Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25% higher at 18,449, signalling that Dalal Street was headed for positive start on Tuesday.

Japanese shares were trading higher with the Nikkei 225 index gaining 0.68% and the Topix rising 0.38%. Meanwhile, the CSI 300 index slipped 0.07% and the Hang Seng jumped 0.55%.

Indian rupee fell 13 paise to 82.30 against the US dollar on Monday.

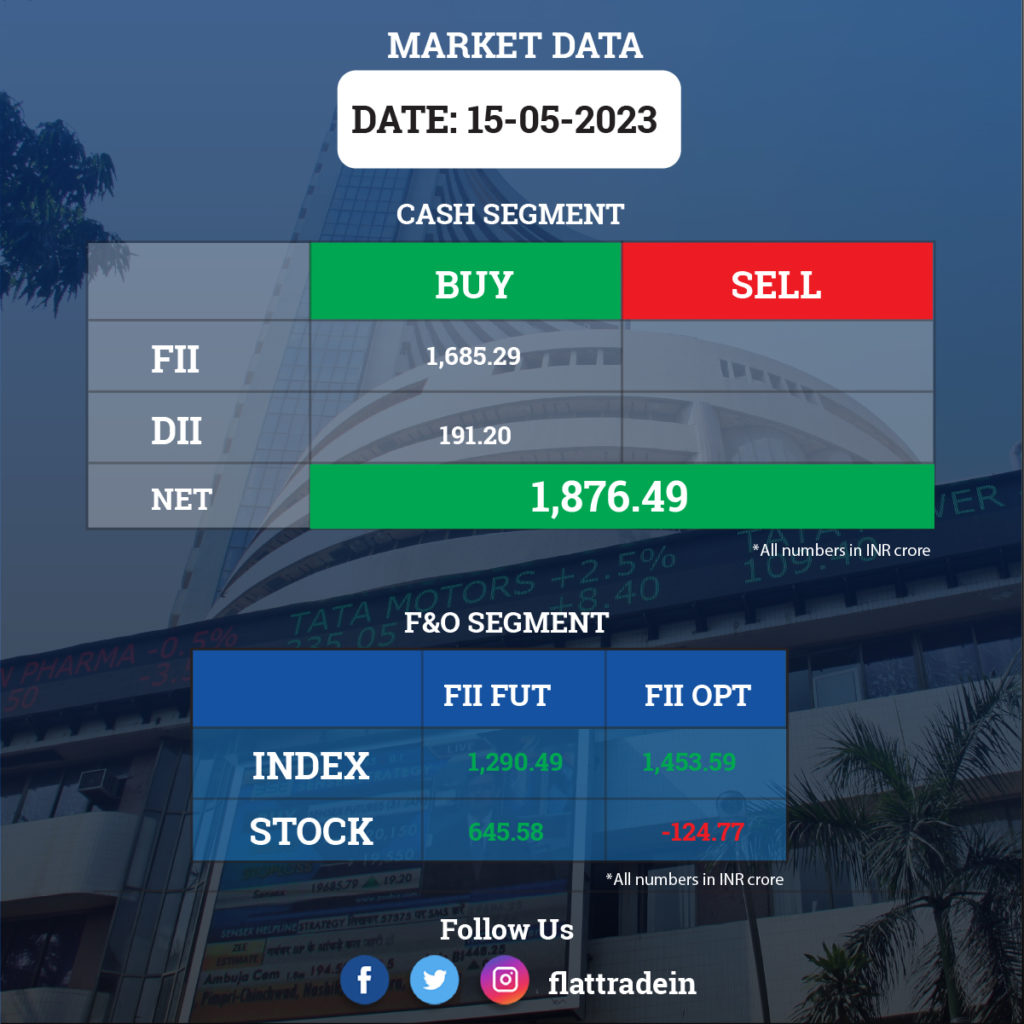

FII/DII Trading Data

Upcoming Results

Bharti Airtel, Indian Oil Corporation, Bank of Baroda, Jindal Steel & Power, LIC Housing Finance, Max Healthcare Institute, JK Paper, Creditaccess Grameen, Alicon Castalloy, Amber Enterprises India, Aurionpro Solutions, Automotive Axles, Chemplast Sanmar, EIH Associated Hotels, Excel Industries, Granules India, Indo Rama Synthetics (India), Jubilant Ingrevia, Kajaria Ceramics, Kaynes Technology India, Metropolis Healthcare, Morepen Laboratories, MPS, Mukand, Navneet Education, Oberoi Realty, Paras Defence And Space Technologies, Prakash Industries, Redington, Safari Industries (India), Shanti Educational Initiatives, Sirca Paints India, Siyaram Silk Mills, Triveni Turbine, TV Today Network, and V-Mart Retail will report the quarterly earnings.

Stocks in News Today

PVR Inox: The theatre operator said its consolidated revenue was up 22% QoQ at Rs 1,143.17 crore in Q4FY23. Ebitda fell 9% QoQ at Rs 263.87 crore in Q4FY23. Consolidated net loss stood at Rs 333.37 crore in Q4FY23 as against a net profit of Rs 16.15 crore in the preceding quarter. The board approved raising Rs 100 crore via non-convertible debentures on a private placement basis in one or more tranches.

