POST-MARKET REPORT

Nifty and Sensex ended flat in a volatile session on April 5 after the Monetary Policy Committee of the Reserve Bank of India (RBI) decided to keep the key rates unchanged.

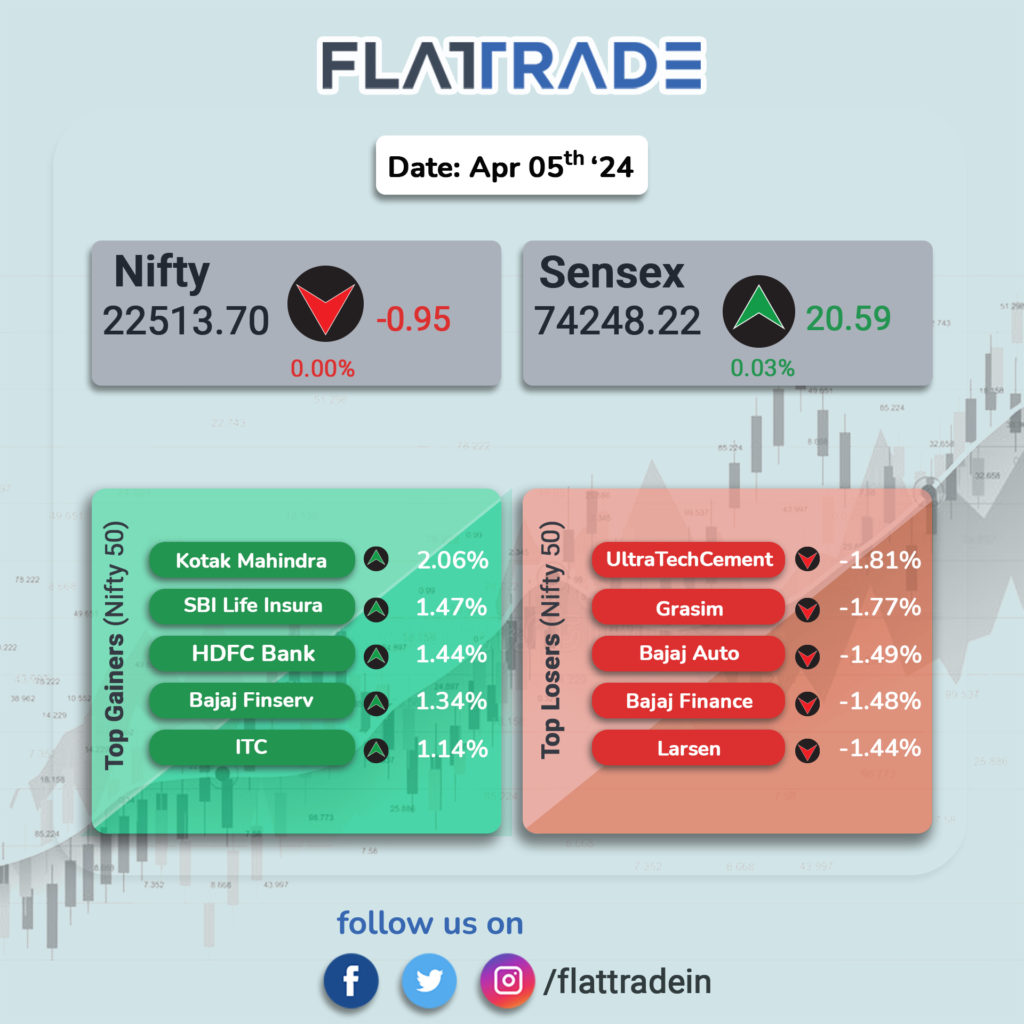

At close, the Sensex was up merely 20.59 points or 0.03 percent at 74,248.22, and the Nifty ended unchanged at 22,513.70.

Kotak Mahindra, SBI Life Insurance, HDFC Bank, Bajaj Finserv, and ITC were among the top gainers on the Nifty, while losers were UltraTech Cement, Grasim Industries, Bajaj Auto, Bajaj Finance and L&T.

Among the sectors, banking, FMCG, and realty index were up 0.5-1.5 percent, while Information Technology and Media ended down 0.4 percent each.

Considering broader market indices, the BSE midcap and smallcap index rose 0.5 percent each.

The Indian rupee closed at 83.2950 against the U.S. dollar, up nearly 0.2% compared with its close of 83.4375 in the previous session.

STOCKS TODAY

Zomato: Shares of Zomato rose 2 percent in trade to scale a record high of Rs 191.80 as it near the Rs 200 mark. Expectations of strong growth in Q4, driven by robust performances of the food delivery as well as Blinkit business have been the triggers behind the spike in Zomato’s share price.

IREDA: Shares of Indian Renewable Energy Development Agency Ltd (IREDA) jumped around 14 percent on high volumes on April 5. The sharp rally comes after the BSE revised the circuit filter for the company upwards from 5 percent, and the revised price band came into effect on the day. The IREDA shares will now have a circuit filter of 20 percent, meaning they can rise or fall to a maximum extent of 20 percent for a trading session.

Globus Spirits: The company shares rose 4 percent to Rs 815 on April 5 after the company announced a joint venture with ANSA McAL, a Trinidad and Tobago headquartered brand for beer production and distribution in India, focusing on the Carib beer brand.

Marico: Shares of Marico rose 3 percent on April 5 as investors rejoiced the company’s positive business updates for the fourth quarter ended March. The company, in its Q4 update, stated that its international business has reverted to clocking double-digit constant currency growth. As for the Q4 consolidated revenue, the company expects it to trend upwards.

Indraprastha Medical Corp: Indraprastha Medical Corporation surged 19 percent in early trade on April 5 as India’s largest private lender HDFC Bank offloaded 27.8 lakh shares in the medical player. HDFC Bank sold 3.03 percent of the total share capital of Indraprastha Medical Corporation for an all-cash consideration of Rs 55.46 crore.

Aavas Financiers: Shares of Aavas Financiers surged 8 percent intraday on April 5 after the company reported strong growth in disbursements and assets under management for the quarter ended March. The non-bank finance company reported a 20 percent on year uptick in disbursements to Rs 1,890 crore during the January-March quarter. Assets under management also rose 22 percent on year to Rs 17,300 crore in the quarter gone by.