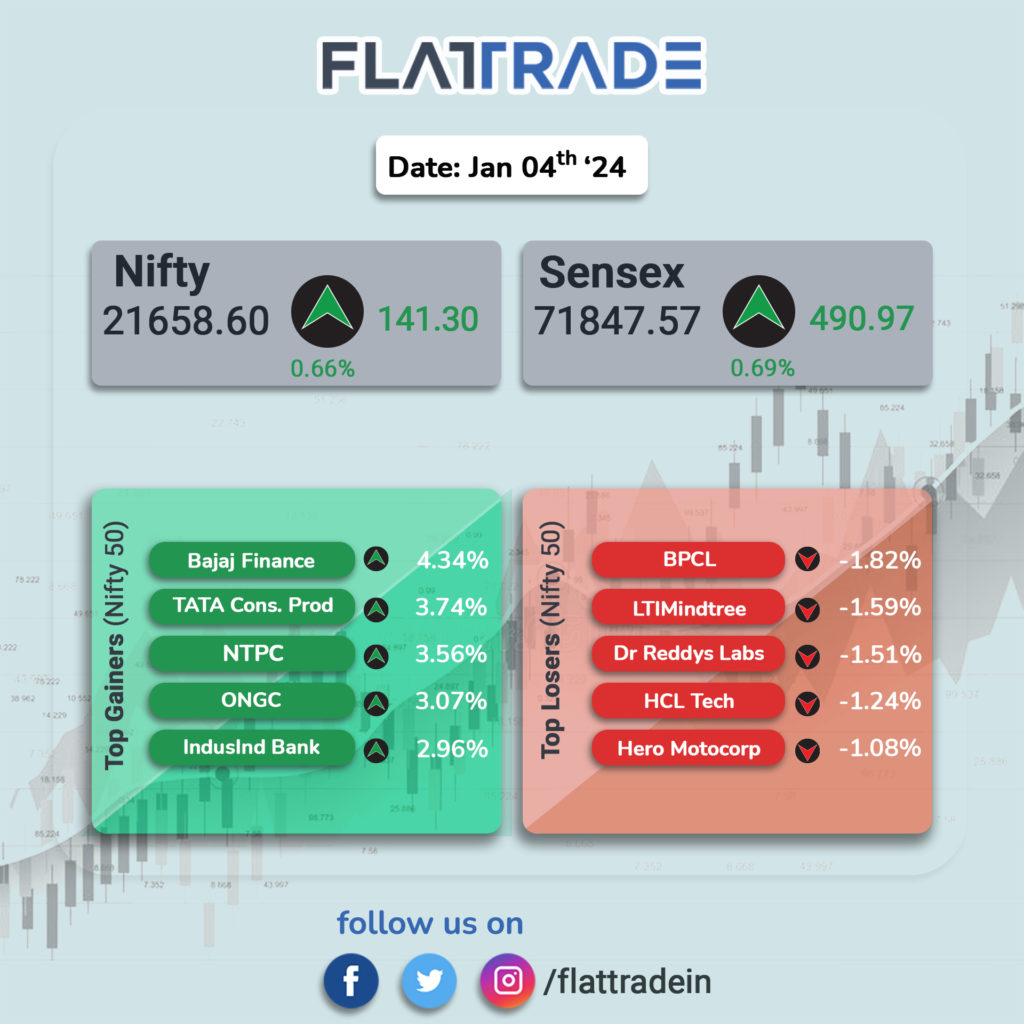

The equity indices bounced back with Nifty above 21,600 amid buying across the sectors and broader indices and the Sensex was up 490.97 points

Bajaj Finance, NTPC, ONGC, Tata Consumer, and IndusInd Bank are among the top gainers on the Nifty

while losers included BPCL, LTIMindtree, Dr Reddy’s Laboratories, HCL Technologies, and Hero MotoCorp

BSE Midcap and smallcap indices were up 1 percent each and touched fresh highs.

sectoral wise, the Realty index was up 6.6 percent, the power index was up 2 per cent, while bank, capital goods, healthcare, and oil & gas index were up 0.5-1 percent.

The rupee ended at 83.23 against the U.S. dollar, higher by 0.05%.

STOCKS TODAY

Jio Financial Services: AMFI announced the new market categorisation list for H1 CY24. Largecap threshold now stands at Rs 67,000 crore. Midcap cut-off has risen to Rs 22,000 crore. These changes make Jio Financial Services officially a large-cap stock, while recently-listed Tata Technologies, IREDA and JSW Infrastructure have made it to the midcap list

Indian Hotels Company (IHCL): Shares of Indian Hotels Company (IHCL) gained over 1 per cent to hit a 52-week high of Rs 458 on January 4 after global brokerage firm Morgan Stanley upgraded the target to Rs 490 from Rs 450, implying an upside of 7 per cent from the current levels. In the past three months, the stock of IHCL surged over 12 per cent against a 10 per cent rise in the benchmark Sensex.

NTPC: Axis Securities says, is a good portfolio bet given its stable dividend yield and adds that further rerating potential is possible if the peak deficits increase in future and from value unlocking through green energy. Shares of NTPC gained nearly 4 per cent during early trade on January 4. At 10 am, the stock was trading at Rs 316.90 on the NSE.

LTIMindtree Limited: The shares slipped over a per cent in afternoon trade on January 4 after the IT services company said it received a tax demand of Rs 206 crore. The violations outlined in the order include the denial of zero-rated supply, resulting in the demand for output IGST, and the rejection of previously granted refunds. The order, which came from the Department of Goods and Service Tax, Mumbai, disallowed input tax credit.

Balaji Amines: Balaji Amines was up 3 per cent after its subsidiary received the status of a mega project from the Maharashtra government on January 4. The mega status project was given to the ‘Expansion Project for Manufacture Speciality Chemicals’ by Balaji Speciality Chemicals Limited, a subsidiary of Balaji Speciality Chemicals. The proposed investment for this is Rs 750 crores, said the company in an exchange filing.

Torrent Power: shares of the company hit a fresh 52-week high, jumping 13.5 per cent in trade, as the power utility firm signed four contracts with the Gujarat government for a total of Rs 47,350 crore. As part of the four non-binding MoUs, the power utility arm of the diversified Torrent Group will invest Rs 47,350 crore in renewable energy, green hydrogen, and power distribution projects.