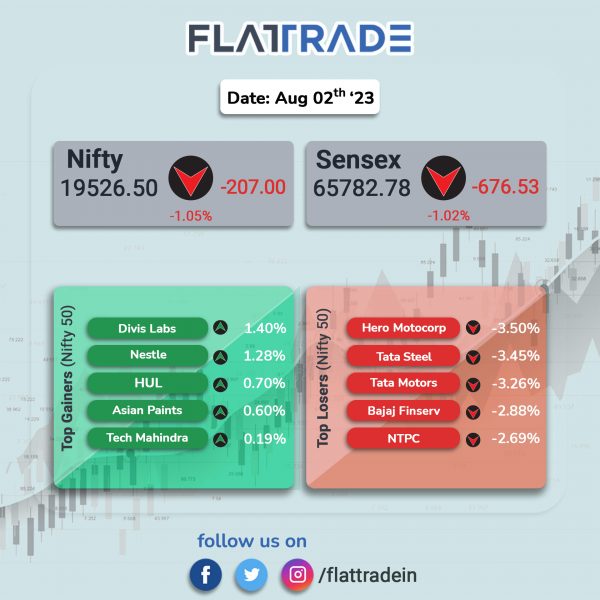

Dalal Street ended lower as investors’ sentiments were dented due to weak global cues after rating agency Fitch Ratings downgraded the US credit rating to ‘AA+’ from ‘AAA. The Sensex tanked 1.06% and the Nifty 50 index plunged 1.05%.

In broader markets, the NSE Midcap 100 index tumbled 1.33% and the BSE Smallcap dropped 1.18%.

All Nifty sectoral indices closed in the red. Top losers were PSU Bank [-2.61%], Metal [-2.02%], Auto [-1.66%], Media [-1.57%] and Realty [-1.49%].

The Indian rupee fell 32 paise to 82.58 against the US dollar on Wednesday.

Stock in News Today

Adani Ports: The company reported a 7% YoY growth in July 2023 in its total cargo volumes to 34 million metric tonnes (MMT). The company said that the growth was observed across all cargo segments, including containers (23%), and liquid & gas (27%). The company’s logistics volumes continue to record a significant jump with year-to-date (YTD) rail volumes of 178,689 TEUs (20% YoY) and general purpose wagon investment scheme (GPWIS) volumes of 5.77 MMT (39% YoY).

Godrej Properties: The company said its consolidated revenue was up 282.5% at Rs 936.09 crore in Q1FY24 as against Rs 244.67 crore in Q1Fy23. Consolidated net profit was up 208.68% at Rs 133.69 crore in q1fy24 as against Rs 43.31 crore in q1fy23. EBITDA losses stood at 149.2 crore in the quarter under review as against an EBITDA loss of Rs 14.19 crore in the year-ago period. The company said that it added 4 new projects with an estimated saleable area of around 3.7 million sq. ft. and total estimated booking value of approximately Rs 6,450 crore in April-July 2023.

Adani Wilmar: The company reported a loss of Rs 79 crore in the June 2023 quarter as against a net profit of Rs 194 crore in Q1FY23. Consolidated revenue slipped 12% YoY to Rs 12,928 crore from Rs 14,724 crore in the year-ago period. EBITDA plunged 71% to Rs 130 crore in the June 2023 quarter from Rs 443 crore in the Q1 of last fiscal.

UltraTech Cement: The company has commissioned a 1.2 Mtpa brownfield cement capacity at Magdalla, Gujarat, taking the total capacity to 1.93 mtpa. The company’s total grey cement manufacturing capacity in India now stands at 132.45 mtpa.

Aditya Birla Capital: The financial services company reported a 51.06% jump in consolidated net profit at Rs 648.76 crore in Q1FY24 as compared with Rs 429.47 crore posted in corresponding quarter last year. Revenue from operations rose 26.02% to Rs 7,044.97 crore in Q1FY24 as compared with Rs 5,590.28 crore in Q1FY23. The company said that it has witnessed strong momentum across businesses led to a 43% year-on-year and 6% sequential growth in the overall lending portfolio (NBFC and HFC) to Rs 1,00,400 crore as on June 30, 2023. The total AUM grew by 9% YoY to approximately Rs 3.9 lakh crore.

Firstsource Solutions: The company reported a 48.06% in consolidated net profit to Rs 125.98 crore in Q1FY24 as compared with Rs 85.09 crore in Q1FY23. Revenue from operations increased 5.11% to Rs 1,526.69 crore in Q1 FY24 as compared with Rs 1,452.44 crore in the same quarter last year. Operating margin stood at Rs 178.9 crore, up 52.8% YoY during the quarter. In Q1 FY24, the company reported revenue of $186 million, a growth of 3.9% YoY.

