POST-MARKET REPORT

The Indian benchmark indices ended with marginal losses in the volatile session on December 6 with Nifty closing below 24,700 after RBI delivered on the expected line by keeping the repo rate unchanged and cutting the CRR to improve liquidity.

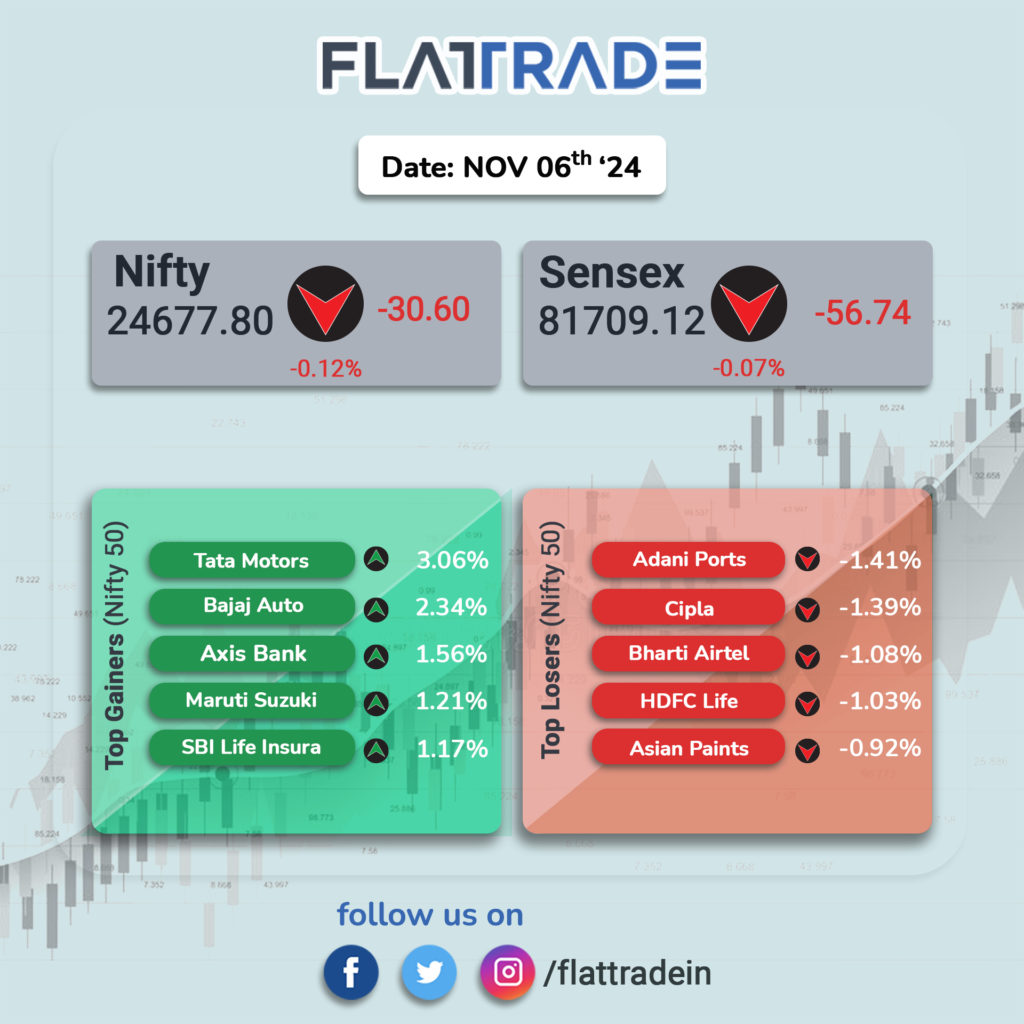

At close, the Sensex was down 56.74 points or 0.07 percent at 81,709.12, and the Nifty was down 30.60 points or 0.12 percent at 24,677.80.

The Reserve Bank of India’s Monetary Policy Committee (MPC) decided to keep the benchmark repo rate unchanged at 6.5 percent for the 11th time in a row.

However, to improve liquidity in the banking system, the RBI Governor announced a reduction in the CRR to 4 percent, a cut of 50 bps, done in two tranches of 25 bps each.

The MPC has revised its inflation forecast for FY25, increasing the Consumer Price Index (CPI) inflation projection to 4.8 percent, up from the earlier estimate of 4.5 percent.

However, it cut its GDP growth forecast to 6.6 percent for the current fiscal year, from 7.2 percent earlier. On the sectoral front, except IT and media, all other indices ended in the green with auto, metal, FMCG, telecom, and PSU Bank up 0.3-1 percent.

For the week, BSE Sensex and Nifty added more than 2 percent each.

STOCKS TODAY

Ceigall India: Shares surged 4 percent after the company announced receiving an arbitration award worth Rs 54.21 crore in its favor in the Greater Mohali Area Development Authority (GMADA) case. The award comes under the Arbitration and Conciliation Act, of 1996. The dispute was related to the project titled “Construction of Service Road along with a 200′ wide road from Mullanpur/UT boundary up to the ‘T’ Junction of Kurali-Siswan road at SAS Nagar.”

Mishtann Foods: Shares cracked 20 percent after it received a Show Cause Notice from the capital market regulator over Rs 100 crore of company funds that Sebi said were misappropriated or diverted through group entities. Mishtann Foods (MFL) has contested the allegations and said it ‘doesn’t agree’ with the observations in the interim order. “The said Interim Order is a SHOW CAUSE NOTICE wherein an explanation from the company has been sought on certain allegations against the company. The SCN is NOT a final order and is inter alia asking for an explanation from the Company,” MFL said.

Zaggle Prepaid Ocean Services: Shares rose 5 percent after the company secured three orders in just two days. The first order won by the company is a five-year contract for Zaggle’s fleet program from AGP City Gas. Following that, the company won a one-year order from Hitachi India. Under this order, Zaggle would provide Hitachi India with its Zaggle propel rewards solution. Aside from these, the company also signed a two-year master agreement with Blink Commerce to provide its Zoyer solution.

Newgen Software: Shares jumped over 3 percent after international brokerage Jefferies stated that it remains constructive on the company’s growth prospects, anticipating a 15 percent upside from Thursday’s closing price. The brokerage retained its ‘buy’ call on the stock with a price target of Rs 1,500.

RITES: Shares of RITES closed nearly 3 percent higher after the company secured a significant project from the Indian Institute of Management (IIM) Raipur. The order, valued at Rs 148.25 crore (excluding GST), involves RITES serving as the Project Management Consultant (PMC) for the development of Phase II of the institute’s campus in Chhattisgarh. The scope of the project includes execution, supervision, monitoring, and development, to be completed on a cost-plus basis within a timeline of 23 months.