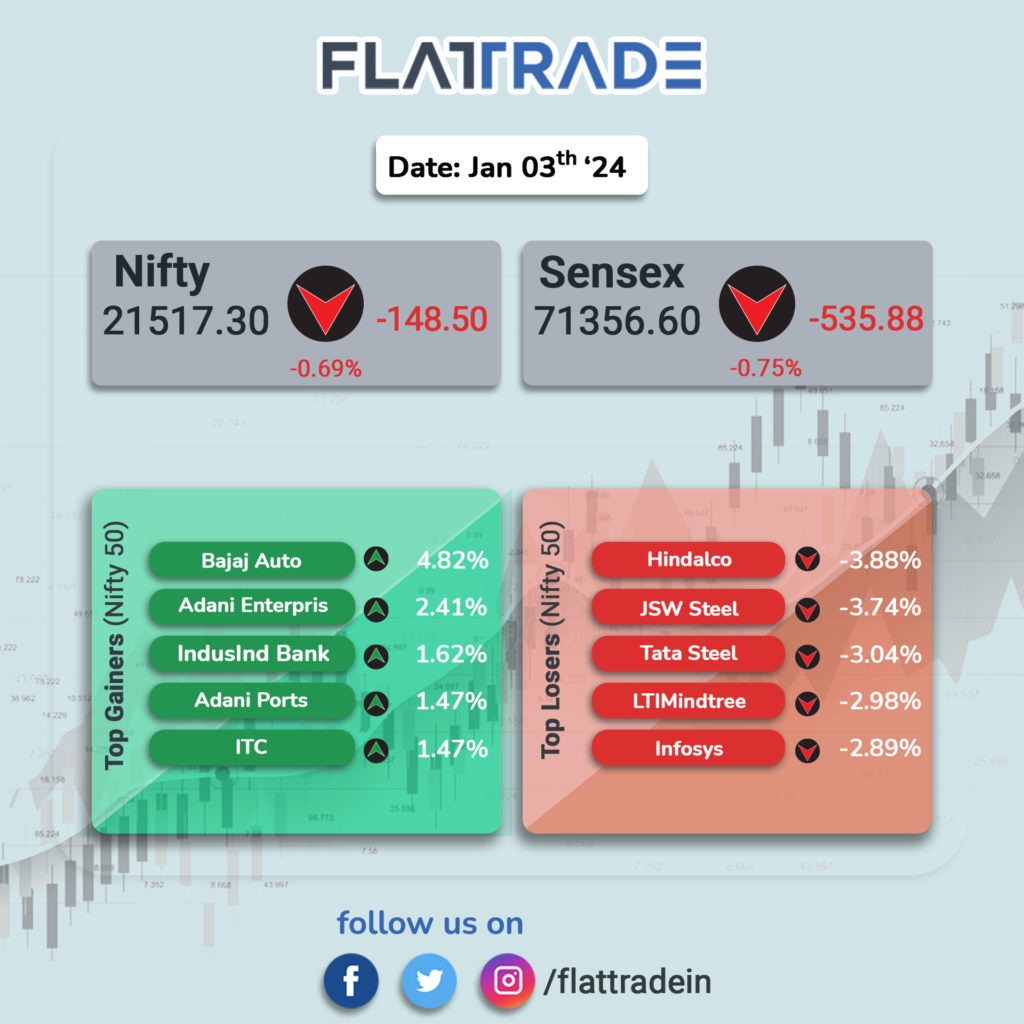

The benchmark indices traded lower for the second straight day on January 3

Investors will track the US Federal Reserve’s interest rate outlook from the FOMC minutes, to be released later in the week.

India’s blue-chip indexes also ended lower today, dragged down by information technology stocks

Broader indices performed better. The Nifty midcap 100 index surged up to 0.3 percent, whereas Nifty Smallcap 100 ended flat

STOCKS TODAY

Adani Group stocks: Shares of the group’s flagship firm Adani Enterprises jumped nearly 5 percent in morning deals. Adani Total Gas surged over 8 percent and Adani Energy Solutions was up 9 percent. After the Supreme Court disposed of petitions filed on the Adani-Hindenburg issue to initiate a Special Investigation Team (SIT) or CBI probe. While the stocks cooled off from the day’s highs, they held firm gains of up to 7 percent.

Hindustan Zinc: Shares of Hindustan Zinc gained 0.6 percent early on January 3 after reporting a 7 percent increase in mined metal production in Q3.Additionally, refined metal production grew 7 percent on-quarter to 2,59,000 tonnes based on better plant availability. It grew about 1 percent year-on-year.

Bajaj Auto: The stock gained over 5 percent on January 3 to top Rs 7,000 for the first time on news that the Bajaj Auto board will consider share buyback on January 8. Bajaj Auto recently reported a 16 percent rise in total sales at 3,26,806 units in December 2023.

Ircon International: Shares of Ircon International jumped over 5 percent each on January 3 after the companies announced management changes earlier this week. In the last year, the stock has more than tripled investors’ income by rising over 200 percent, outperforming the benchmark Nifty 50, which has risen around 18 percent during this period.

Tata Steel: Shares of Tata Steel fell 2.5 percent in trade on January 3 after brokerage firm Kotak Institutional Equities downgraded the stock to ‘reduce’ citing unfavorable risk-reward at the current valuations.

MOIL: State-run MOIL shares rallied 4 percent in trade on January 3 after the manganese ore producer recorded the highest-ever monthly output in December 2023. On the sales front too, the company clocked growth of 40 percent during the first nine months of FY24 with sales of 11.01 lakh tonnes of manganese ore.