POST-MARKET REPORT

The Indian benchmark indices extended their ongoing correction phase for a sixth straight session on November 14, with the Nifty ending below 23,550 amid selling seen in the FMCG, PSU Bank, and oil & gas names.

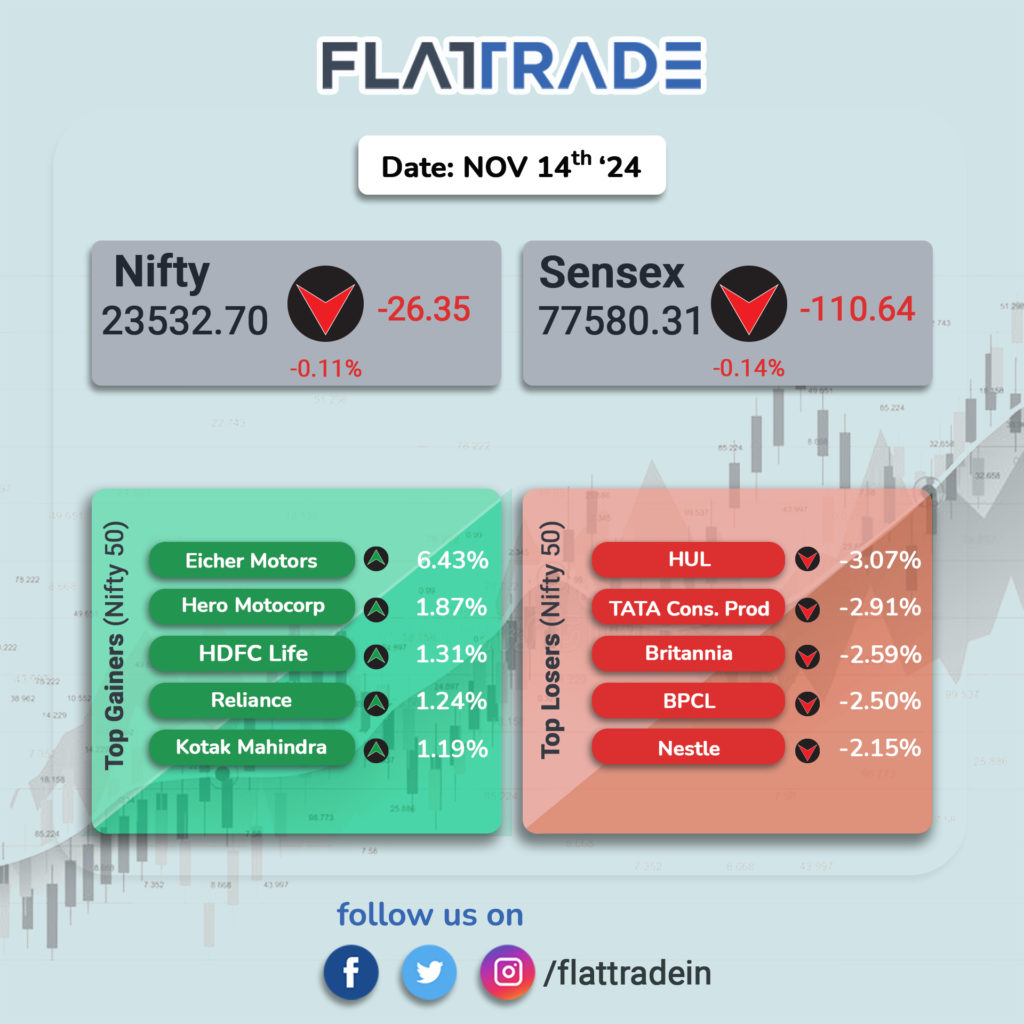

At close, the Sensex was down 110.64 points or 0.14 percent at 77,580.31, and the Nifty was down 26.35 points or 0.11 percent at 23,532.70. For the week, BSE Sensex and Nifty fell 2.5 percent each.

HUL, BPCL, Tata Consumer, Nestle, and Britannia were among the major losers on the Nifty, while gainers were Eicher Motors, Hero MotoCorp, Reliance Industries, HDFC Life and Kotak Mahindra Bank.

Among sectors, FMCG, power, PSU Bank, and oil & gas shed 0.3-1 percent, while auto, media, and realty rose between 0.6-2 percent.

BSE Midcap index was up 0.4 percent and Smallcap index added nearly 1 percent.

The Market will remain shut on Friday, November 15, on account of Guru Nanak Jayanti.

STOCKS TODAY

Jio Financial Services: Jio Financial Services shares rose nearly 7 percent after the National Stock Exchange (NSE) announced that 45 stocks will be included in the futures and options (F&O) segment. According to experts, following its inclusion into the F&O segment, Jio Financial Services could be included in the frontline Nifty 50 index during the March 2025 rebalancing.

Zomato: Zomato shares rose over 4 percent on news that the stock could be included in the Nifty 50 index during the March rejig, as its free float market capitalization, along with its inclusion in the F&O segment, could lead to the counter entering the benchmark index.

Eicher Motors: Eicher Motors’ shares rose over 6 percent after decent quarterly earnings and its plan to shift strategy to prioritize growth over margins has gone down well with the Street. Eicher Motors’ Q2 consolidated net profit rose 8.3 percent year-on-year to Rs 1,100 crore, matching Street expectations.

Shilpa Medicare: Shares of Shilpa Medicare surged nearly 6 percent after the company reported significant annual and sequential increases in both net profit and revenue for the quarter ended September. In Q2 of FY25, Shilpa Medicare’s consolidated net profit jumped 28 percent sequentially and an astounding 1014 percent year-on-year to Rs 18 crore.

PI Industries: Shares of PI Industries came under intense selling pressure, plunging over 4 percent after the company revised its FY25 revenue growth guidance sharply lower amid persisting industry challenges. The agrochemical company re-aligned its revenue growth guidance for FY25 to high single-digit amidst continued global industry challenges, a sharp cut from the previous 15 percent.

Agro Tech Foods: Shares fell 7 percent after Agro Tech Foods, backed by private equity firm Samara Capital, is set to acquire Del Monte Foods — a JV between Bharti Enterprises and Del Monte Pacific — in a deal valuing the joint venture at over Rs 1,300 crore. However, the Street was not too happy with the announcement and shares fell over three percent.