POST-MARKET REPORT

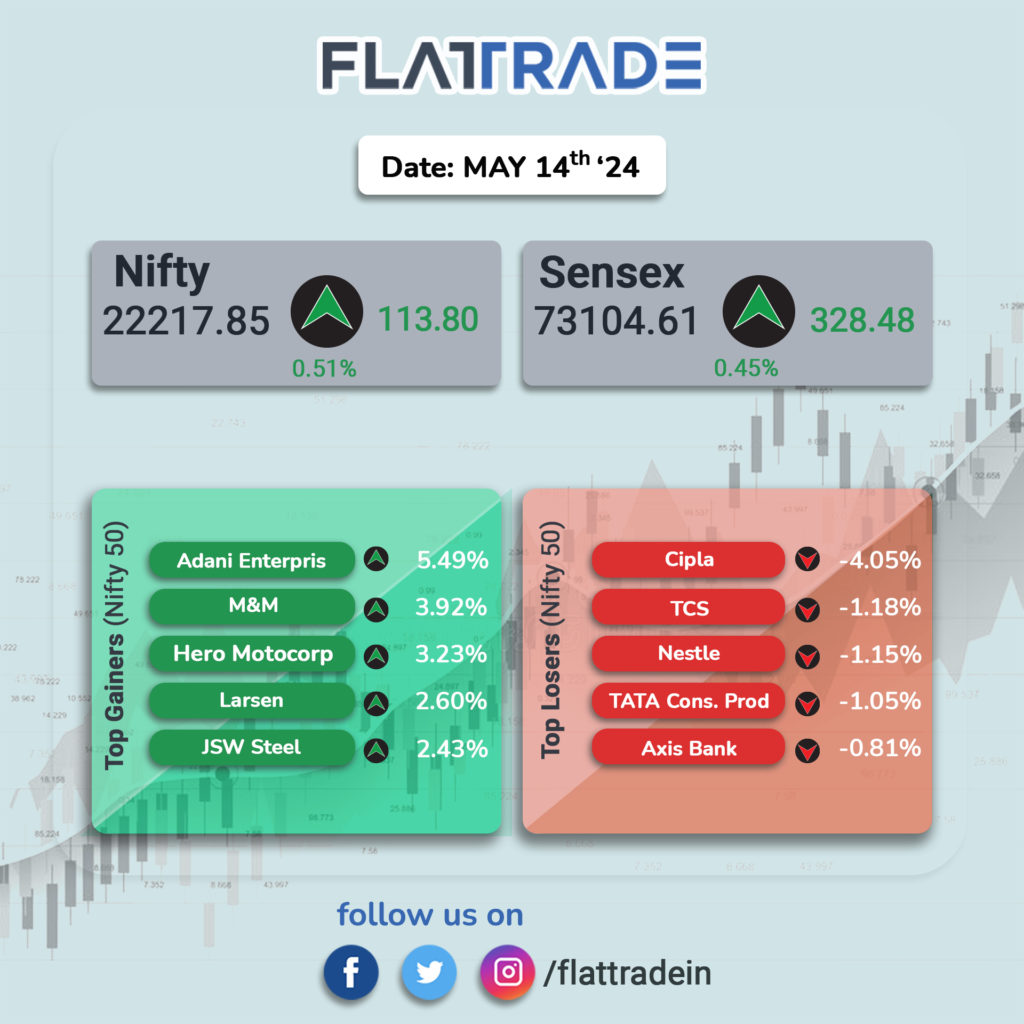

Indian stock market benchmarks, the Sensex and the Nifty 50 ended in positive territory for the third consecutive session on Tuesday, May 14, amid mixed global cues.

At close, Sensex ended above the 73000-mark, up 0.45 percent or 328 points while Nifty closed at 22218, up 0.51 percent or 114 points.

Gainers and Losers on Nifty50

The top gainers in the Nifty index were Adani Enterprises (up 5.49%), Mahindra & Mahindra (up 3.92%), Hero Motocorp (up 3.23%), Larsen & Toubro (up 2.60%), and JSW Steel (up 2.43%).

The top losers in the Nifty index were Cipla (down 4.05%), Tata Consultancy Services (down 1.18%), Nestle India (down 1.15%), Tata Consumer (down 1.05%), and Axis Bank (down 0.81%).

Gainers and Losers on Sensex

The top gainers in the Sensex were Mahindra & Mahindra (up 3.76%), Larsen & Toubro (up 2.54%), NTPC (up 1.45%), IndusInd Bank (up 1.28%), and Sun Pharmaceutical Industries (up 1.27%).

The top Losers in the Sensex were Tata Consultancy Services (down 1.14%), Nestle India (down 1.05%), Axis Bank (down 0.94%), ICICI Bank (down 0.59%), and Bajaj Finance (down 0.53%).

Sectoral indices performance

Most sectoral indices ended with gains today. Nifty Metal (up 2.77 percent), followed by Nifty Auto (up 1.83 percent) and Nifty Oil & Gas (up 1.56 percent) ended as the top gainers among sectoral indices.

Nifty Bank rose 0.22 percent. The PSU Bank index and the Private Bank index rose 1.04 percent and 0.18 percent respectively.

Broader market indices today

The mid and smallcap segments outperformed the benchmarks as they witnessed strong gains. The BSE Midcap index ended 1.14 percent higher, while the Smallcap index clocked a gain of 1.79 percent.

STOCKS TODAY

Varun Beverages: Shares of Varun Beverages surged over 5 percent to Rs 1,558 per share on May 14 after the company posted an all-around January-March quarter (Q4FY24) performance. Varun Beverages revenue from operations grew 11 percent year-on-year (YoY) to Rs 4,317 crore in the first quarter of calendar year 2024 (Q1CY24), while PAT rose 25 percent YoY to Rs 547 crore.

Hero Motocorp: The company share climbed 3.37 percent and hit a 52-week high after the company joined the ONDC Network, becoming the first automobile company in India to do so. The stock has risen consistently across five trading sessions, gaining 57 percent over the past year and significantly outperforming the Nifty 50, which rose by 13 percent.

Mankind Pharma: Shares surged 3.14 percent after CNBC-TV18 reported that the company is planning to acquire Bharat Serum & Vaccines from private equity firm Advent International. For its exit, Advent is eyeing a valuation of $2 billion for its entire stake, the report said.

Karur Vysya Bank: Shares rallied 3.61 percent after the company reported a steady January-March quarter (Q4FY24) performance. Analysts at Kotak Institutional Equities maintained a ‘buy’ call post-Q4 results and raised the target price to Rs 215 per share from Rs 195, indicating an upside of 11 percent from current levels.

Jindal Steel & Power: Shares soared 4.31 percent after the company reported solid Q4 results, driven by a robust domestic demand scenario and high steel prices. On top of that, the completion of most of its planned capex in FY25, at a time when demand and prices seem to be on the rise, has ushered positivity among brokerages.

Cochin Shipyard: Shares skyrocketed 11.7 percent after the company bagged a large order from a European client, for the design and construction of a Hybrid Service Operation Vessel (Hybrid SOV) with an option for two more such vessels. The project is expected to be completed by the end of 2026. As per Cochin Shipyard’s classification, any order with a value of Rs 500 crore to Rs 1,000 crore is considered a large order.

Ethos: Shares surged 4.86 percent after the company reported an upbeat January-March quarter (Q4FY24) performance. Ethos’s consolidated revenue from operations rose 21.7 percent year-on-year (YoY) to Rs 252 crore in Q4FY24, while profit-after-tax (PAT) surged 58 percent YoY to Rs 21 crore.