POST-MARKET REPORT

The Indian equity market escalated to a fresh record high and extended the winning run for the fourth straight session on July 18 led by IT, banking, and FMCG names.

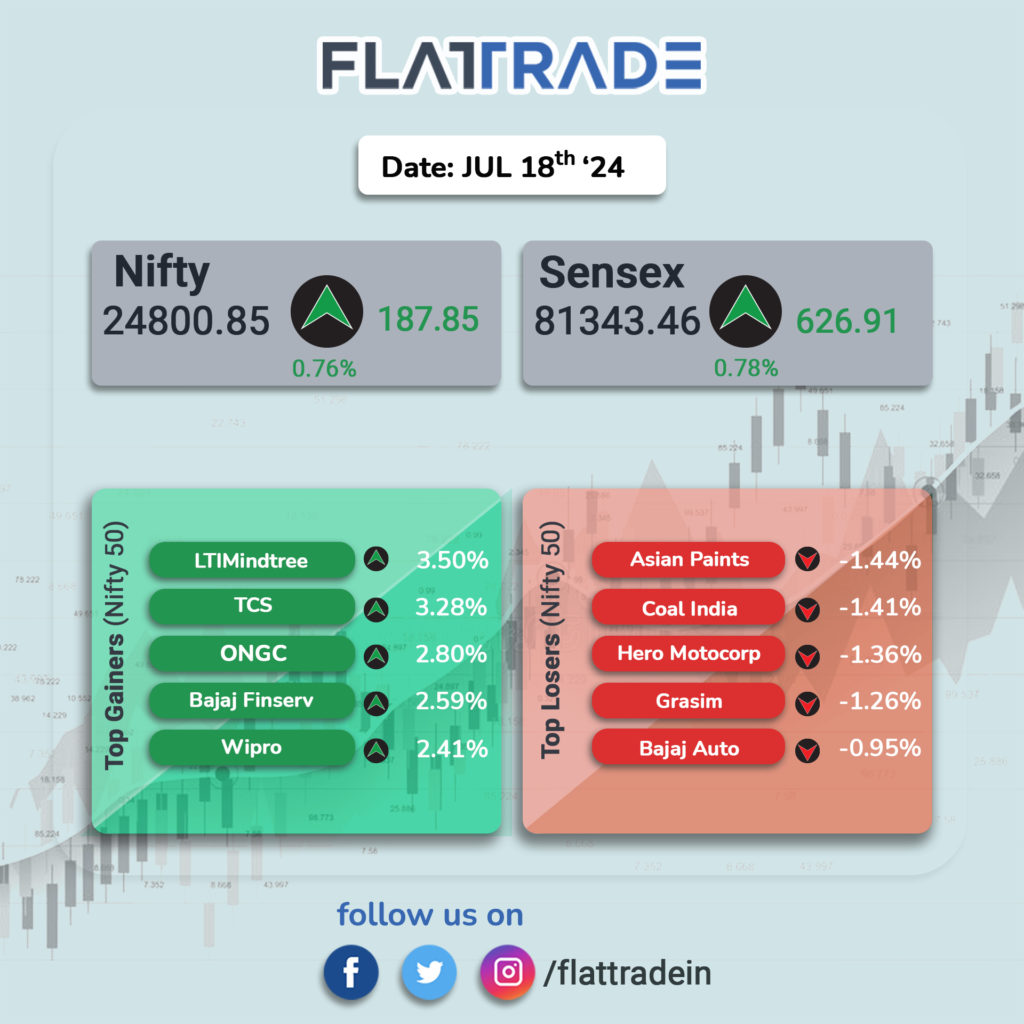

At close, the Sensex was up 626.91 points or 0.78 percent at 81,343.46, and the Nifty was up 187.85 points or 0.76 percent at 24,800.85.

The BSE Sensex and Nifty50 touched fresh record highs of 81,522.55 and 24,837.75, respectively, during intraday trade.

TCS, LTIMindtree, ONGC, Bajaj Finserv, and Wipro were among the top gainers on the Nifty, while losers included Asian Paints, Hero MotoCorp, Grasim, Coal India and Bajaj Auto.

Among sectors, bank, auto, IT, FMCG, and telecom rose 0.3-2 percent, while capital goods, metal, power, and media were down 1-3.5 percent.

The BSE midcap and smallcap index shed one percent each.

STOCKS TODAY

Mahanagar Telephone Nigam Limited (MTNL): Shares skyrocketed 19 percent to hit a multi-year high at Rs 63.32 on NSE amid heavy volumes. The sharp rally comes after the government deposited Rs 92 crore to clear immediate bond interest dues of the state-owned telecom service provider.

LTIMindtree: Shares rose 3.5 percent as the Street cheered for a strong start to FY25 after the company reported steady earnings for the April-June quarter. On top of that, the management’s positive commentary, hinting at green shoots of recovery, further bolstered sentiment.

Eicher Motors: Shares fell as much as 3 percent to Rs 4,784 apiece in the morning after a host of brokerages issued bearish calls on the stock following the company’s launch of Royal Enfield Guerrilla 450.

Just Dial: Shares skyrocketed over 11 percent to Rs 1,156 per share following a strong performance in the April-June quarter (Q1FY25), aligning with market expectations.

IDBI Bank: Shares soared nearly 6 percent to Rs 93 per share after the Reserve Bank of India (RBI) issued a ‘fit and proper’ report on bidders, advancing the divestment process, according to sources reported by CNBC-Awaaz.

KEC International: Share price gained nearly 4 percent in the early trade after the company secured new orders of Rs 1,100 crore for transmission & distribution (T&D) projects in India, the Middle East, Australia, and the Americas.

Newgen Software Technologies: Shares fell nearly 7 percent and hit an intraday low of Rs 976 on the NSE after the company reported a sequential decline in its consolidated net profit and revenue for Q1 FY25.