POST-MARKET REPORT

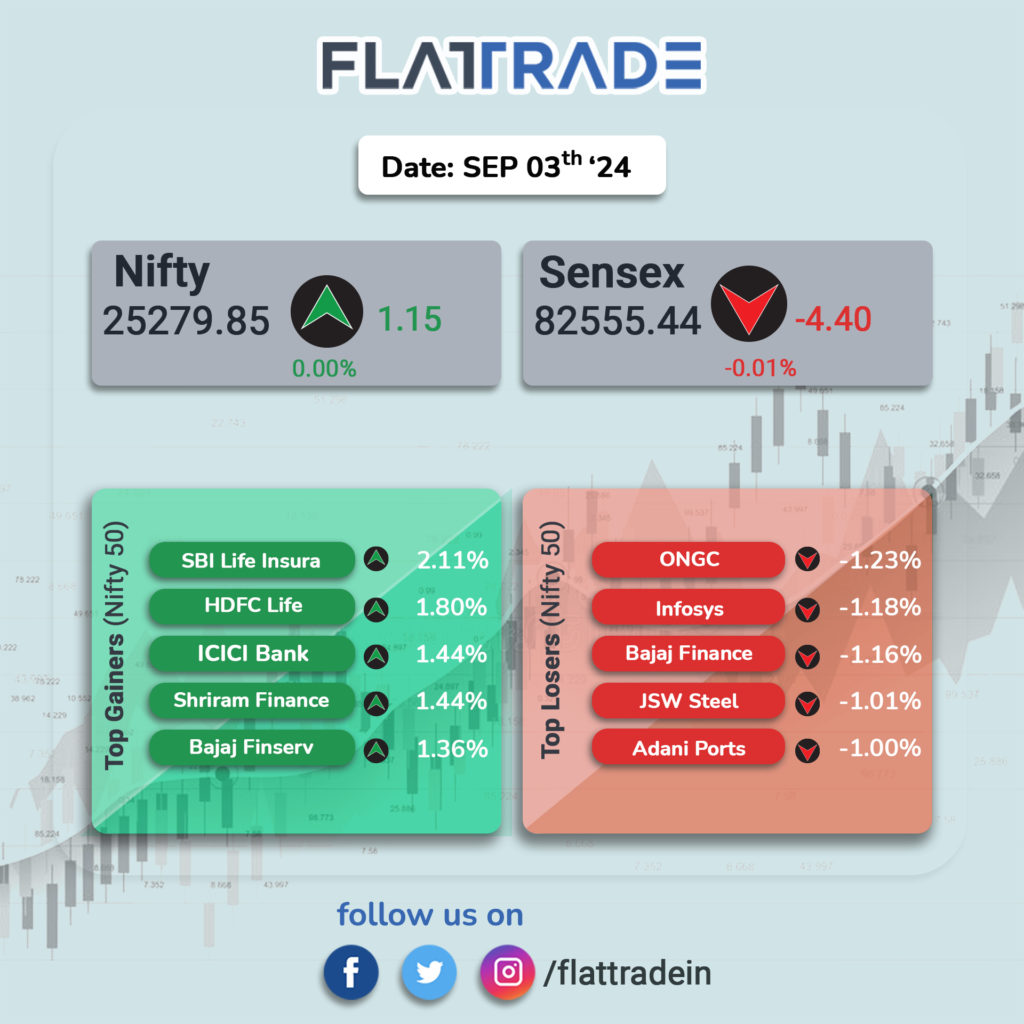

In the rangebound trading session, the benchmark indices ended with little. At close, the Sensex was down 4.40 points or 0.01 percent at 82,555.44, and the Nifty was up 1.10 points at 25,279.80.

BSE Sensex snapped 11th consecutive session gains, while the Nifty 50 extended its rally for the 14th straight session.

Top Nifty gainers were SBI Life Insurance, ICICI Bank, HDFC Life, Shriram Finance and Bajaj Finserv, while losers were ONGC, Infosys, Bajaj Finance, JSW Steel and Adani Ports.

Among sectors, bank and capital goods indices were up 0.5 percent each, while media, power, metal, realty, and oil & gas were down 0.5-1.5 percent.

The BSE midcap index ended with marginal gains and the smallcap index rose 0.5 percent.

STOCKS TODAY

GMR Power & Urban Infra: The stock jumped 5 percent on September 3 as Authum Investment & Infrastructure bought 74.9 lakh shares or 1.2 percent stake at Rs 134 apiece a day ago via open market transactions. Additionally, analysts at B&K Securities initiated a ‘buy’ coverage on GMR Power and Urban Infra, seeing an upside potential of 37 percent from current levels.

Apollo Pipes: The stock rallied over 10 percent amid heavy volumes and a strong growth outlook. Around 1.6 million equity shares exchanged hands at both NSE and BSE intra-day deals, significantly exceeding a one-week average of 0.1 million equity shares.

FIEM Industries: The automotive lighting maker’s stock soared over 5 percent after Kotak Securities initiated coverage with a ‘Buy’ call and a price target of Rs 2,140 on the stock, nearly 40 percent higher from the previous close. FIEM’s product portfolio is versatile across different technologies, Kotak’s note said, implying the rise in electric vehicle adoption may not disrupt the auto components maker’s business.

Adani Green Energy: Shares fell over 2 percent amid weak markets. This is despite the company announcing that it has signed a binding agreement for a JV with TotalEnergies Renewables Singapore, involving an investment of $444 million into a new entity. This comes after the company and the French oil major had inked a $300 million deal to build renewable capacity in India, where the bulk of energy requirements are still met by coal.

Signature Global: Shares dropped nearly 6 percent in the early trade on Tuesday after over 57 lakh shares changed hands in Rs 828 crore large trade. Signature Global stock fell 6.60 percent to hit the day’s low of Rs 1,397.15 apiece after a large trade deal worth Rs 828.2 crore. As many as 57.2 lakh shares or 4.1 percent equity changed hands at Rs 1,449 per share.

Aadhar Housing Finance: The stock rallied over 7 percent after Kotak Securities initiated a ‘buy’ coverage on Aadhar Housing and set the target price at Rs 550 apiece, implying an upside potential of 41 percent from current levels. The bullish coverage comes as analysts believe that it is one of the large diversified players with over 20 percent growth trajectory.