POST-MARKET REPORT

The market posted solid gains on the last day of FY24 and extended the winning run on the second consecutive session.

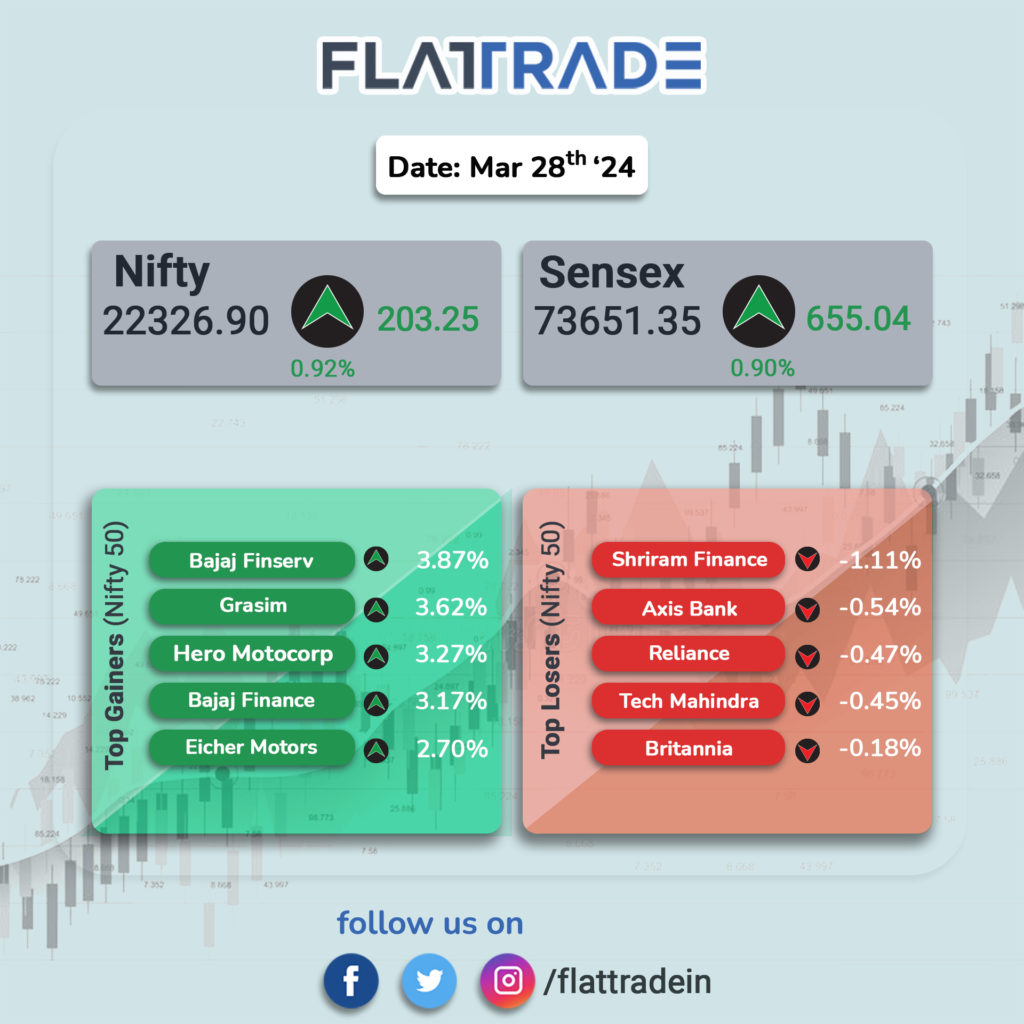

At close, the Sensex was up 655.04 points or 0.90 percent at 73,651.35, and the Nifty was up 203.20 points or 0.92 percent at 22,326.90.

The biggest gainers on the Nifty included Bajaj Finserv, Grasim Industries, Hero MotoCorp, Bajaj Finance and Eicher Motors, while losers were Shriram Finance, Tech Mahindra, Axis Bank, Reliance Industries and Britannia Industries.

All the sectoral indices ended in the green with auto, healthcare, metal, power, and capital goods up 1 percent each, while oil & gas, Information Technology, bank, realty, and FMCG gained 0.5 percent each.

Considering Broader market indices, the BSE midcap index added 0.6 percent and the smallcap index was up 0.3 percent.

STOCKS TODAY

Tata Elxsi: Shares surged over a percent after the company tied with Germany-based Dräger to advance critical care innovation in India. As part of this collaboration, Dräger is expanding its research and development presence by establishing a new Offshore Development Center (ODC) at Tata Elxsi’s facility in Pune.

ICICI Securities: The stock slumped 1.6 percent after shareholders a day earlier approved a proposal to delist ICICI Securities Ltd, following which it will become a wholly-owned subsidiary of ICICI Bank. According to the filing, 83.8 percent of the institutional shareholders and 32 percent of non-institutional shareholders voted in favor of the delisting.

Mahindra Lifespace Developers: The stock surged 4 percent after the company purchased land with a revenue potential of Rs 225 crore. The locality offers good connectivity to tech parks and commercial offices, along with a robust social infrastructure including educational institutes, healthcare facilities, and retail options, it said.

Titan Company: Shares of the Nifty50 major gained 0.8 percent after Motilal Oswal analysts rated it as a ‘buy’. The analysts predicted a vigorous growth outlook for the company and set a target price of Rs 4,300, which implies a 14% increase from the current level.

Chalet Hotels: Shares of the hospitality major jumped 2.7 percent after the company’s board of directors approved a proposal to raise funds through Qualified Institutional Placement (QIP). The floor price for the QIP has been fixed at Rs 780.76 per equity share but the company can offer a discount of up to 5 percent.

GOCL: The stock zoomed 20 percent and was locked in the upper circuit after the Hinduja Group-led company agreed with Squarespace Builders to sell a piece of land worth Rs 3,402 crore. GOCL Corp will monetize approximately 264.50 acres of land at Kukatpally, Hyderabad, where 32 acres are under a joint development agreement (JDA).

Sona BLW Precision Forgings: The stock gained 3.6 percent after Bernstein said the automotive systems and components manufacturer was on the “right side of auto disruption”. The brokerage raised its target price on the company to Rs 780 from Rs 770 earlier, implying an upside of 14.5 percent. The brokerage maintained its ‘outperform’ rating.