POST-MARKET REPORT

The Indian equity benchmark ended lower in a volatile session today amid selling capital goods, power, and FMCG names.

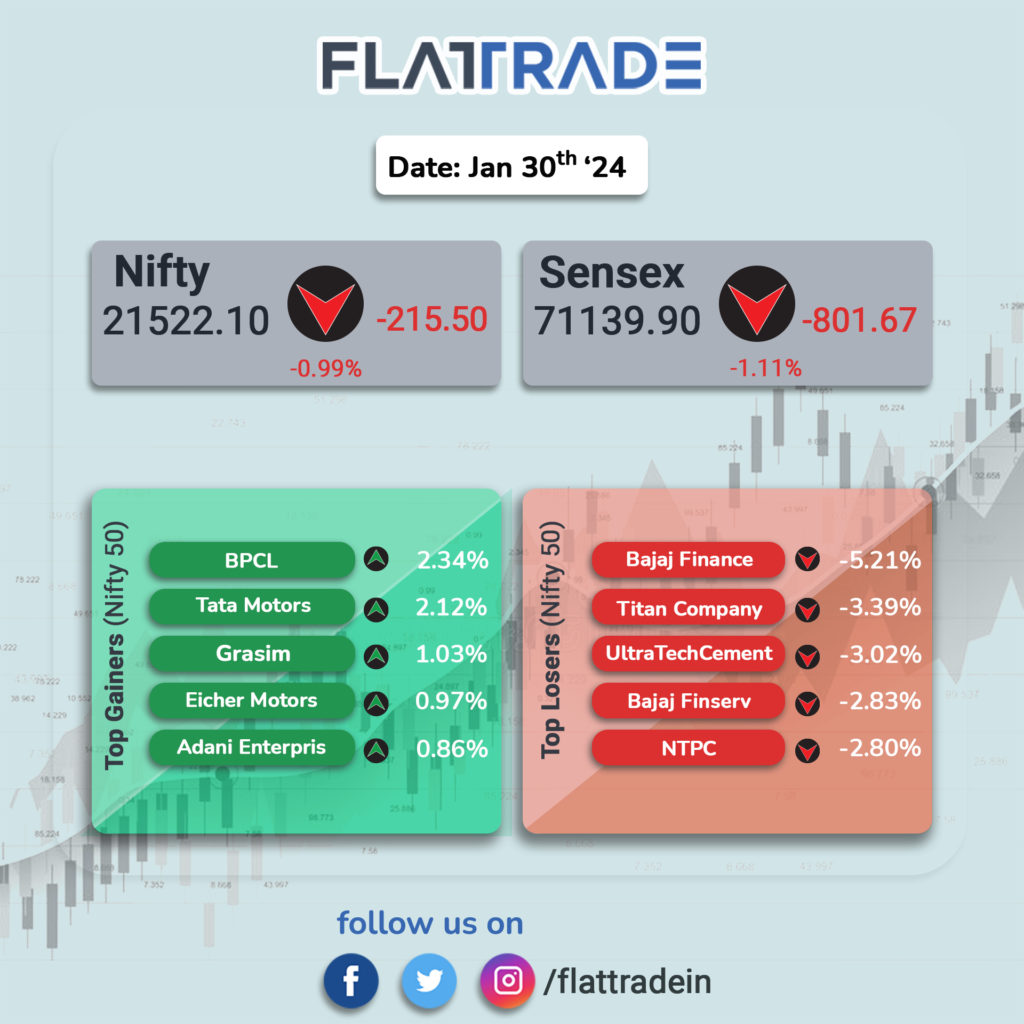

At close, the Sensex was down 801.67 points, or 1.11 percent and the Nifty was down 215.50 points, or 0.99 percent.

Top Nifty losers were Bajaj Finance, Titan Company, UltraTech Cement, NTPC, and Bajaj Finserv, while gainers were Tata Motors, BPCL, Grasim Industries, Eicher Motors and Adani Enterprises.

Among sectors, except realty and PSU bank, all indices ended in the red, with capital goods, FMCG, pharma, and power down 0.5-1 percent.

The BSE midcap index shed 0.5 percent, while the smallcap index ended on a flat note.

The Indian rupee ended flat at 83.11 per dollar versus the previous close of 83.13.

STOCKS TODAY

VIP Industries: Luggage maker VIP Industries Ltd on January 30 reported a consolidated net profit of Rs 7.15 crore for the December quarter of FY24, which is 83.78 percent down from Rs 44.10 crore in the same quarter of the previous financial year.

Adani Total Gas: The company said its consolidated net profit for the quarter ended December 2023 rose 17.61 percent to Rs 176.64 crore, up from Rs 150.19 crore in the same quarter last year. Its revenue from operations stood at Rs 1,244 crore, registering a growth of 4.93 percent from Rs 1,185.50 crore in the corresponding quarter last fiscal, the company said in an exchange filing.

Tata Motors: Shares of Tata Motors surged 5 percent to an all-time high ahead of its Q3FY24 results announcement. The company’s stock has gained significantly on the back of record sales in its Jaguar Land Rover (JLR) volumes in Q3 and its decision to hike prices for its passenger vehicles. The stock has rallied over 10 percent in the last 1 month.

Zee Entertainment: shares surged 8.9 percent on January 30 morning on reports that there will be an emergency arbitration hearing of the now junked Zee-Sony merger a day later in Singapore. On January 24, Zee moved the National Company Law Tribunal (NCLT) and Singapore International Arbitration Centre (SIAC) against Sony Pictures. SIAC would have an emergency hearing on January 31, CNBC-TV18 said.

Macrotech Developers: The company reported stellar growth for the quarter ended December 2023 with best-ever pre-sales numbers. The real estate developer’s net profit jumped 24.4 percent on-year to Rs 503.3 crore, and revenue soared 65.2 percent YoY to Rs 2,930.6 crore, its highest ever.

Marico: FMCG player Marico’s share price gained 1.3 percent in early trade today after the firm recorded a consolidated net profit of Rs 386 crore for the October-December quarter, marking a growth of 16 percent from Rs 333 crore in the year-ago quarter. Total revenue of the company stood at Rs 2,422 crore, falling two percent from Rs 2,470 crore in the year-ago quarter, the FMCG company said in a regulatory filing.