Sula Vineyards: Shares of the company plunged 8% after it received a notice of Rs 116 crore excise duty from the Maharashtra excise department. The demand notice was issued on the grounds that Sula Vineyards had blended wine brought from across the custom frontier or from other states with wine produced or manufactured from grapes produced in Maharashtra. However, Sula Vineyards has filed a writ petition in the High Court of Bombay challenging the demand notice. The company clarified that the demand order will not affect its existing business or the activities.

Strides Pharma Science: The company said its net loss narrowed to Rs 7.11 crore in Q1FY24 from a net loss of Rs 136 in q1fy23. Revenue was down 1% at Rs 930 crore in q1fy24 as against Rs 940 crore in q1fy23. EBITDA was up 177% at Rs 167 crore in q1fy24 as against Rs 60 crore in q1fy23.

Lupin: The company announced that its wholly-owned subsidiary, Novel Laboratories Inc., has received an approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application for Fluocinolone Acetonide Topical Oil, a generic equivalent of Derma-Smoothe Topical Oil of Hill Dermaceuticals, Inc. Fluocinolone Acetonide Topical Oil had an estimated annual sales of $9 million in the US, according to IQVIA MAT March 2023.

TVS Motor: The company has entered into a partnership with Paisalo Digital, a non-deposit taking NBFC, for funding three-wheeler Internal Combustion Engine & Electric Vehicle segment.

Ambuja Cements: The company reported a 31.21% YoY rise in consolidated net profit at Rs 1,135 crore for the June quarter compared with Rs 865 crore in the same quarter last year. Net revenue for the quarter rose 8.46% YoY to Rs 8,713 crore from Rs 8,033 crore in the corresponding quarter last year. EBITDA jumped 55% YoY to Rs 1,930 crore, while EBITDA margin expanded 6.7% to 22.2% from 15.5% YoY. Meanwhile, the company will acquire Sanghi Cement at an enterprise valuation of Rs 6,000 crore.

Tata Chemicals: The company has cut the price of domestic soda ash by over 5% with effect from August 2. With the new price revision, soda ash light will now be priced at Rs 30,500 per tonne, while soda ash dense will cost Rs 31,000 per tonne, effective August 2, according to the company’s website.

Ipca Laboratories: The company has acquired 2,35,01,440 shares comprising 33.38% of Unichem Laboratories from one of Unichem’s promoters, the company announced through an exchange filing. The acquisition was at a price of Rs 402.23 per share aggregating to Rs 945.35 crore. The Company had recently received the approval of the Competition Commission of India under The Competition Act, 2002 for this acquisition.

Indian Overseas Bank (IOB): The company has reported a 27.58% jump in net profit to Rs 500.35 crore on 23.85% increase in total income to Rs 6,227.34 crore in Q1FY24 over Q1FY23. Operating profit stood at Rs 1,345.32 crore in Q1 FY24, up 31.08% from Rs 1,026.37 crore posted in the corresponding quarter last year. Net interest margin (NIM) improved to 3.21% in Q1FY24 as compared to 2.53% registered in the same period a year ago. The ratio of net NPAs reduced to 1.44% as on 30 June 2023 from 2.43% as on 30 June 2022.

Cholamandalam Investment and Finance: The company’s net profit increased 28.3% to Rs 726.01 crore on 49.2% jump in total income to Rs 4,133.62 crore in Q1FY24 over Q1FY23. Net income margin stood at 7.3% as on 30 June 2023 as compared with 8% as on 30 June 2022. Aggregate disbursements in Q1FY24 were at Rs 20,015 crore as against Rs 13,329 crore in Q1FY23. Assets under management as of 30 June 2023, grew by 42% at Rs 122,755 crore as compared to Rs 86,703 crore as of 30 June 2022. Its net NPA has come down to 2.82% in June 2023 against 3.11% in March 2023.

Prism Johnson: The company’s net profit rose to Rs 20.8 crore as compared to a loss of Rs 16 crore posted a year ago. Its revenue rose 7% YoY to Rs 1,942.2 crore from Rs 1,811.1 crore in the corresponding quarter last fiscal. EBITDA rose nearly 26 percent YoY to Rs 151.7 crore while operating margin expanded to 7.8 percent from 6.6 percent a year ago.