POST-MARKET REPORT

The market failed to cope with the opening gains and ended on a sideways note. Benchmark indices climbed to fresh all-time highs in the opening trade with Nifty surpassing 22,500 for the first time.

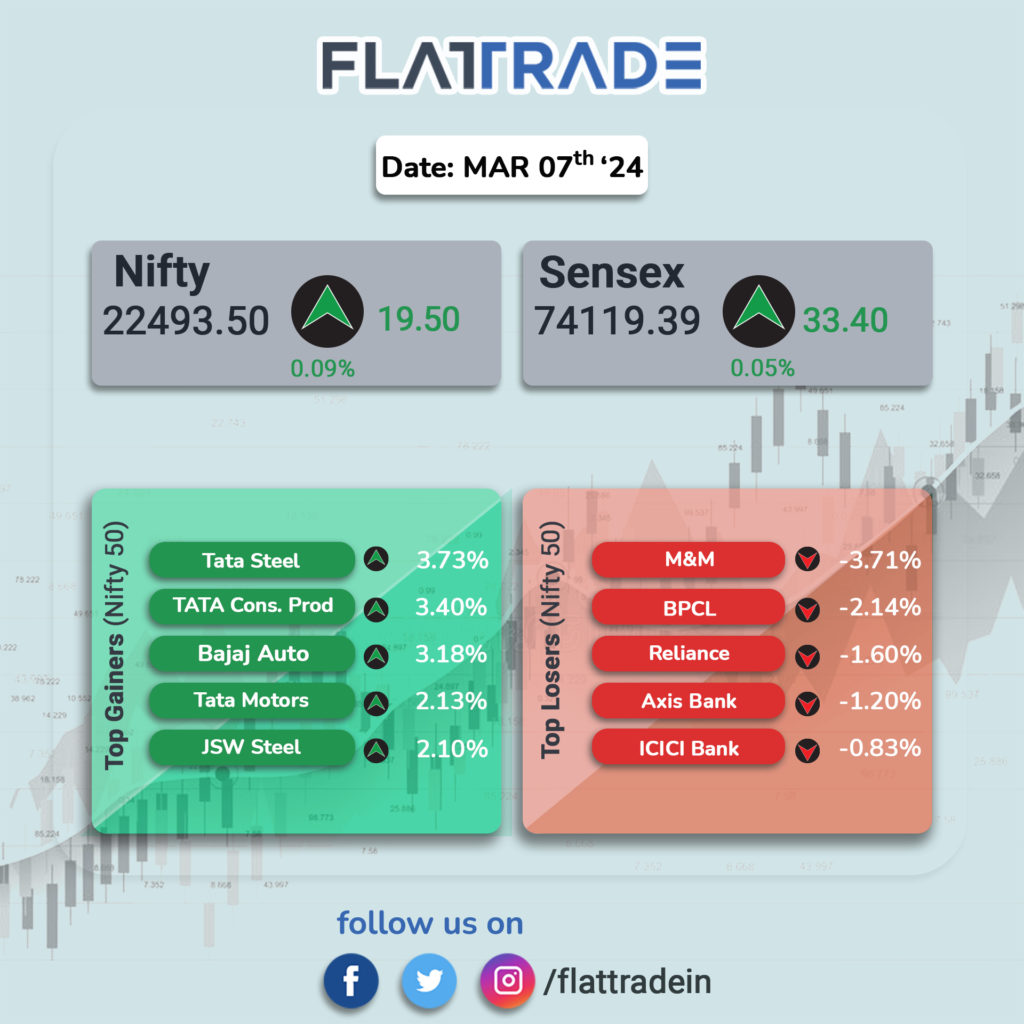

BSE Sensex touched a fresh record high of 74,245.17 but ended 33.40 points (0.05 percent) higher at 74,119.39, while the Nifty50 index also hit a new high of 22,525.65 and closed 19.50 points or 0.09 percent higher at 22,493.50.

Tata Steel, Bajaj Auto, Tata Consumer, Tata Motors, and JSW Steel were among the top Nifty gainers, while losers were M&M, BPCL, Reliance Industries, Axis Bank and ICICI Bank.

Among sectors, bank, oil & gas, auto, and realty ended in the red, while metal, capital goods, media, and FMCG were up 1-2.5 percent each.

The BSE mid-cap index added 0.3 percent and the small-cap index rose 0.7 percent and for the week, BSE Sensex and Nifty rose 0.5 percent each.

STOCKS TODAY

GR Infraprojects: Shares of GR Infraprojects surged 3.28 percent after the promoters decided to divest up to a 5 percent equity stake in the company to meet SEBI’s minimum public shareholding norms.

Macrotech Developers: Macrotech Developers stock fell 0.41 percent after the company raised Rs 3,281 crore by selling equity shares to institutional investors to repay debt, acquire land, and cover other expenses through a QIP. The company’s QIP, which opened on March 4, is set to close on March 7.

Suzlon Energy: Shares of Suzlon Energy rallied 4.91 percent after the renewable energy solutions provider bagged an order for a wind power project from Juniper Green Energy. Suzlon will develop a 72.45 MW wind power project for Juniper Green Energy.

Spicejet: Spicejet stock gained 2.08 percent after the company announced a resolution of a Rs 413 crore dispute with Echelon Ireland Madison One and the settlement will save Rs 398 crore for the company.

Tata Chemicals: Chemicals stock zoomed 11.3 percent with strong trading volumes. 5 crore shares were traded compared to the monthly average of 23 lakh. The stock has been rallying since March 1 after the company said that Fitch Ratings affirmed its Long Term Foreign Currency Issuer Default Rating (IDR) at BB+.

NLC India: NLC India stock fell 3.29 percent after the government announced it is planning to sell up to 7 percent stake in the company via an offer for sale from March 7 to 11.

Gujarat Toolroom: Gujarat Toolroom stock gained 4.99 percent and got locked in the upper circuit after the company won a Rs 29 crore order from Reliance Industries for construction supplies