POST-MARKET REPORT

Indian equity markets remained largely indifferent to the Reserve Bank of India’s (RBI) rate cut, with both the Sensex and Nifty closing lower for the third consecutive session.

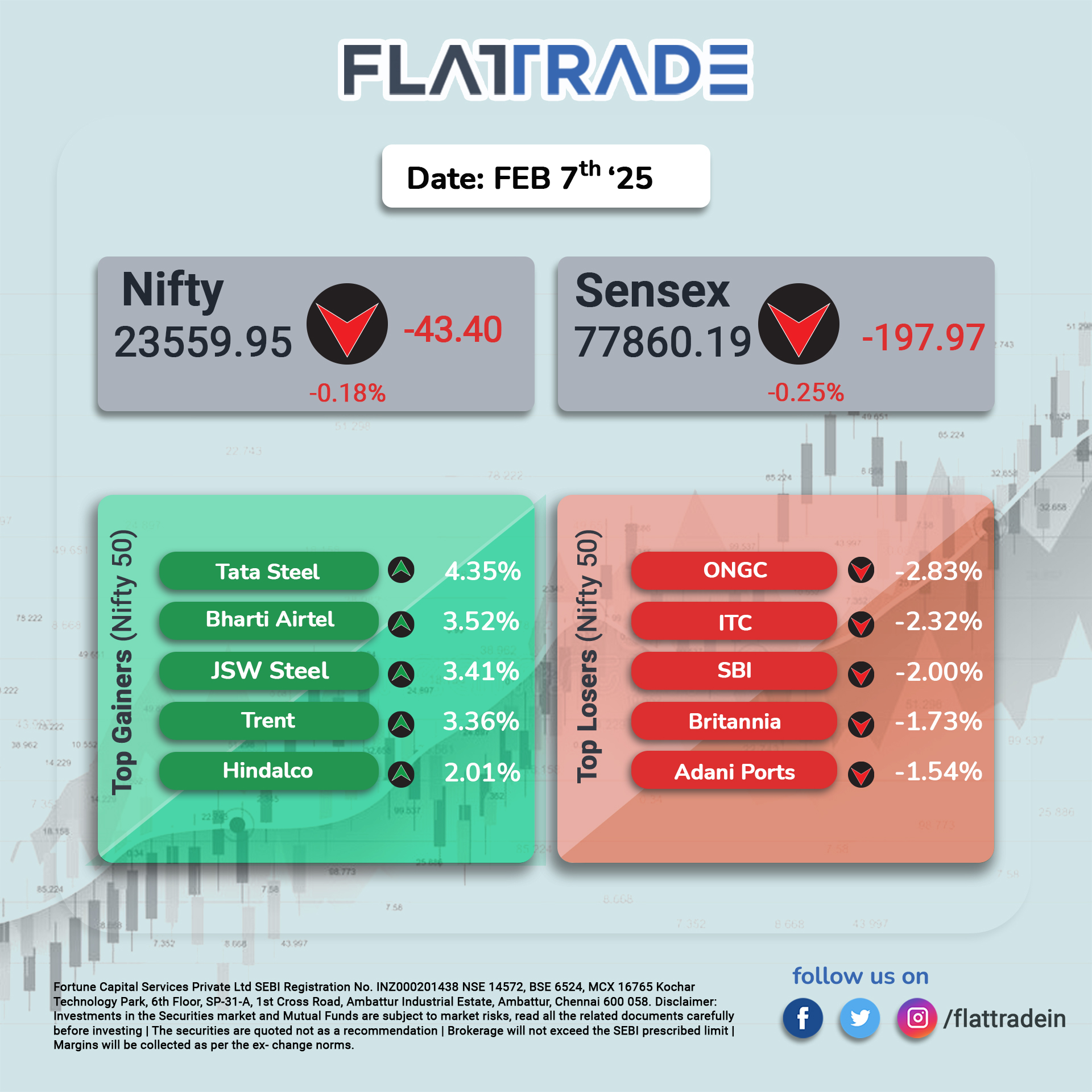

At close, the benchmark Sensex declined by 0.25 percent, shedding 197.97 points to settle at 77,860, while the Nifty slipped 0.18 percent, down 43.4 points to 23,559.95.

The top gainers in the Nifty index included Tata Steel (up 4.35%), Bharti Airtel (up 3.52%), JSW Steel (up 3.41%), Trent (up 3.36%), and Hindalco Industries (up 2.01%).

Conversely, the top losers were Oil & Natural Gas Corporation (down 2.83%), ITC (down 2.32%), State Bank of India (down 2.00%), Britannia Industries (down 1.73%), and Adani Ports & Special Economic Zone (down 1.54%).

Nifty Bank index declined 0.44 percent, while the Financial Services index lost 0.51 percent. The PSU Bank and FMCG indices lost 1.38 percent and 1.30 percent, respectively. On the other hand, the Nifty Metal index jumped 2.66 percent.

Considering the Broader market indices, the BSE Smallcap index followed suit, closing 0.68 percent lower. However, the BSE Midcap index outperformed the Sensex, gaining 0.13 percent.

The Nifty midcap index outperformed the Nifty 50, with the Nifty Midcap 50 closing up by 0.32%. On the other hand, small-cap stocks underperformed as the Nifty Small Cap 100 ended at 17056.75, down by 49.9 points or 0.29%.

STOCKS TODAY

Cochin Shipyard: Cochin Shipyard shares dropped 5% after reporting a 27% year-on-year decline in profit for Q3FY25. The fall in profit from Rs 244 crore to Rs 177 crore triggered concerns about the company’s short-term growth prospects, pushing the stock lower.

Swiggy: The company’s stock continued to slide, falling 2.5% as investors reacted to higher-than-expected EBITDA losses for Q3FY25. The fourth consecutive day of losses followed downgrades by analysts, including Macquarie, who lowered their target price to Rs 325, further fueling investor caution.

Sonata Software: Sonata Software’s stock plummeted by 15% after the company reported a ramp-down in business from a key client in Q3FY25. The change in outlook for Q4FY25, which is now expected to show revenue de-growth, led to significant negative sentiment around the stock.

Bharti Airtel: Shares of Bharti Airtel soared 5% as the company reported a staggering 505% increase in net profit for Q3FY25. The exceptional profit boost was driven largely by a one-time gain due to the consolidation of a majority stake in Indus Towers.

Gulf Oil: Gulf Oil saw a 7% jump in its stock price after reporting a 22% year-on-year surge in its net profit for the quarter ending December 31, 2024. The firm also announced a dividend of Rs 20 equity per share for its shareholders.

PG Electroplast: PG Electroplast shares gained 6% following a strong earnings report for Q3FY25, with notable growth in both revenue and profitability. For the quarter ended December of FY25, the company reported a growth of 109 percent on a year-on-year (YoY) basis in its net profit to Rs 40.1 crore.