POST-MARKET REPORT

Indian markets ended lower for the third straight session on February 20 while Nifty managed to close just above 22,900, led by amid buying sell across the sectors barring IT and banks.

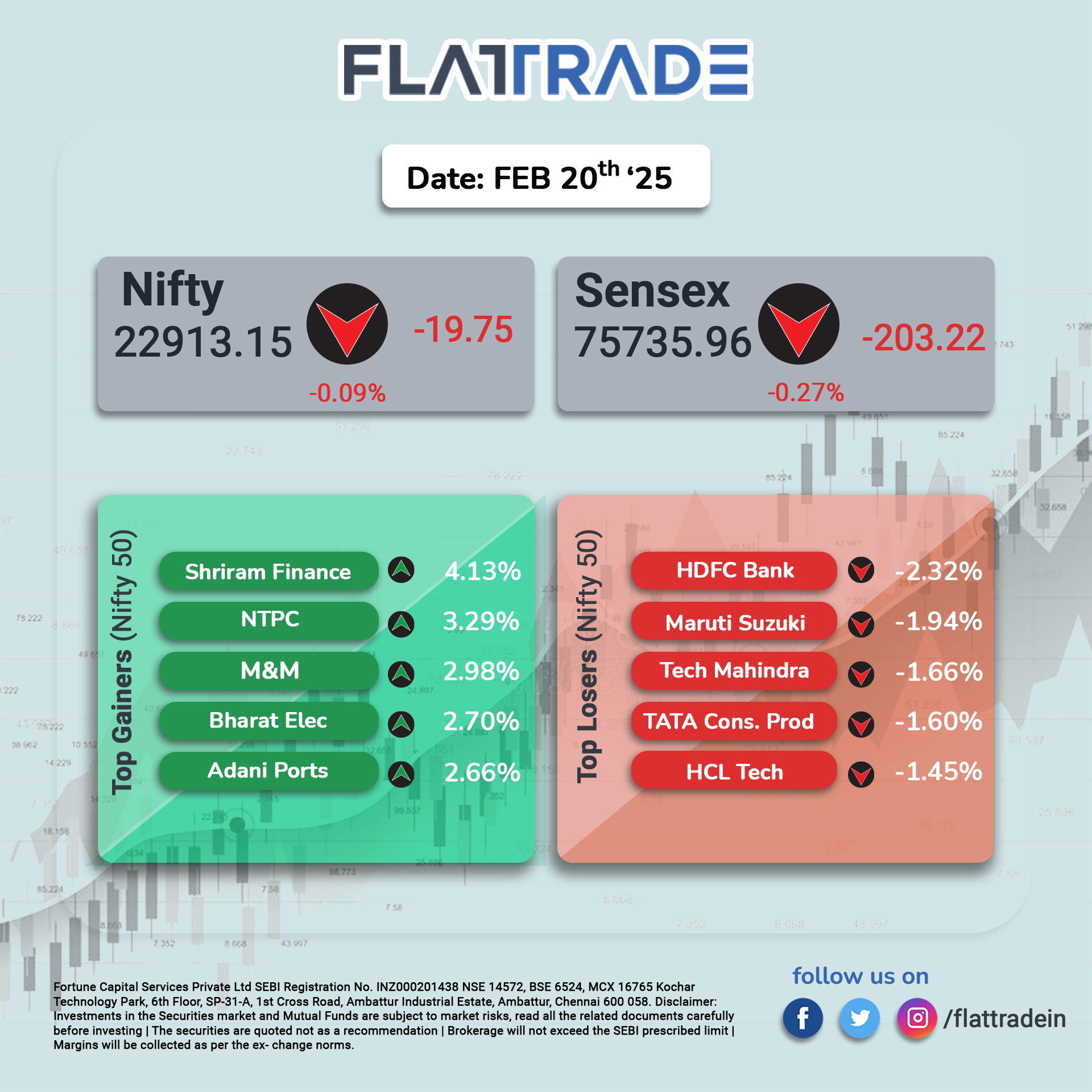

At close, the Sensex was down 203.22 points or 0.27 percent at 75,735.96, and the Nifty was down 19.75 points or 0.09 percent at 22,913.15.

HDFC Bank, Maruti Suzuki, Tech Mahindra, HCL Technologies, and Tata Consumer are among the major losers on the Nifty, while gainers are Shriram Finance, NTPC, Adani Ports, M&M, Bharat Electronics.

On the sectoral front, auto, metal, oil & gas, media, power, realty, and PSU Bank were up 1-2 percent, while the bank index was down 0.5 percent.

BSE Midcap and Smallcap indices were up 1 percent each.

STOCKS TODAY

Servotech Renewable Power System Ltd: The company rose 5% to Rs 127 after the company signed an agreement with France-based Watt & Well SAS to design, manufacture, and sell EV charger components in India. The collaboration will initially focus on a 30kW Power Module and later explore V2G applications, signaling growth potential in the EV charging market.

Bharat Electronics Ltd: The shares rose 2.5% to Rs 260 as the Ministry of Defence inked a contract worth Rs 1,220 crore with the company for procurement of 149 Software Defined Radios for the Indian Coast Guard. This contract will enhance the Coast Guard’s communication and operational capabilities.

Mahindra & Mahindra: The company jumped 2% to Rs 2,818 after the Mahindra Group announced a partnership with US-based Anduril Industries to develop Autonomous Maritime Systems, AI-enabled CUAS technologies, and C2 software. The collaboration aims to strengthen regional security through advanced autonomous solutions.

Just Dial: Shares surged nearly 9% buoyed by heavy trading volumes and an upgrade from Nuvama Institutional Equities to a ‘buy’ rating. Nuvama cited lucrative valuations and views the stock as an attractive opportunity. The brokerage also set a price target of Rs 1,140, reflecting a 36% upside potential. The heavy trading volume, significantly higher than the one-month daily average, further underscores the positive investor sentiment.

HDFC Bank: The share price fell 2% to Rs 1,693 as multiple large deals aggregating over Rs 230 crore were executed on the NSE within the first few minutes of opening, possibly contributing to the selling pressure. The high trading volume suggests increased activity and potential investor concerns.