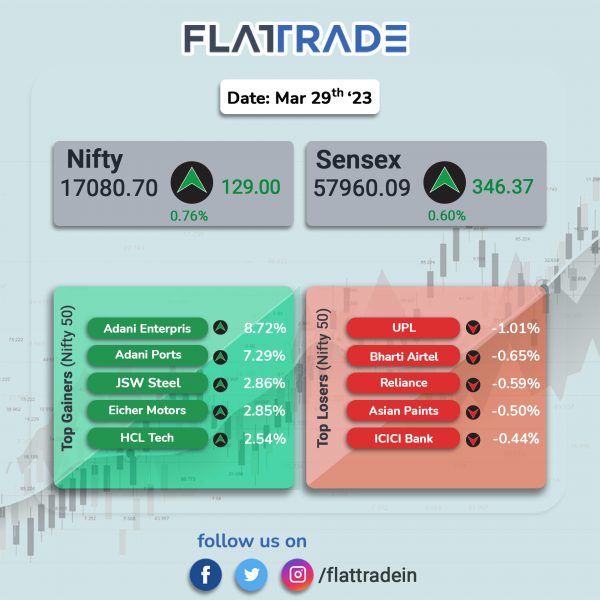

Indian equity indices ended higher on broad-based buying of beaten-down stocks amid volatility. Public sector bank, realty, metal and auto shares were top gainers. The Sensex rose 0.60% and the Nifty gained 0.76%. Adani Enterprises and Adani Ports surged 9% and 7%, respectively.

In broader markets, Nifty Midcap 100 index jumped 1.54% and the BSE Smallcap index soared 1.68%.

Top gainers among Nifty sectoral indces were PSU Bank [3.22%], Media [2.65%], Realty [2.46%], Metal [2.44%], and Auto [1.71%]. Top losers were Oil & Gas [-0.07%] and Energy [-0.07%].

Indian rupee fell 15 paise to 82.34 against the US dollar on Wednesday.

Stock in News Today

Larsen & Toubro (L&T): The infrastructure major said that its Minerals & Metals (M&M) business has secured ‘large’ orders from the Vedanta Group. As per L&T classification, the value of the large project is Rs 2,500 crore to Rs 5,000 crore. The contract entails setting up a 5 LTPA Fertiliser Plant for Hindustan Zinc, a Vedanta Group subsidiary. The business also received another order to expand the capacity of the Aluminum Smelter Complex at BALCO Korba, Chhattisgarh by 435 KTPA for Bharat Aluminium Company, a Vedanta Group subsidiary.

NTPC: The company said that its wholly-owned subsidiary — NTPC Renewable Energy — has signed term sheet with Greenko ZeroC to supply 1300 MW round the clock RE power for powering Greenko’s upcoming Green Ammonia Plant at Kakinada, India. The agreement between the two companies is one of the world’s single largest contract for supply of round-the-clock renewable supply for an industrial client.

Zee Entertainment (ZEEL) and IndusInd Bank: The media company on Wednesday informed the National Company Law Appellate Tribunal (NCLAT) that it has settled the dispute over dues with the private sector bank. With this development, the bank’s plea objecting to the merger of ZEEL and Sony has been withdrawn. The dispute arose due to a default of Rs 89 crore by Siti Networks, a division of the Zee Group. ZEEL served as the loan guarantor for Siti Networks. The lender then filed an insolvency petition against Siti Networks.

Hindustan Construction Company (HCC): The company has completed the sale transaction of Baharampore-Farakka Highways Ltd. (BFHL) to Cube Highways and Infrastructure V Pte. Ltd. For Rs 1,323 crore, which includes SPV debt of Rs 646 crore. The company will receive a total of Rs 941 crore in two tranches. HCC will also be entitled to a revenue share from BFHL over the entire concession period.

Mphasis: The company announced that it has no exposure to Silicon Valley Bank, Signature Bank or Silvergate Capital, either as a client or as a banker. The IT company said that its business from the US regional banks is a low single digit percentage contribution to the overall revenue.

HFCL: The company said that it has secured an order worth Rs 282.61 crore from Gujarat Metro Rail Corporation (GMRC) for setting up of telecommunication systems for Surat Metro Rail Project Phase-I. The project entails design, manufacture, supply, installation, testing and commissioning of telecommunication systems for Surat Metro Rail Project Phase-I of GMRC. The order must be executed within 90 weeks from the date of contract and the company has to provide warranty support for 110 weeks.

RHI Magnesita India: The company rose over 4% after the company announced that its board will meet on Saturday, 1 April 2023, to consider raising up to Rs 200 crore via preferential allotment.

G R Infraprojects: The company has emerged as lowest (L‐1) bidder for the tender invited by National Highways Authority of India for a construction project aggregating to Rs 740.77 crore in Karnataka. The construction is expected to be completed in 730 days from appointed date and the operation period is 15 years from the commercial operation date. The scope of the project involves construction of four lane with paved shoulders in Belgaum-Hungund-Raichur section of NH‐748A (extension SH‐20) on hybrid annuity mode (Package‐6) under NH (O).

Granules India: The company said it has received ANDA approval for Gabapentin tablets. The drug is bioequivalent to Neurontin tablets of Viatris Specialty LLC. Gabapentin tablets are indicated for management of postherpetic neuralgia in adults and as an adjunctive therapy in the treatment of partial onset seizures. The current annual US market for Gabapentin tablets is approximately $145 million, according to MAT Jan 2023, IQVIA/IMS Health data.

Quess Corp: Fairbridge Capital Mauritius Limited, promoter of the company has bought 66,00,000 (4.45%) equity shares of the company on March 29, 2023 through reverse book building process on NSE portal, according to its exchange filing.