The Indian market plunged to its biggest single-day fall in 18 months

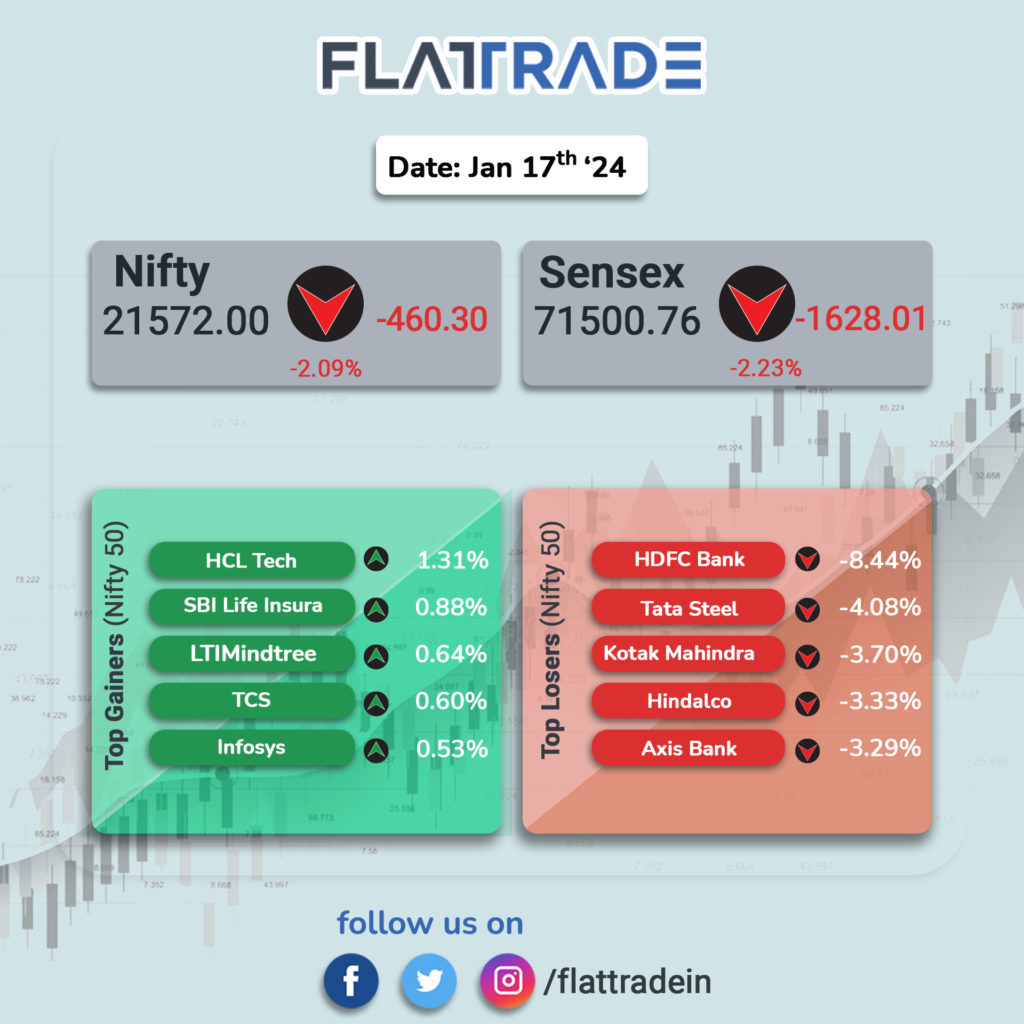

At close, the Sensex was down 1,628.01 points, or 2.23 percent, at 71,500.76, and the Nifty was down 460.30 points, or 2.09 percent, at 21,572.

The biggest losers on the Nifty were HDFC Bank, Tata Steel, Kotak Mahindra Bank, Axis Bank and Hindalco Industries, while gainers were HCL Technologies, SBI Life Insurance, Infosys, LTIMindtree and TCS.

Among sectors, except IT, all indices ended in the red, with the bank index down 4 percent, and auto, metal, oil & gas realty down 1-2 percent.

BSE midcap and smallcap indices shed a percent each.

The Indian Rupee stands at 83.13 against the US Dollar.

STOCKS TODAY

HDFC Bank: Shares of HDFC Bank plunged 8.16 percent after its Q3 results disappointed the markets. Although Q3 net profits grew 33 percent and met expectations, it was powered by a one-time tax gain. The bank’s net interest income increased by 24 percent and missed the street estimates.

DB Realty: The shares of the company fell more than four percent intraday. In a meeting, DB Realty’s board of directors gave their nod for “raising of funds by way of issuance of equity shares and/or securities convertible into equity shares, and/or non-convertible debt instruments along with warrants or any combination of securities”, the company told the exchanges.

MRF: Shares of Madras Rubber Factory, touched the Rs 1.5-lakh mark in afternoon trade, extending gains for the sixth trading session in a row on the bourses. At this price, MRF became the most expensive Indian stock. In the last year, the stock has climbed over 53 percent, as compared with Nifty’s 20 percent during the same period.

PTC Industries: Shares of PTC Industries gained nearly 1 percent after the company signed an agreement with France-based Dassault Aviation for the supply of titanium casting parts. Aerolloy Technologies, a subsidiary of PTC Industries, will produce the full range of Titanium casting parts for the Rafale multirole fighter aircraft and the Falcon business jet programme.

ICICI Lombard: Shares of ICICI Lombard gained 5 percent after the company’s Q3 results beat the market expectations. ICICI Lombard reported a net premium income of Rs 4,690 crore, beating market expectations of Rs 4,376 crore.

IREDA: Stock gained 5 percent after the company announced a partnership with Indian Overseas Bank (IOB) to co-finance renewable energy projects in India. The stock also hit its all-time high price in the exchanges today.

PNC Infratech: Shares of PNC Infratech gained 2.15 percent after the company won a Rs 1174 crore road project in Madhya Pradesh. The company will construct a 41-km four-lane Western Bhopal Bypass along with a service road in Madhya Pradesh in the Hybrid Annuity Mode (HAM). The work has to be done in 24 months, while the operation period is 15 years after the construction.

Adani Energy Solutions: Stock fell 3.4 percent after the company reported 2 million smart meters contracts worth Rs 2,300 crore in Q3. The company said the transmission and smart metering business has maintained system availability of 99.67 percent in Q3FY24 and added 302 ckms to the operational network during the quarter with a total network of 20,422 ckms.