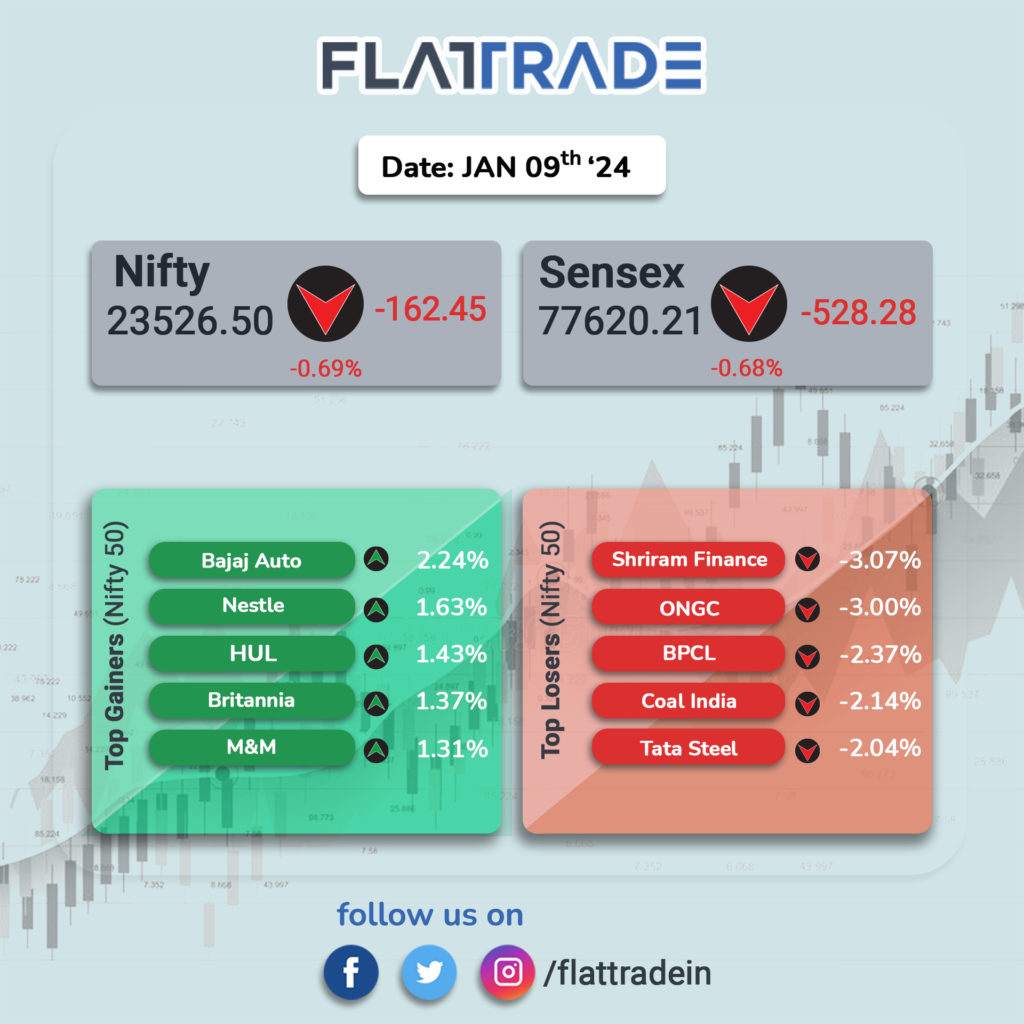

At close, the Sensex was down 528.28 points or 0.68 percent at 77,620.21, and the Nifty was down 162.45 points or 0.69 percent at 23,526.50.

Shriram Finance, ONGC, Tata Steel, Coal India, and BPCL were among the top losers on the Nifty, while gainers included HUL, Britannia Industries, Nestle India, M&M, and Bajaj Auto.

Among sectors, except FMCG all other indices ended in the red with capital goods, IT, metal, oil & gas, PSU Bank, power, and realty down 1-2 percent.

BSE Midcap and smallcap indices shed 1 percent each.

STOCKS TODAY

IREDA: IREDA had reported a nearly 36% year-over-year rise in its net profit to Rs 388 crore for the second quarter ended September 30, 2024. The total income from its operations during that quarter increased to Rs 1,630.38 crore from Rs 1176.96 crore a year ago, a rise of 38.52%. IREDA, under the Ministry of New and Renewable Energy, is a non-banking financial institution engaged in promoting, developing, and extending financial assistance for setting up projects relating to new and renewable sources of energy.

GTPL Hathway: The company reported a significant decline in net profit during the second quarter of the current fiscal year. Net profit plummeted by 61.8 percent year-on-year to Rs 13.7 crore, compared to Rs 35.9 crore in the same period last year. Despite this decline, the company demonstrated positive revenue growth, with revenue increasing by 9.8 percent year-on-year to reach Rs 856 crore in Q2. This growth was fueled by a continued expansion of the subscriber base, which reached 9.5 million active subscribers and 8.8 million paying subscribers at the end of the quarter.

Bajaj Auto: Shares of Bajaj Auto were buzzing in trade, rising 2 percent on January 9 after brokerage firm CLSA upgraded it to an ‘outperform’ call from the previous ‘underperform’ rating. Bajaj Auto’s market share in the e-2W segment surpassed 25 percent, boosted by the launch of a more affordable Chetak variant. The brokerage CLSA highlighted the company’s ability to maintain a 20 percent margin while scaling up its e-2W operations, touting it as a significant achievement.

OK Play India: shares rose around 4.9% on December 9 to trade at around Rs 18.37. A meeting of the Board of Directors of the company is set to be held on Tuesday, January 14, to consider and approve the proposal for raising funds through the issue of one or more instruments. This includes equity shares, convertible or non-convertible securities of any description or warrants, through preferential issues, private placements, or any other methods/combination thereof.

Kalyan Jewellers: share prices continued to witness a decline, the fifth day in a row. Earlier, the company had released its Q3 FY25 updates on Tuesday, highlighting the likeliness of its net revenue to grow by 39 percent with India business surge standing at 41 percent on festive and wedding demand. The jeweler launched 24 Kalyan showrooms in India, in the aforementioned quarter, and has a strong pipeline of showrooms for the ongoing quarter. It plans to launch 30 Kalyan showrooms and 15 Candere showrooms in India during the current quarter.