POST MARKET REPORT

The Indian equity market ended in a loss with Sensex and Nifty50 falling 1.5 percent each amid selling across the sectors barring Pharma.

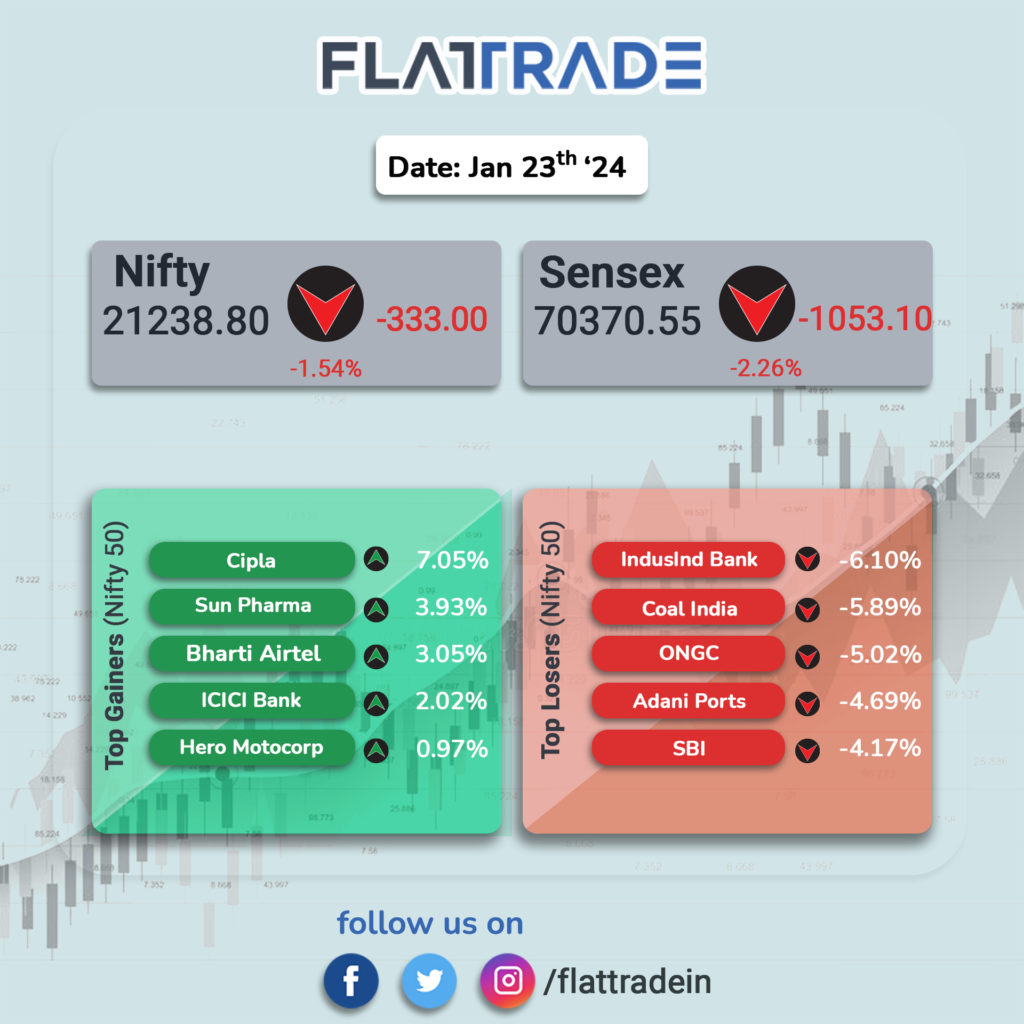

At close, the Sensex was down 1,053.10 points or 1.47 percent at 70,370.55, and the Nifty was down 333.00 points or 1.54 percent at 21,238.80.

The biggest losers on the Nifty were IndusInd Bank, Coal India, ONGC, Adani Ports and SBI Life Insurance, while gainers were Cipla, Sun Pharma, Bharti Airtel, ICICI Bank and Hero MotoCorp.

On the sectoral front, except pharma, all other sectoral indices ended in the red.

BSE Midcap and Smallcap indices were down nearly 3 percent each.

The Indian Rupee stands at 83.16 against US Dollar

STOCKS TODAY

HDFC Bank: An over 3-percent drop in banking heavyweight HDFC Bank, along with selling in other banking stocks, dragged Nifty Bank below a key support level, paving the way for potential further downside. All banking index constituents except ICICI Bank were in red today

Zee Entertainment: The stock fell more than 30.47 percent as it hit a series of lower circuits after Japan’s Sony Pictures’ Indian arm scrapped its $10-billion merger with the Indian media giant. Several brokerages also downgraded the stock.

Finolex Industries: The stock fell 3.91 percent after the company’s Q3 results disappointed the markets. Its net profit grew 24 percent YoY to Rs 89.21 crore and sales revenue fell 9.3 percent to Rs 1,019.69 crore in the quarter.

Oberoi Realty: Shares of Oberoi Realty slumped 9.12 percent after the real estate developer’s net profit declined 49 percent to Rs 360 crore in the December quarter. Revenue fell 35.3 percent to Rs 1,054 crore.

Cipla: The stock jumped 6.97 percent after the company reported strong performance in Q3. Net profit grew 32.7 percent to Rs 1049 crore. Revenue also went up by 14.2 percent to Rs 6,544 crore.

Persistent Systems: Shares of Persistent Systems surged 4.53 percent after reporting healthy Q3 earnings. The company reported a 20 percent growth in net profit at Rs 286.1 crore. This growth was delivered by a strong order book, the company said.

Hero Motocorp: Hero Motocorp gained 3 percent intraday after the company announced the launch of two new bikes, the Xtreme 125R, and a special collector’s edition Hero Forever for its 40th anniversary. The stock pared some of the gains to close 0.71 percent higher.

ICICI Bank: Shares of ICICI Bank surged 1.9 percent after the private lender reported a 23.5 percent increase in net profit at Rs 10,271.54 crore in Q3.