POST-MARKET REPORT

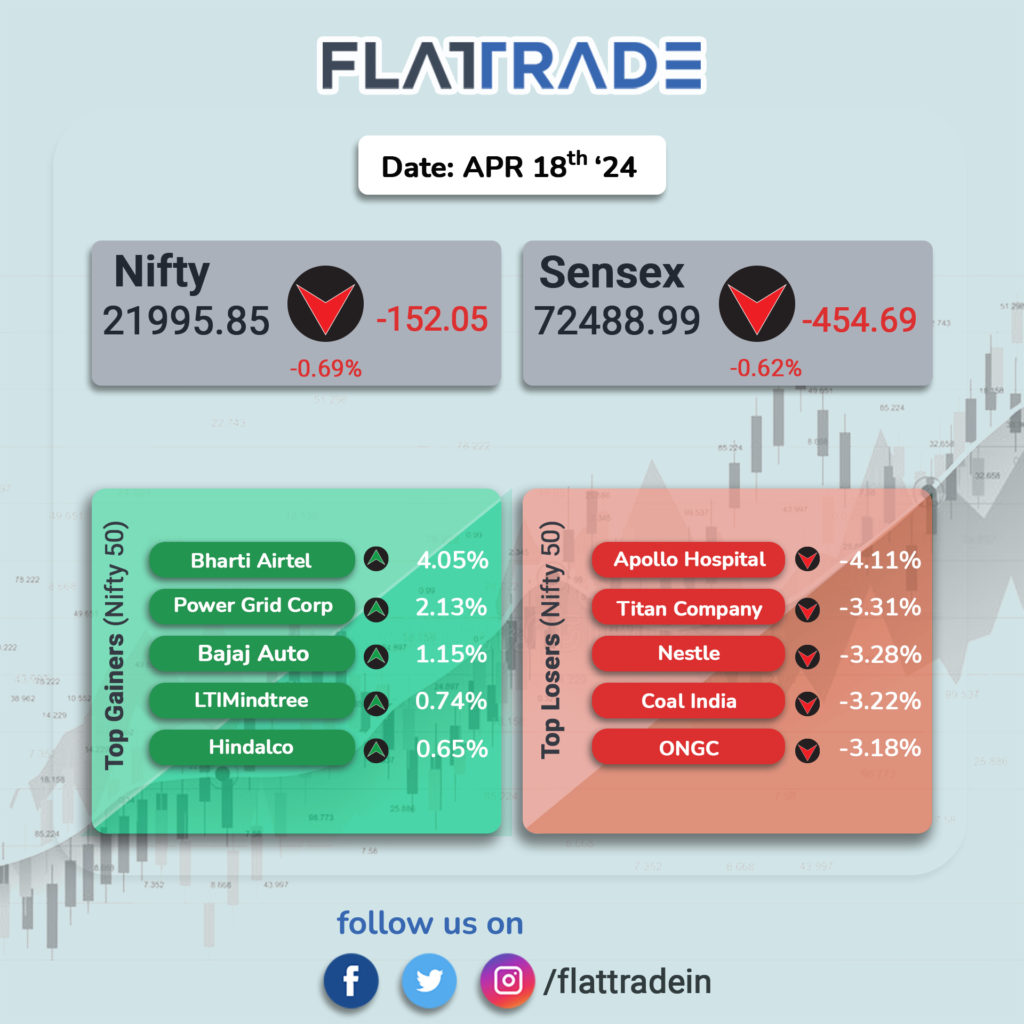

In a highly volatile session, Indian equity indices ended lower for the fourth straight day on April 18 with Nifty below 22,000.

At close, the Sensex was down 454.69 points or 0.62 percent at 72,488.99, and the Nifty was down 152.05 points or 0.69 percent at 21,995.85.

The biggest losers on the Nifty included Apollo Hospitals, Nestle India, ONGC, Adani Enterprises, and Titan Company, while gainers were Bharti Airtel, Power Grid Corporation, Hindalco Industries, Bajaj Auto, and LTIMindtree.

Among the sectoral indices, Except telecom and media, all other sectoral indices were in the red.

Considering broader market indices, the BSE midcap index shed 0.4 percent, while the smallcap index ended on a flat note.

STOCKS TODAY

HDFC Life Insurance: Shares of HDFC Life Insurance Company were trading 1.1 percent higher after the insurer announced fiscal fourth-quarter results that beat expectations. The company reported a net profit of Rs 411 crore for the January-March quarter, up 14.8 percent from a year ago.

Nestle India: Shares of Nestle India tumbled nearly 3 percent on April 18, registering its worst fall in three years after a report by Public Eye, called out the FMCG major for adding sugar and honey to its best-selling infant milk and cereal products in developing countries like India but not in the European markets.

Mastek: Mastek stock surged 8 percent after the company won a £1.2-billion UK digital and IT services supply order from the British Defence Ministry. The project budget will be spread across a period of four years. Mastek has been assigned to provide solutions, enterprise and tech architecture, data, innovation, tech assurance, and knowledge and information management for the UK Ministry of Defence’s digital and professional services framework.

Power Grid: Power Grid stock gained 2 percent after the company’s successful bid in tariff-based competitive bidding for establishing inter-state transmission systems. The bid for transmission projects in Rajasthan and Gujarat. They will handle evacuating power from specific areas in these regions.

Bharti Airtel: Shares of Bharti Airtel gained 4 percent on expectations of higher than expected Tariff hikes. In a report released this week, IIFL Securities analysts said that they expect to see two rounds of tariff increase in the next three years, which could benefit all three telcos – Bharti Airtel, Vodafone Idea, and Reliance Jio.

Sterling Tools: Sterling Tools, the 2nd largest automotive fastener maker, has signed an MoU with South Korea’s Yongin Electronics Co., Ltd., a key supplier to Hyundai Kia Motor Group. This partnership aims to generate Rs. 250 crore in business over 5 years and boost EV and electronic component production in India.

Brigade Enterprises: Shares of Brigade Enterprises jumped 4 percent after the company recorded pre-sales of Rs 2,243 crore in Q4 and Rs 6,013 crore in FY24, both being the highest ever for a quarter as well as a full fiscal. The average realization for FY24 grew 23 percent on-year, while collections across the group rose to Rs 5,915 crore in FY24, up from Rs 5,424 crore a year ago.