POST-MARKET REPORT

Indian equity benchmark indices, Sensex and Nifty50, surged on Wednesday, led by heavyweights. However, at the fag end of the session, indices came off their day’s high and closed with mild gains.

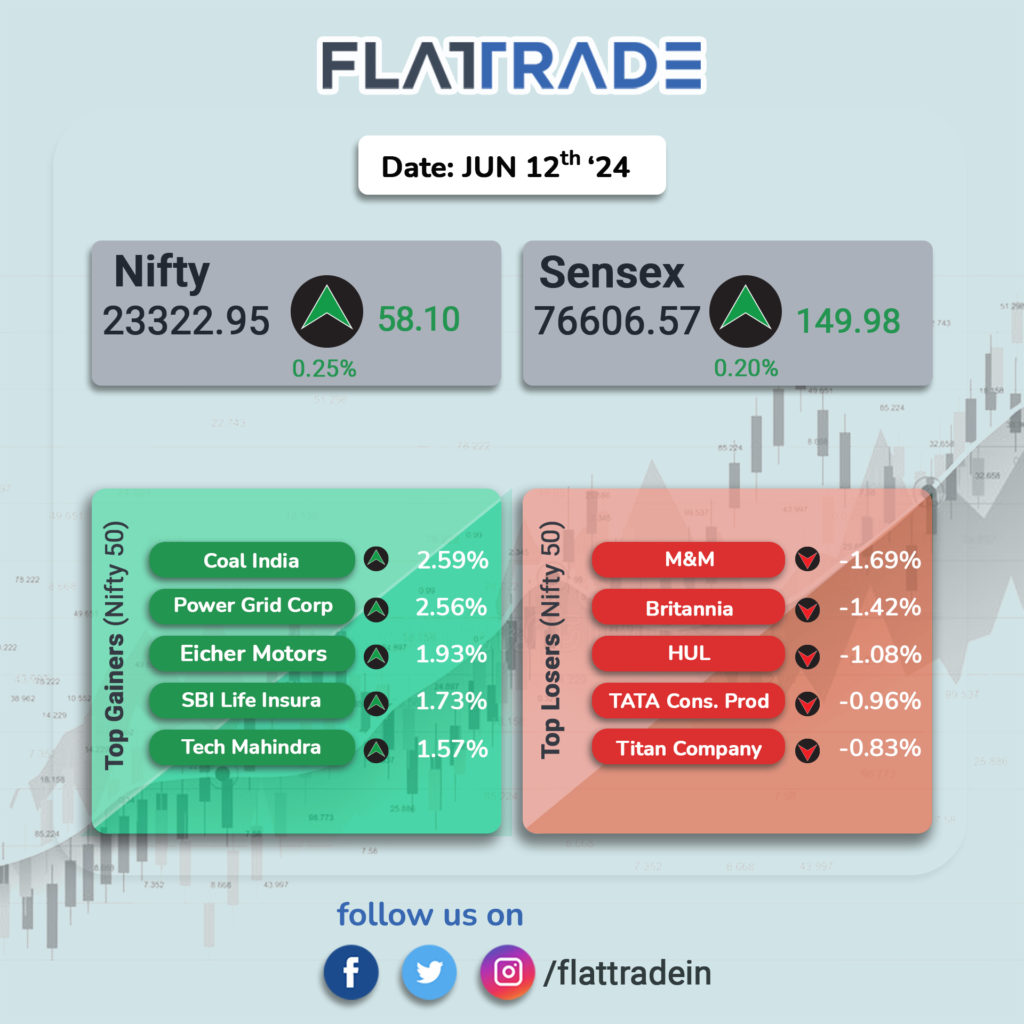

At close, Sensex was up by 149.98 points, at 76,606.57 while the Nifty was up by up 0.25% to end at 23,322.95.

Gainers and Losers on Nifty50: Coal India, Power Grid, Eicher Motors, and SBI Life were amongst the biggest gainers on Nifty 50 while M&M, Britannia, HUL, Tata Consumer Products, and Titan were some of the biggest losers.

Gainers and Losers on Sensex: Power Grid, Tech Mahindra, and Bajaj Finance were the top gainers, while M&M and Hindustan Unilever were the biggest laggards on the Sensex.

Sectoral and Broader markets today: Nifty Media and Nifty PSU Bank were the top gainers among sectoral indices as they both gained 2 percent and 1 percent, respectively. Meanwhile, Nifty FMCG, the only loser amongst the sectoral indices, fell 0.4 percent. Smallcaps and midcaps outperformed the benchmarks.

The Indian rupee ended flat at 83.54 per US dollar after likely RBI intervention averted a fall to an all-time low.

STOCKS TODAY

IOL Chemicals: The stock soared as much as 6.32 percent on June 12 after it secured a certification of suitability (CEP) certificate for Pantoprazole Sodium Sesquihydrate for alternative process (Process – II). Pantoprazole is used for heartburn, acid reflux, and gastro-oesophageal reflux disease.

HCLTech: Shares rose around 3 percent after the company announced renewing a $278 million deal with Germany’s apoBank for 7.5 years. The IT major will help apoBank with an outcome-oriented managed services model to deliver fast and secure banking services to its customers.

TVS Supply Chain Solutions: Shares surged 8 percent after the company inked a five-year strategic contract with Daimler Truck South East Asia Pte Ltd, a Daimler Truck AG subsidiary. Per the deal details, the company will serve as the primary logistics partner for Daimler Truck AG, the world’s largest commercial vehicle manufacturer, across the Asia-Pacific region.

Brigade Enterprises: Real estate developer Brigade Enterprises on June 12 announced its plan to invest Rs 8,000 crore in Chennai by 2030 to expand its business. With this investment, Brigade aims to establish Chennai as its second-largest market. Brigade Group also announced the launch of Brigade Icon Residences as part of its high-end mixed-use development projects in Chennai.

Tata Motors: The company’s India business was a big drag in the past decade but now forms 50 percent of the price target set by Jefferies, wrote the brokerage’s analysts in their latest report. The report came after the company made its presentation on India Investor Day, where the company shared its plans to raise its market share in passenger vehicles (PVs) and increase its non-vehicle revenues in commercial vehicles (CVs).

Heritage Foods: A block deal, representing 1.5 percent equity or 14.2 lakh shares of Heritage Foods, which is worth Rs 89.4 crore exchanged hands in trade on June 12, at an average price of Rs 629 per share. Since June 3, the stock of Heritage Foods has been hitting a series of upper circuits after TDP became one of the key allies of the National Democratic Alliance 3.0 government.