POST-MARKET REPORT

Indian benchmark indices ended deep in the red on Thursday, their third straight session of closing lower, weighed down by a raft of weak March quarter results and the uncertainty surrounding the ongoing 2024 Lok Sabha elections.

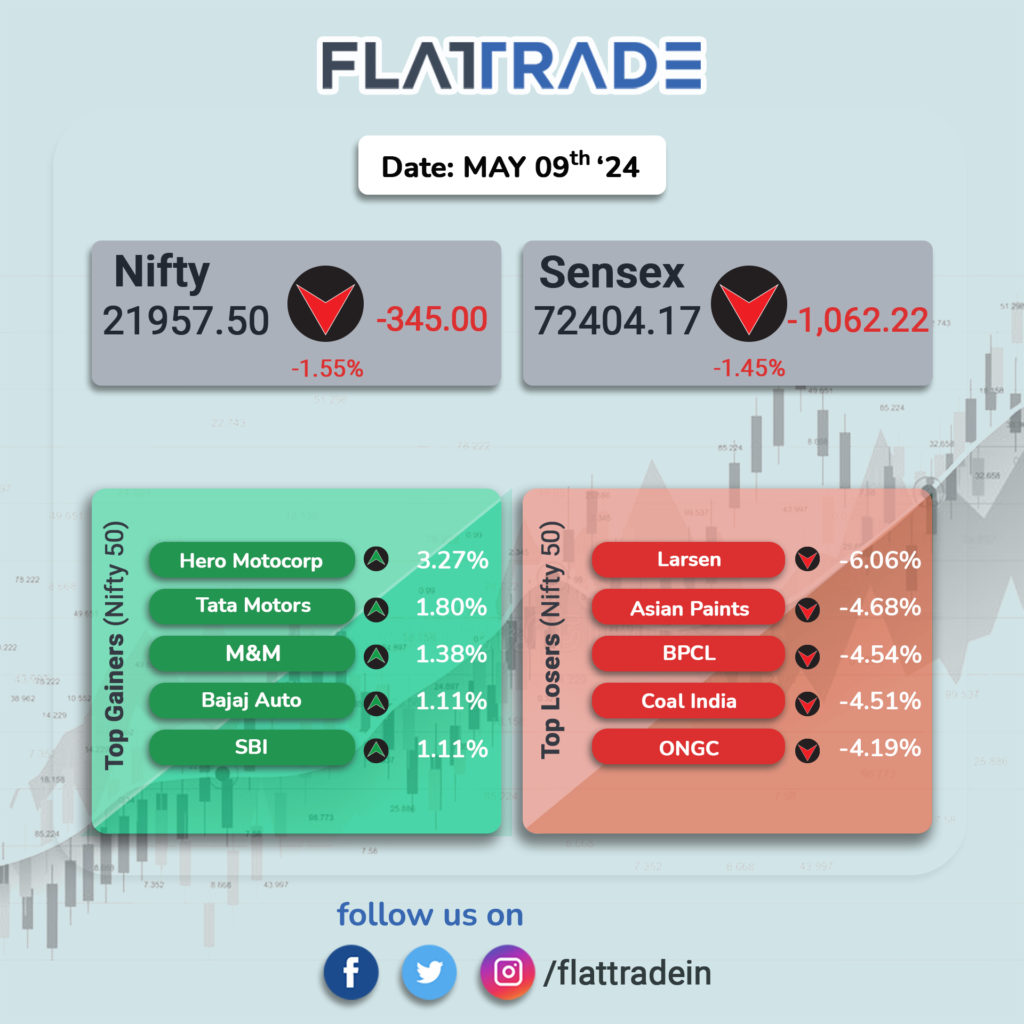

The Sensex closed 1,062 points at 72,404, and Nifty 50 was down 345 points at 21,958.

Gainers and Losers on Nifty

Only seven stocks, Hero MotoCorp, Tata Motors, Mahindra & Mahindra, Bajaj Auto, SBI, Infosys, and HCLTech, out of the 50 on the Nifty 50 were in the green, while Larsen & Toubro, Asian Paints, BPCL, Coal India, and ONGC were the top drags.

Gainers and Losers on Sensex

Only five stocks, Tata Motors, Mahindra & Mahindra, SBI, Infosys, and HCLTech, out of the 30 on the BSE Sensex were in the green, while Larsen & Toubro, Asian Paints, ITC, JSW Steel, and IndusInd Bank were the top drags.

Sectoral Indices performance

Across sectors, the Auto index continued to maintain its lead as the only sectoral index trading in the green. It was up 0.84%. Barring that, all other sectoral indices were trading in the red.

Broader market indices today

The broader market was deep in the red, with the BSE SmallCap index down 2.17% and the BSE MidCap index down 1.76%.

STOCKS TODAY

Jupiter Wagons: Shares of Jupiter Wagons rose 4 percent after its net profit jumped over two-fold year-on-year (YoY) to Rs 104.2 crore in the January-March quarter (Q4FY24) from Rs 40.7 crore a year back. Analysts at Systematix raised the target price to Rs 535 per share from Rs 474 following its upbeat Q4 performance, indicating an upside of over 19 percent from current levels.

Bajaj Consumer: Bajaj Consumer stock fell 7 percent after the company posted a 12 percent fall in consolidated net profit for the quarter that ended in March. The small-cap FMCG player’s net profit came in at Rs 35.58 crore, compared to Rs 40.46 crore for the same quarter in the year-ago period. The total revenue fell 3.8 percent on-year to Rs 239.96 crore for the quarter, from Rs 249.42 crore in the March quarter of FY23.

Muthoot Finance: Shares of Muthoot Finance and Manappuram Finance fell a day after the Reserve Bank of India reported to them an advisory letter limiting cash disbursal of loans. The central bank has reportedly asked both NBFCs to strictly adhere to the Income Tax Act (IT) provision on cash disbursement and said that no NBFC should disburse loan amounts above Rs 20,000 in cash.

Tata Power: Tata Power stock fell 4 percent after company’s the thermal generation (including coal) cluster saw a sharp 58 percent year-on-year drop in PAT, primarily on account of losses of Rs 43 crore, said Kotak Institutional Equities. The company’s net profit rose 11.37 percent to Rs 1,045.59 crore in the fourth quarter.

Hero Motocorp: Shares of Hero Motocorp jumped 3 percent after the world’s leading two-wheeler company’s robust Q4 results prompted brokerages to maintain a bullish sentiment due to positive growth prospects. During the quarter, the automobile giant reported an 18.4 percent increase in net profit, reaching Rs 1,016 crore, driven by robust volume growth, a diverse product mix, decreasing commodity expenses, and increased average selling prices (ASPs).

Larsen and Toubro: Shares of Larsen and Toubro plunged 5 percent after the company gave weak guidance. L&T Chief Financial Officer R Shankar Raman said order inflows in Q1 and Q2 of FY25 will be muted due to the ongoing Lok Sabha elections and the new government taking time to award projects after coming to power.

Asian Paints: Asian Paints stock fell 4 percent after the company’s Q4 earnings missed estimates. The company’s net profit increased 1.3 percent YoY to Rs 1,275.3 crore. Its revenue fell by 0.64 percent to Rs 8,730.76 crore.