HDFC Bank: Market regulator Sebi has approved the proposed change in control of HDFC Capital Advisors, a subsidiary of HDFC and a co-investment portfolio manager, pursuant to proposed composite scheme of amalgamation for the amalgamation of HDFC with HDFC Bank. The proposed amalgamation is subject to receipt of final approvals from Sebi in respect of change in control of certain subsidiaries of HDFC.

Berger Paints: The company said its consolidated revenue rose 11.71% YoY at Rs 2,443.63 crore in Q4FY23. Ebitda jumped 6.44% YoY at Rs 368.76 crore in Q4FY23. Consolidated net profit fell 15.56% YoY at Rs 186.01 crore in Q4FY23. The board recommended a dividend of Rs 3.20 per share for the fiscal 2023.

Coromandel International: The fertiliser company has recorded a 15% year-on-year decline in consolidated profit at Rs 246.44 crore for the quarter ended March FY23, dented by contraction in operating profit margin. Revenue from operations remained strong, rising 29.5% to Rs 5,476 crore compared to the year-ago period. Ebitda as up 6.2% YoY at Rs 403.23 crore in Q4FY23. The board recommended a final dividend of Rs 6 per share.

Pfizer: The biopharmaceutical company has recorded a 3% year-on-year growth in profit at Rs 129.65 crore for quarter ended March FY23, and revenue from operations during the same period grew by 4.2% to Rs 572.64 crore. Ebitda increased by 10% to Rs 181.9 crore with margin expansion of 170 bps to 31.8% compared to same period last year. The board recommended a final dividend of Rs 35 per share for the fiscal 2023. It also announced a special dividend of Rs 5 a share in view of the gain on sale of business undertaking at Thane.

Astral: The CPVC pipes and fitting manufacturer has reported a massive 45.5% year-on-year growth in consolidated profit at Rs 205.7 crore for the quarter ended March FY23, driven by healthy operating performance. Revenue from operations for the quarter grew by 8.3% to Rs 1,506.2 crore compared to the same period last year with the plumbing business growing 3.6% and the paints & adhesives business showing a 25% growth. Ebitda jumped 45.87% YoY at Rs 311 crore in Q4FY23. The company announced a final dividend of Rs 2.25 per share for the fiscal ended March 2023. Further, the board approved appointment of Kairav Engineer as whole-time director and redesignation of Hiranand Savlani as additional director. Both directors have been appointed for a period of five years, effective July 1.

Procter & Gamble Health: The company’s revenue was up 19.83% YoY at Rs 320.92 crore in Q4FY23. Ebitda rose 15.84% YoY to Rs 79.66 crore in the quarter under review. Ebitda margin stood at 24.82% in Q4FY23 as against 25.68% in Q4FY22. Net profit rose 15.7% YoY at Rs 59.19 crore in Q4FY23.

Ultratech Cement: Ultratech Nathdwara Cement, the company’s wholly-owned subsidiary, commissioned a brownfield cement facility with annual capacity of 0.8 million tonnes in Neem Ka Thana, Rajasthan. The company’s total grey cement manufacturing capacity now stands at 129.95 million tonnes per annum.

Wipro: The company will integrate its cloud computing framework with Google Cloud’s Rapid Migration Program, together with artificial intelligence and automated tooling, to accelerate cloud adoption among its clients.

HCL Technologies: The company expanded its partnership with SAP, becoming a customer of and a global strategic service partner for SAP SuccessFactors Human Experience Management Suite.

NIIT: The company bought remaining 10% stake in RPS Consulting for a fixed consideration of Rs 15 crore, and a performance based earnout consideration of up to Rs. 3.71 crore, payable over the next two years. NIIT now owns 100% stake in RPS Consulting.

Vedanta: The company appointed Sonal Shrivastava as the chief financial officer, effective June 1, it said in a statement

Punjab & Sind Bank :The bank will hike marginal cost of funds based lending rates for overnight, one-month, and six-month tenures in the range of 5-10 basis points. Lending rates for three-month and one-year tenures have been kept unchanged.

PCBL: The company’s consolidated revenue was up 12.72% YoY at Rs 1,373.81 crore in Q4FY23. Ebitda was up 36.84% YoY at Rs 183.83 crore in Q4FY23. Consolidated net profit climbed 15.88% YoY at Rs 102.28 crore in Q4FY23.

Uttam Sugar Mills: The company’s consolidated revenue was up 7.55% YoY at Rs 527.42 crore in Q4FY23. Ebitda rose 15.89% YoY at Rs 111.71 crore in Q4FY23. Consolidated net profit rose 14.64% YoY to Rs 70 crore in Q4FY23. The board recommended a dividend of 6.5% on Series-I non-cumulative redeemable preference shares and 10% on Series-II non-cumulative redeemable preference shares for FY23. It also approved a dividend of Rs 2.50 per equity share.