POST-MARKET REPORT

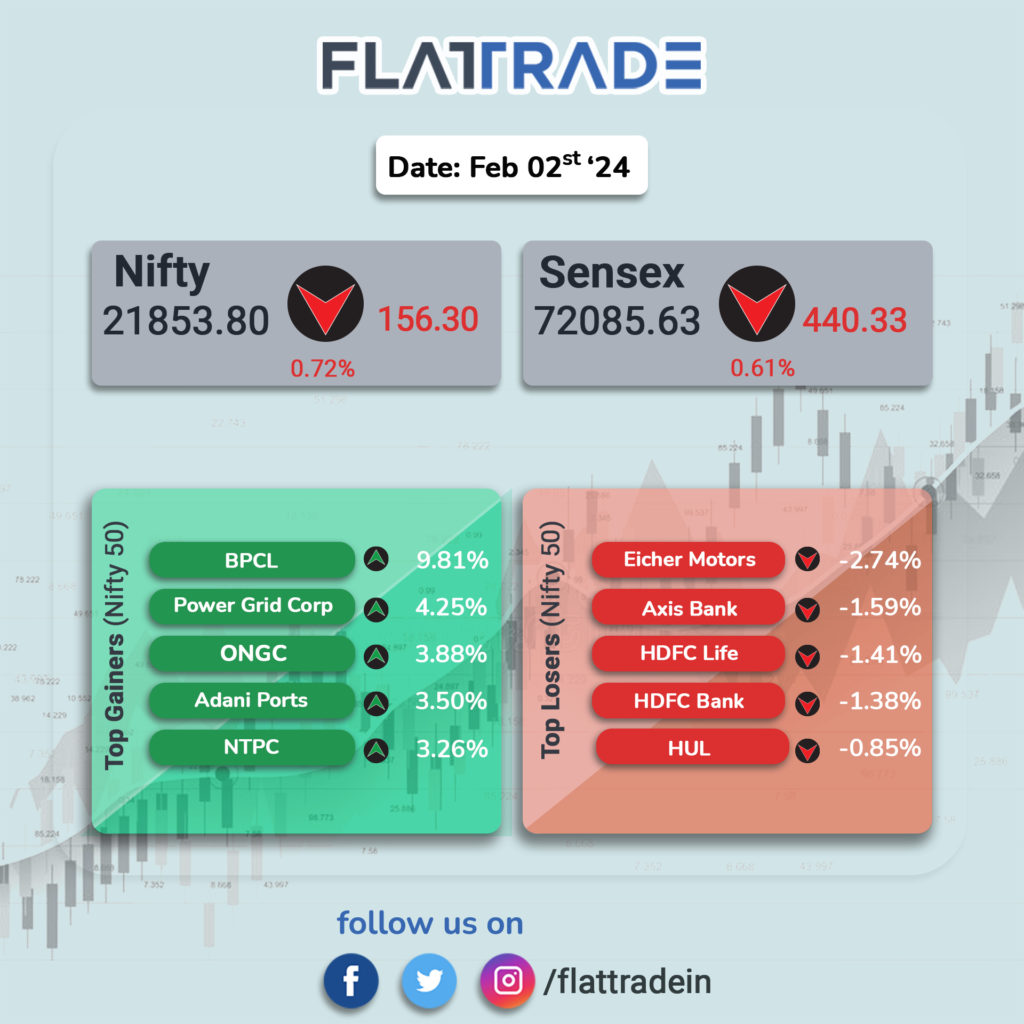

The benchmarks gave up some of the gains to close off the day’s high. The Sensex ended 440.33 points, or 0.61 percent higher at 72,085.63, and the Nifty 156.30 points, or 0.72 percent higher at 21,853.80.

Top gainers on the Nifty were BPCL, Power Grid Corporation, ONGC, Adani Ports, and NTPC, while losers were Eicher Motors, Axis Bank, HDFC Life, HDFC Bank, and HUL.

Among sectors, the oil & gas index was up 4 percent and information technology, metal, realty, and power indices gained up to 2 percent each, while the banking index was down 0.5 percent.

The BSE midcap index closed 0.8 percent and smallcap index 0.5 percent higher.

The Indian rupee stands at 82.90 against the US dollar.

STOCKS TODAY

TVS Motor Company: The company traded 2.4 percent higher after the leading two-wheel manufacturer reported a 23 percent on-year increase in vehicle sales in January. The company sold a total of 339,513 vehicles in the first month of 2024, up from 275,115 units in the same period last year, the company said in an exchange filing on February 1.

PB Fintech: Shares of PB Fintech, the parent firm of Policybazaar, fell 1.62 percent after Claymore Investments sold its stake in the company. Claymore Investments (Mauritius) Pte Ltd sold 2.44 crore equity shares of PB Fintech on February 1 at Rs 992.8a per share, aggregating to over Rs 2,425 crore.

Adani Ports: shares jumped around 3 percent, a day after the company’s Q3 earnings beat estimates. For the December quarter, Adani Ports’ net profit more than doubled on-year to Rs 2,250 crore, driven by robust power sales to customers and higher capacity utilization. The company revenue surged 47 percent YoY to Rs 7,426 crore, driven by an increase in cargo volumes.

Reliance Industries Ltd: The stock experienced a significant uptick in January, rising around 11 percent, which marks its most substantial monthly increase since March 2022. hit a fresh record high with the stock gaining over 2 percent. Its current market capitalization stands at Rs 19.7 lakh crore.

Ashok Leyland: Shares of Ashok Leyland fell over 3 percent after the company announced that its total sales, including exports, slipped 7 percent to o 15,939 units. It sold 17,200 units during the same month last year. The commercial vehicles major reported a decline in total MHCV (Medium and Heavy Commercial Vehicle) sales, which dropped by 8 percent. Additionally, the Light Commercial Vehicle (LCV) segment volumes fell by 7 percent.

Abbott India: Shares of Abbott India surged 8.55 percent after the company reported a solid set of earnings for the December quarter. The company recorded a net profit of Rs 311 crore in Q3, up 26 percent on year. Revenue rose nearly 9 percent to Rs 1,437 crore.

Indian Overseas Bank: Shares of Indian Overseas Bank gained 7.88 percent to hit a new high. The bank’s market capitalization also crossed the 1 lakh crore mark. Analysts suggest that public sector banks are well-equipped to handle the net interest margins, benefiting from excess liquidity and lower credit-deposit and liquidity coverage ratios.