POST-MARKET REPORT

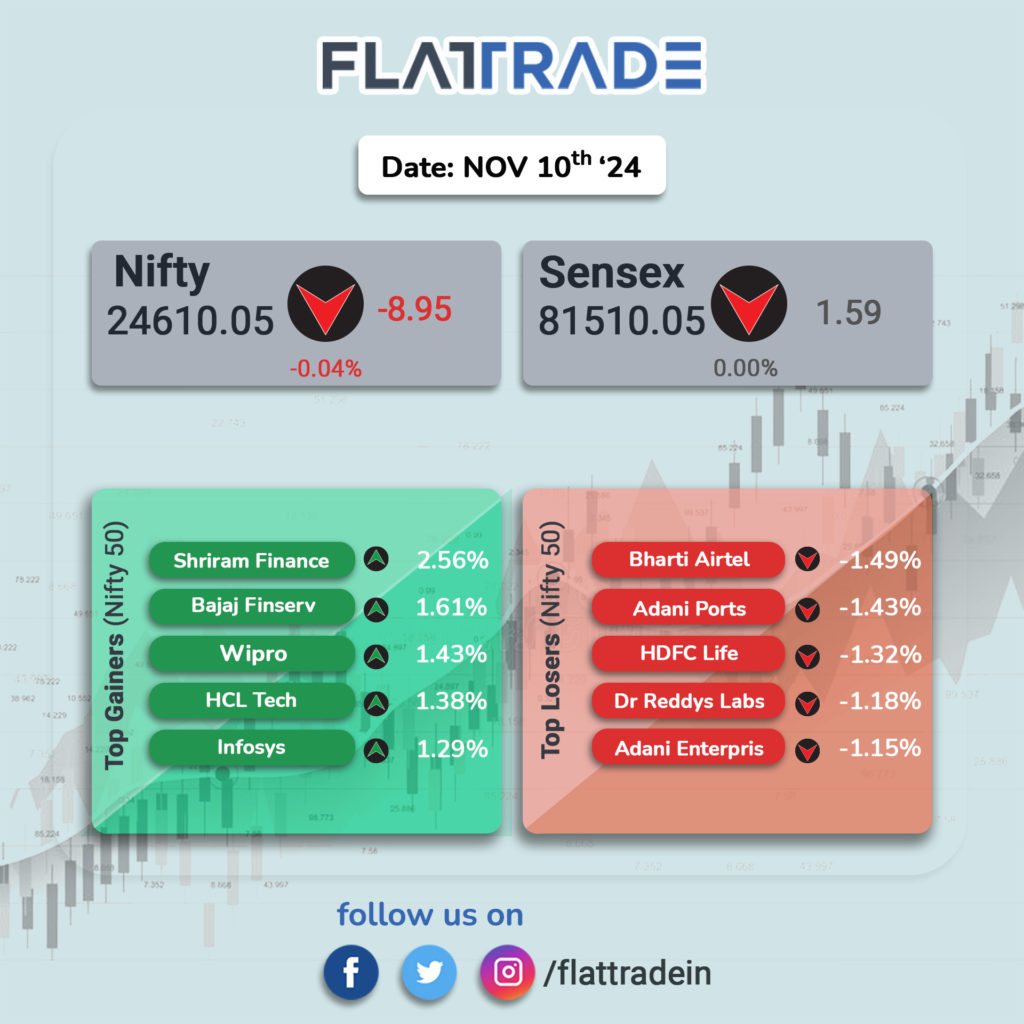

The Indian benchmark indices ended on a flat note in a highly volatile session on December 10. At close, the Sensex was up 1.59 points at 81,510.05, while the Nifty was down 8.95 points or 0.04 percent at 24,610.05.

After a flat to positive start, the market traded in positive territory in the first half. However, profit booking in the second half dragged the Nifty into the red. But final-hour buying, especially in the IT, and Realty names, erased all the losses to end with little change.

Bharti Airtel, Adani Ports, Adani Enterprises, Dr Reddy’s Laboratories, and HDFC Life were among the top losers on the Sensex, while gainers were Bajaj Finserv, Infosys, HCL Technologies, Wipro, and Shriram Finance.

On the sectoral front, power, telecom, and media were down 0.5-1 percent, while IT, metal, PSU Bank, and realty rose 0.4-1 percent.

The broader indices outperformed the main indices, with BSE Midcap and Smallcap indices up 0.3 percent each.

STOCKS TODAY

Waaree Energies: Shares rallied as much as 7.2 percent, extending its remarkable rally to five trading sessions in a row after it secured a new order to supply up to 1 GW of solar modules. The order comes from a prominent renewable energy company in India, with deliveries planned for FY25 and FY26, as per the company’s regulatory filing.

Swiggy: Shares rallied over 4 percent intraday after CLSA was among the latest to initiate coverage on recently-listed food delivery players. The brokerage issued a bullish ‘outperform’ call, seeing a target price of Rs 708 per share, indicating a whopping 32 percent upside from current levels. As a result, shares of the player surged over 4 percent in the morning session on December 10.

CEAT: After surging over 10 percent in the previous session on news, CEAT shares fell 6 percent on heavy volumes and profit booking. Investors had given a thumbs up to the company’s decision to acquire global tyre maker Michelin’s Camso brand of ‘off-highway tyres’ (OHT). The deal, valued at Rs 1,900 crore includes the brand, two manufacturing facilities in Sri Lanka, and the high-technology products and tracking business.

Life Insurance Corporation of India (LIC): The share price dropped nearly 4 percent amid a decline in November premiums for the state-run insurer. The insurance behemoth reported a drop of 27 percent year-on-year (YOY). Both total and retail APE for LIC were down in November, by 19 percent and 12 percent, respectively.

CE Info Systems: Shares of the owners of MapmyIndia tanked 5 percent as investors rushed to take home partial profits after the recent bull run in the stock. With today’s fall, the stock also snapped a four-day winning streak wherein it clocked in close to 23 percent gains.

Borosil Renewables: Shares extended their winning streak to the sixth consecutive session, surging close to 32 percent during the period. In today’s session as well, the stock managed to close x percent higher, aided by a spike in trading volumes. As much as 33 lakh shares of the company changed hands on the exchanges so far, already more than double the one-month daily traded average of 15 lakh shares.