POST-MARKET REPORT

Indian stock market benchmarks the Sensex and the Nifty 50 ended with losses for the third consecutive session on Tuesday with IT heavyweight stocks among the top losers, amid weak global cues.

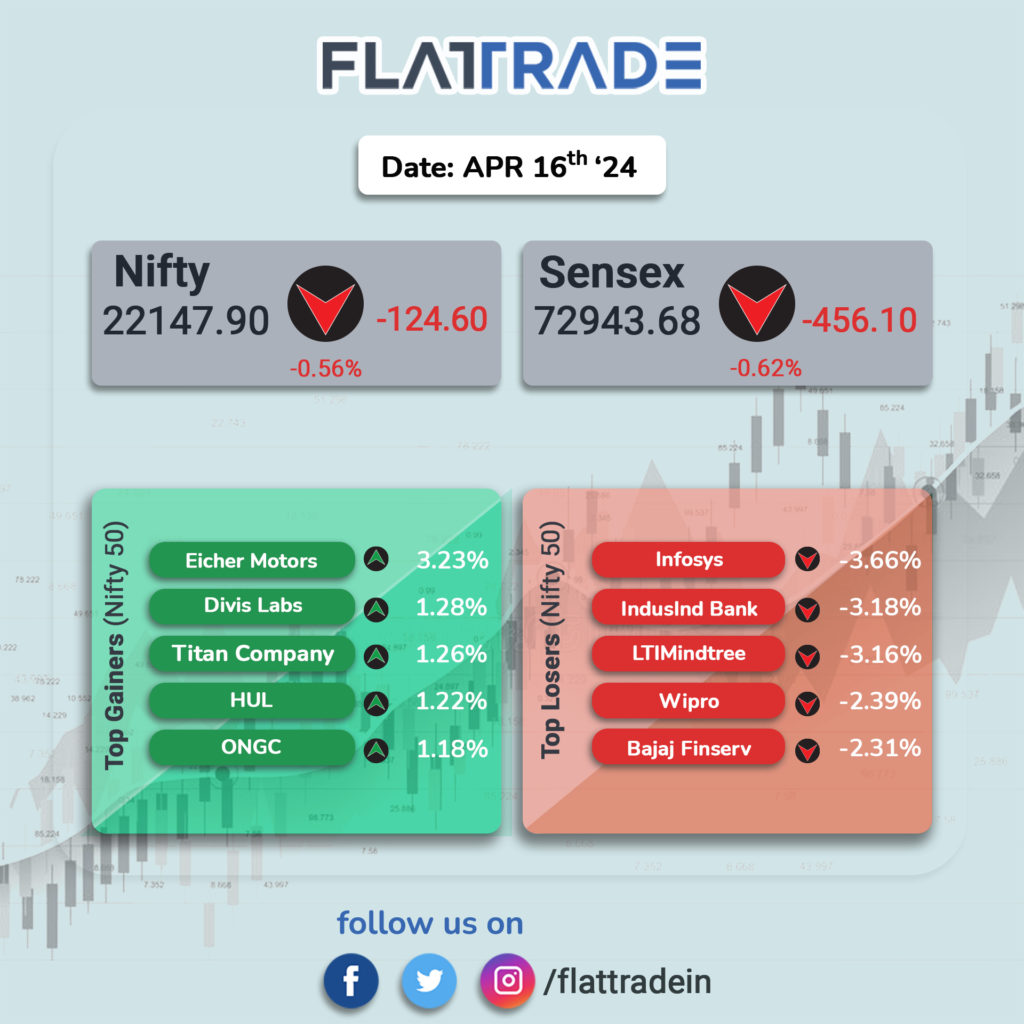

At close, Sensex was down by 456 points, or 0.62 percent, lower ending at 72,943.68 while the Nifty 50 ended with a loss of 125 points, or 0.56 percent, at 22,147.90.

Shares of Eicher Motors, Hindustan Unilever, ONGC, Titan, Divi’s Labs, and HDFC Bank ended as the top gainers in the Nifty 50 index, rising 1-3 percent. Meanwhile, as many as 34 stocks ended lower in the Nifty 50 index among which Infosys, LTIMindtree, IndusInd Bank, Bajaj Finserv, Wipro, and HCL Tech ended as the top losers.

Considering the broader markets, Mid and smallcap indices, however, ended in the green, outperforming the benchmarks. The BSE Midcap index inched up by 0.05 percent while the BSE Smallcap index ended with a healthy gain of 0.57 percent.

Among the sectors, the Nifty IT index ended as the top loser with a loss of 2.58 percent. Nifty PSU Bank index fell 1.27 percent and the private bank index declined 0.66 percent. Nifty Bank fell 0.60 percent and Nifty Media rose 1.57 percent.

STOCKS TODAY

PVR Inox: Kotak Institutional Equities in its latest note cut the target price of PVR Inox to Rs 1500 from Rs 1700 but maintained add rating with expectations of subdued fourth-quarter earnings. The brokerage also expects the upcoming general election in April and May and the ICC T20 World Cup in June is likely to weigh the fiscal 2025 first-quarter pipeline and collections.

Cipla: Cipla’s share price was trading flat in early trade on April 16 after it was announced the company was going to acquire a business undertaking from Ivia Beaute Private Limited. Cipla Health Limited India, a wholly owned subsidiary of the company, signed a business transfer agreement (BTA) for the purchase of the distribution and marketing business undertaking of cosmetics and personal care business from Ivia Beaute Private Limited India.

HDFC Bank: Global brokerage firm Jefferies maintained a ‘buy’ rating on India’s biggest private lender, HDFC Bank, saying that its margin improvement will be key to increasing the RoA and re-rating valuations. The brokerage firm assigned a target price of Rs 1,800 per share, signaling an upside of 20 percent from current levels.

Zaggle Prepaid Ocean Services Ltd: Brokerage Equirus Securities has initiated a ‘buy’ call on Zaggle Prepaid Ocean Services Ltd and raised the target price by 43 percent to Rs 400 a share from its current market price. Zaggle has primarily self-funded its growth as a startup. It specializes in spending management, offering three main products: ‘Propel’ for corporate rewards and incentives, ‘Save’ for employee reimbursement and tax benefits, and ‘Zoyer’ for integrated data-driven spending management.

Jio Financial Services: Shares of Jio Financial Services Ltd jumped high in intraday trading on April 16 after the company announced an equal joint venture with BlackRock to launch a wealth management business. Over the past six months, Jio shares have soared 64 percent. Notably, Jio has delivered positive monthly returns consistently from November 2023 to March 2024.

VST Industries: Shares of VST Industries gained nearly 2 percent at the open on the NSE on April 16, a day after veteran investor Radhakishan Damani bought 2.33 lakh shares, or a 1.51 percent stake, in the company. According to exchange information, Damani, who is the founder and chairman of retail chain Avenue Supermarts (DMart), picked up an additional stake in VST Industries at an average price of Rs 3,689.96. He previously held around 32.89 percent stake.