WEEKLY REPORT

Indian equity indices ended a volatile week on a positive note, after the central bank’s policy decision came in line with expectations.

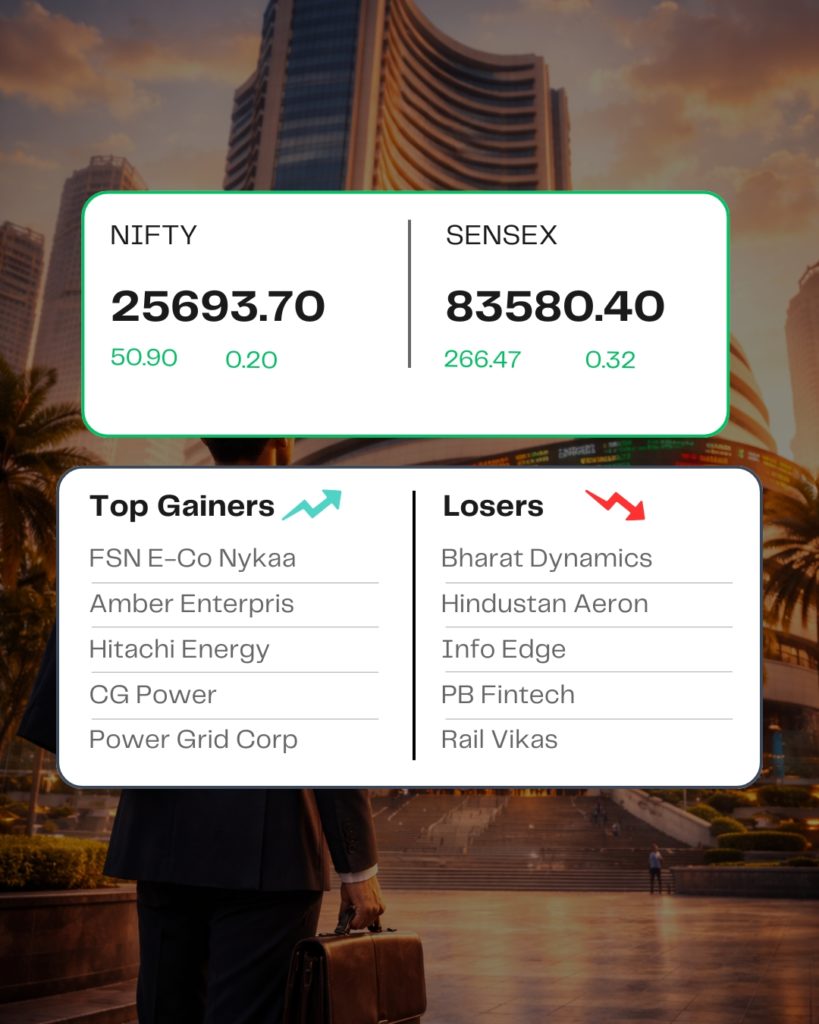

The BSE Sensex climbed 2,618.16 points, or +3.23%, to close at 83,580.40, while the Nifty50 advanced +840.60 points, or +3.38%, to settle at 25,693.70.

Top gainers – FSN E-Co Nykaa, Amber Enterprise, Hitachi Energy, CG Power, and Power Grid Corp

Top losers – Bharat Dynamics, Hindustan Aeronautics, Info Edge, PB Fintech, and Rail Vikas Nigam

Among Sectors, Hardware Tech, Consumer durables, Textiles, Telecom performed well, while IT, Defence, Metals & Mining sectors slipped.

The Indian rupee cooled off during the week and ended higher at 90.66 on February 06, compared to 91.99 on January 30.

ECONOMY

India Increases Infrastructure Spending to ₹12.2 Trillion

India’s government announced a record infrastructure outlay of ₹12.2 trillion ($133 billion) for the 2026-27 fiscal year, marking an 11.4% increase from the previous year to support economic growth, create jobs, and boost sectors like manufacturing and construction. The move is expected to benefit capital goods and infrastructure stocks after the announcement.

U.S. Software Stocks Plunge on AI Disruption Fears

Shares of major U.S. software and data services companies extended losses for a seventh session, wiping out about $1 trillion in market value over the week. Investors are increasingly concerned about potential disruption from AI technologies and the pressure these innovations could place on traditional software business models.

STOCKS IN NEWS

MRF

Shares of tyre maker MRF surged over 10 percent over the week to close at 1,46,195.00 per share on the NSE. The upward momentum is after the company reported a more than two-fold jump in net profit to Rs 679 crore for the December quarter, while revenue from operations rose 15.3 percent year-on-year.

Infosys

Shares of IT giant Infosys went down almost 8 percent in the week, amid concerns that artificial intelligence can intensify competition rapidly after Anthropic’s launch of a legal AI tool.

FSN E-Commerce Ventures

FSN E-Commerce Ventures Ltd, the operator of beauty and fashion platform Nykaa shares, went up over 17 percent this week, after the company reported profitability for the December quarter, with net profit attributable to equity holders surging 143 percent year-on-year to Rs 63.3 crore in Q3 FY26. The company had posted a net profit of Rs 26.1 crore in the corresponding quarter last year, according to its unaudited financial results.

Kalyan Jewellers India

Shares of Kalyan Jewellers rose almost 5 percent after the company’s Q3 FY26 net profit jumped over 90 percent year-on-year to Rs 416.3 crore, driven by higher sales and inventory gains. The jewellery company’s revenue from operations for the fiscal third quarter rose 42 percent on-year to Rs 10,343.4 crore.

Bharat Coking Coal

The shares of Bharat Coking Coal ended almost 4 percent lower at the end of the week, after the company released its results for the October-December quarter of the ongoing financial year 2026. The company reported a net loss of Rs 23 crore for the October-December quarter of the ongoing FY26, as against a net profit of Rs 425 crore in the corresponding quarter of the previous financial year.

Source – Moneycontrol, Reuters