POST-MARKET REPORT

The benchmark indices shed 1.5 percent on January 6 amid fears about Human Metapneumovirus (HMPV) weighed on investor sentiment.

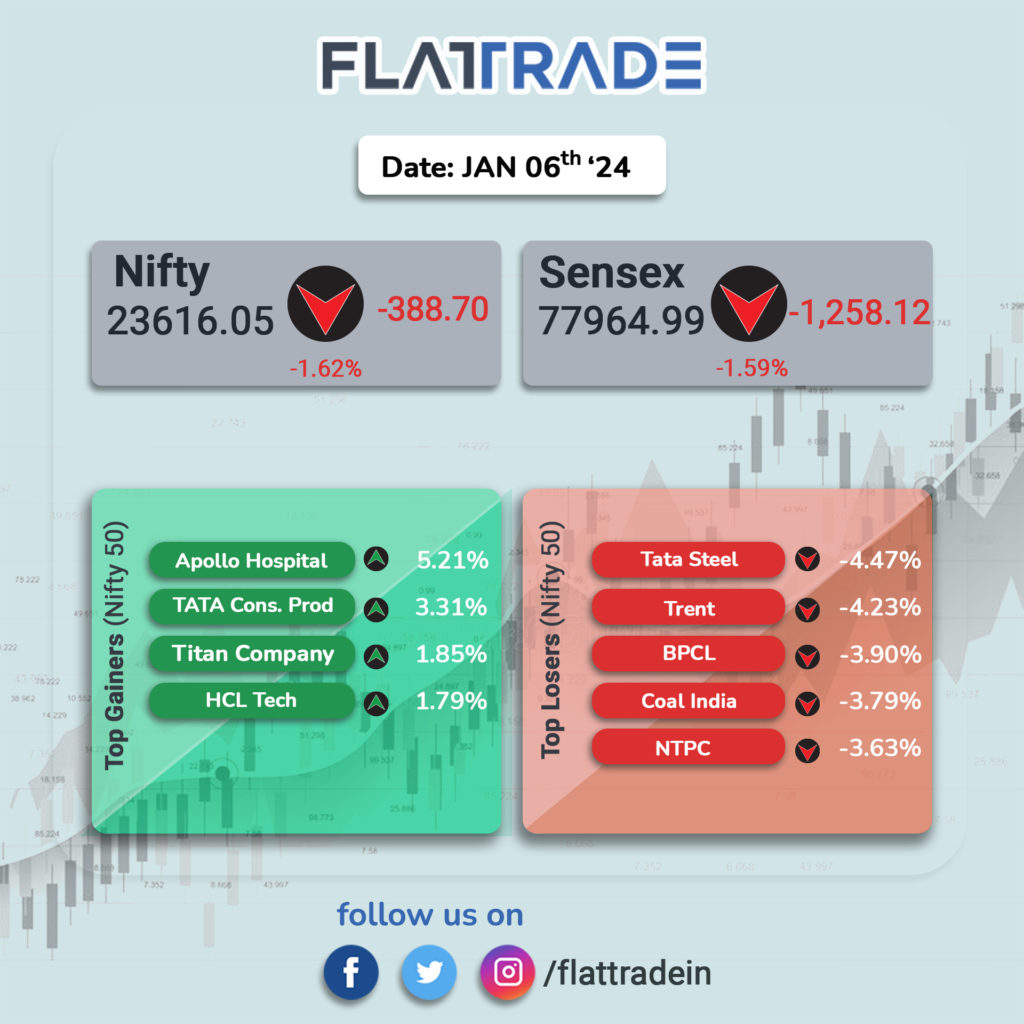

At close, the Sensex was down 1,258.12 points or 1.59 percent at 77,964.99, and the Nifty was down 388.70 points or 1.62 percent at 23,616.05.

The biggest Nifty losers included Tata Steel, Trent, Coal India, NTPC, and BPCL, while gainers were Apollo Hospitals, Tata Consumer, Titan Company, and HCL Technologies.

All the sectoral indices ended in the red with PSU Bank down 4 percent, while metal, realty, energy, PSU, power, and oil & gas were down 3 percent each.

Broader indices underperformed with the BSE Midcap index falling 2.4 percent and Smallcap index down 3 percent.

STOCKS TODAY

Union Bank of India: Shares of Union Bank of India tumbled 7 percent to Rs 115 per share on January 6 after the state-run reported weakest December quarter business update amongst all lenders so far. Union Bank’s deposits grew modestly by 4 percent year-on-year (YoY) to Rs 12.16 lakh crore in Q3FY25 but declined 2 percent on a quarter-on-quarter (QoQ) basis. Global gross advances, meanwhile, rose by 6 percent YoY and 2.2 percent QoQ in the December quarter.

Easy Trip Planners: Easy Trip Planners shares soared over 17 percent in early trade on Monday after its former CEO and promoter Nishant Pitti confirmed that there would be no further sale of promoter stake in the company. The development comes shortly after Pitti, who stepped down as CEO on January 1, clarified in an earlier post on January 3 that he remains committed to the company’s growth and does not intend to offload more shares. “The brand is on a strong growth path,” he had said.

Jubilant Foodworks: Shares of Jubilant Foodworks surged for the fourth consecutive day on January 6, climbing up to 5 percent to hit a fresh 52-week high of Rs 796 per share, following a positive December quarterly business update. The company reported 56 percent year-on-year (YoY) growth in consolidated revenue for the December quarter to Rs 2,156 crore, driven in part by the acquisition of DP Eurasia. On a standalone basis, revenue rose 19 percent YoY from last year’s Rs 1,611 crore.

Bajaj Finance: Shares of Bajaj Finance and Bajaj Finserv surged up to 2.5 percent on January 6, reaching Rs 7,599 and Rs 1,732 per share. Bajaj Finance reported 28 percent year-on-year (YoY) growth in assets under management (AUM), reaching Rs 3.98 lakh crore in Q3FY25, up from Rs 3.10 lakh crore a year ago. The NBFC also saw a 19 percent YoY increase in its deposit book, rising to Rs 68,800 crore from Rs 58,008 crore last year.

Titan: Titan Company Ltd. shares spiked over two percent in the morning deals to become the top gainer on the Nifty 50 index as the firm registered a growth of 24 percent on-year for the quarter ended December. Titan shared that its combined retail network presence (including CaratLane and international stores) expanded by 69 stores in the quarter to reach 3,240 stores.