POST-MARKET REPORT

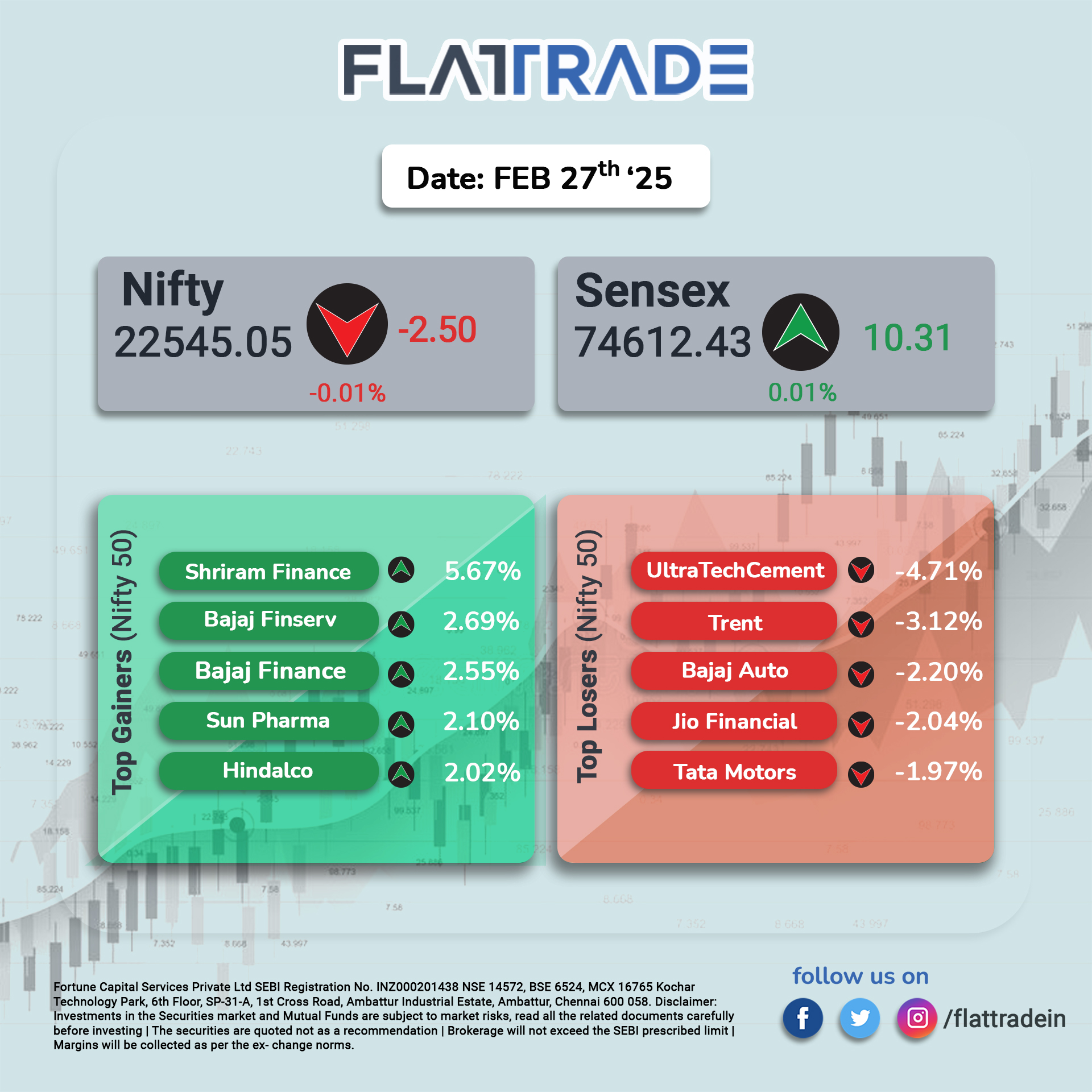

Indian equity indices ended with no change in the muted session on February 27 (F&O expiry day). At close, the Sensex was up 10.31 points or 0.01 percent at 74,612.43, and the Nifty was down 2.50 points or 0.01 percent at 22,545.05.

Shriram Finance, Bajaj Finance, Bajaj Finserv, Sun Pharma, and Hindalco Industries were among the major gainers on the Nifty, while losers were UltraTech Cement, Trent, Jio Financial, Bajaj Auto and Tata Motors.

Except for bank and metal, all other sectoral indices ended in the red auto, media, energy, capital goods, realty, and power down 1-2 percent.

Considering the Broader market indices, the BSE Midcap index shed 1 percent, and the smallcap index fell 2 percent.

STOCKS TODAY

INOX India: Shares jumped about 13% in early trade after the company announced it became India’s first cryogenic equipment manufacturer to receive the prestigious IATF 16949 certification. The award, given after a comprehensive audit of its Kalol facility in Gujarat, has significantly boosted investor confidence.

Prestige Estates: Prestige Estates was the top loser on the Nifty Realty index, crashing nearly 5 percent, following Income Tax searches at the registered office and other branch offices. The shares of Raymond, Mahindra Lifespace Developers, DLF, and Godrej Properties dropped over 2 percent each on the Nifty Realty index.

KEI Industries: Cables and wires players such as KEI Industries and Polycab India shares sank 17 percent and 14 percent while Havells India was down 5 percent as UltraTech Cement announced its foray into the C&W segment. According to Motilal Oswal, this entry could pose a threat to the valuation multiples of C&W companies.

UltraTech: UltraTech plans to build a cable and wires plant in Gujarat’s Bharuch by December 2026, and target demand across all segments – be it residential, commercial, or industrial. The foray comes at a time of an expanding infrastructure boom across India.

Titagarh Rail Systems: Shares declined 2.5% after Morgan Stanley trimmed its target price from Rs 1,300 to Rs 1,090, even as it reaffirmed an “overweight” rating. The revision suggests cautious optimism, with a potential upside of 40% from current levels still in view.

CreditAccess Grameen: CreditAccess Grameen, Bandhan Bank, AU Small Finance Bank, Fusion Finance, and other microfinance lenders’ shares jumped up to 18 percent in trade as the RBI stated that the microfinance loans like consumer credit would be risk-weighted at 100 percent instead of the 125 percent earlier.