Cereal prices in India are expected to be higher in the next fiscal after rising at a faster pace in the recent past due to factors such as unpredictable climate changes, increasing domestic demand and robust global demand, according to rating agency CRISIL.

Pushan Sharma, Director, Research CRISIL Market Intelligence & Analytics, said, “Recent years have seen a spurt in climate change events, like heat waves and erratic monsoon which has resulted in lower production of wheat and paddy, respectively, this fiscal. Add to this, demand from global and domestic markets and the stocks of wheat and rice are estimated to be lower by 12% and 35%, respectively, for fiscal 2023, leading to a surge in prices of these commodities.”

The rating agency said that the production of cereals have grown consistently in the past 50 years, registering a CAGR of about 2-3%. In recent years, awareness on good agriculture practices have improved among farmers and support from government in terms of input subsidies and procurement at minimum support prices, positive export sentiments, and growth in domestic demand have contributed to rise in production.

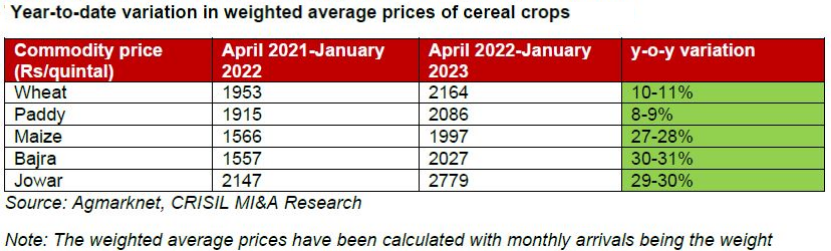

The rating agency said that prices of cereals have increased faster with the weighted average crop price index for cereal crops registering 3-4% CAGR from FY2017 to FY2022. Even in this fiscal, prices of cereals have jumped significantly year-on-year during April-December period. Prices of wheat and paddy have climbed by 8-11%, while maize, jowar and bajra prices have increased between 27% and 31%, according to CRISIL.

Moreover, the global wheat market was disrupted in 2022 by the ongoing Russia-Ukraine war as both the countries contributed to 20-25% of world wheat exports. However, India bridged the gap by exporting 7 million tonnes of wheat in fiscal 2022. Consequently, this led to the depletion of wheat stock in India, following which the government banned wheat exports in May 2022. Despite this, India has exported a further 4.6 million tonnes of wheat as of December this fiscal to fulfil previously committed consignments.

Further, India priced its rice competitively compared to other nations boosting demand for Indian rice in the global market. Even during April-December 2022 period, overall rice exports have grown 6-7% YoY, despite a decline of about 7% in paddy production, an increase in export duty to 20% for a few varieties of rice, and a ban on exports of broken rice.

CRISIL noted that this increased momentum in exports has been one of the key reasons for a rise in wheat and paddy prices by 8-11% YoY from April 2022 to January 2023.

Priyanka Uday, Manager, Research CRISIL Market Intelligence & Analytics, said, “Demand has surged on the domestic front, too. Among other crops, maize and bajra, which majorly contribute to the animal feed industry, have witnessed an increase in demand this fiscal following fodder shortage and 5-6% growth in poultry demand.”

Uday added that rise in beer sales after pandemic-related restrictions of fiscals 2021 and 2022 has also led to higher demand for bajra. This increase in domestic demand has pushed up prices of these commodities.

In the case of jowar, a fall in production by 5-6% and increase in prices of substitute commodities such as wheat, bajra and maize has led to higher price.

Outlook

CRISIL stated that the price sentiment for cereal crops is expected to be strong in absolute terms. Expectation of higher production of wheat in the current rabi crop season (winter season) is expected to improve the stock condition. This is likely to put a downward pressure on prices, though heatwaves remain an important monitorable.

The rating agency also said that the production of kharif crops such as paddy, maize, and millets is expected to be positive, provided there is normal, and well-spread monsoon in India. However, the impact of El Nino on south-west monsoon is one of the important monitorables as El Nino had resulted in 14% less rainfall and a 2-3% lower kharif cereal production during 2015.