POST-MARKET REPORT

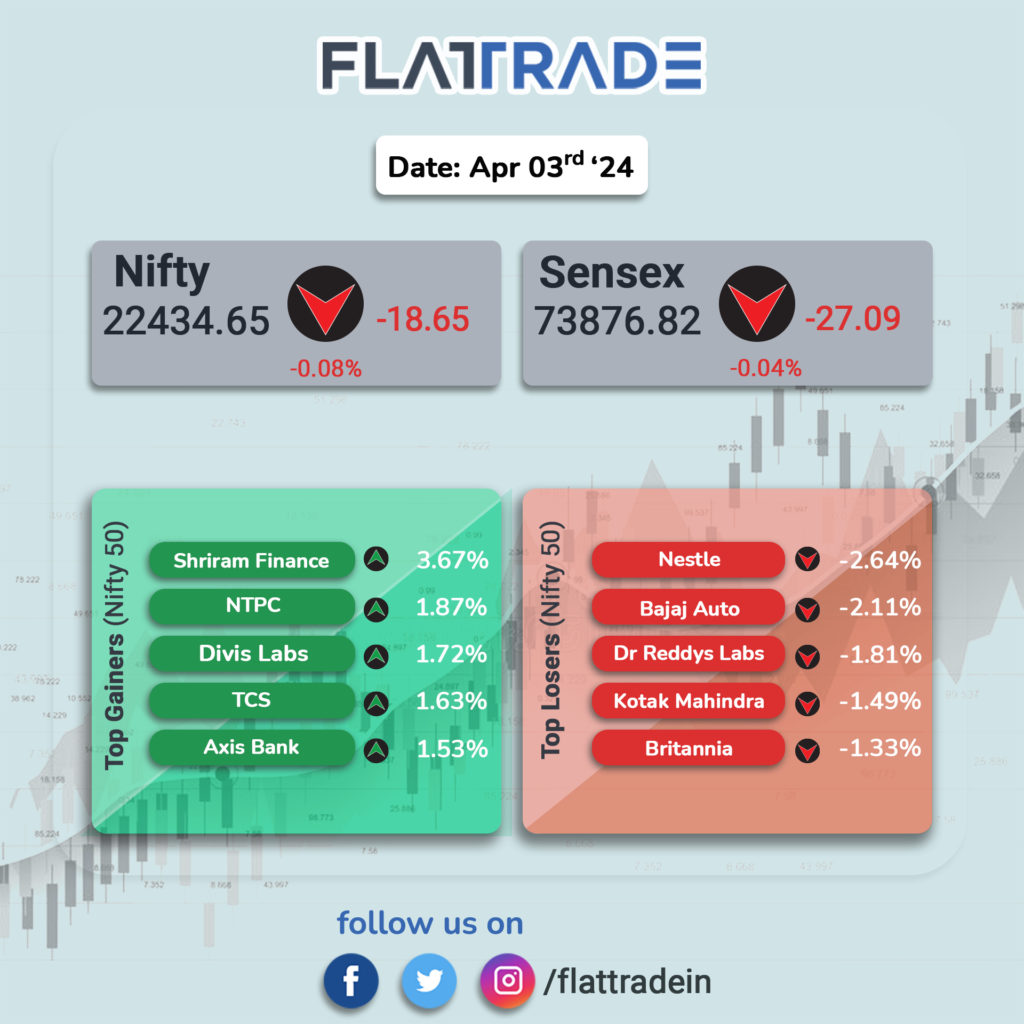

The Indian market ended on a flat note in the highly volatile session. At close, the Sensex was down 27.09 points, or 0.04 percent, at 73,876.82, and the Nifty was down 18.6 points, or 0.08 percent, at 22,434.70.

Shriram Finance, NTPC, TCS, Axis Bank, and Tech Mahindra were among the major gainers on the Nifty, while losers were Nestle India, Bajaj Auto, Kotak Mahindra Bank, Britannia Industries and Dr Reddy’s Laboratories.

On the sectoral front, the Realty index was down 2.5 percent and the Auto index slipped 0.4 percent. On the other hand, Power, and PSU Bank indices rose 1 percent each, and Information Technology and Media indices were up 0.5 percent each.

Broader indices outperformed with the BSE midcap index up by 0.6 percent, hitting a fresh record high, and smallcap index rose 1 percent.

STOCKS TODAY

Epigral: Shares of Epigral zoomed over 2 percent after the successful commissioning of an additional 45,000 TPA (tonnes per annum) capacity of CPVC (Chlorinated Polyvinyl Chloride) resin plant at its Dahej facility in Gujarat. Its total capacity now stands at 75,000 TPA, positioning it as the largest CPVC resin facility in the world at a single location.

Vodafone Idea: Vodafone Idea stock gained a percent after the company’s shareholders approved on April 3 raising Rs 20,000 crore, which could potentially unlock revenue opportunities for multinational telecom gear vendors such as Nokia and Ericsson.

Moil: Shares of Moil advanced over 3 percent, a day after the PSU announced that it recorded the best-ever production of any financial year since inception at 17.56 lakh tonnes, a jump of 35 percent yearly.

JSW Energy: Shares of JSW Energy soared 7 percent after the company announced plans to raise Rs 5,000 crore through qualified institutional placements (QIP) in one or more tranches.

Nalco: Shares of National Aluminium Company surged over 4 percent with high volumes after the state-owned firm said it clocked the highest-ever cast metal production of 4.63 lakh metric tonnes in FY24. 8 crore shares were traded against the monthly average of 2 crore.

Mahindra Finance: The Mahindra Finance stock closed 0.12 percent lower after Nomura and Jefferies remained cautious about the company despite it reporting a robust performance in the financial year 2023-24, showcasing growth in disbursements and business assets.

Sunteck Realty: The Sunteck Realty stock rose 1.78 percent after the company said that leased its second “commercial premium” building in Mumbai for a long term. The company “entered a long-term understanding/ agreement of its second premium commercial building at BKC Junction, Sunteck Icon, to Bennett, Coleman & Co Ltd”, it said in a release.