POST-MARKET REPORT

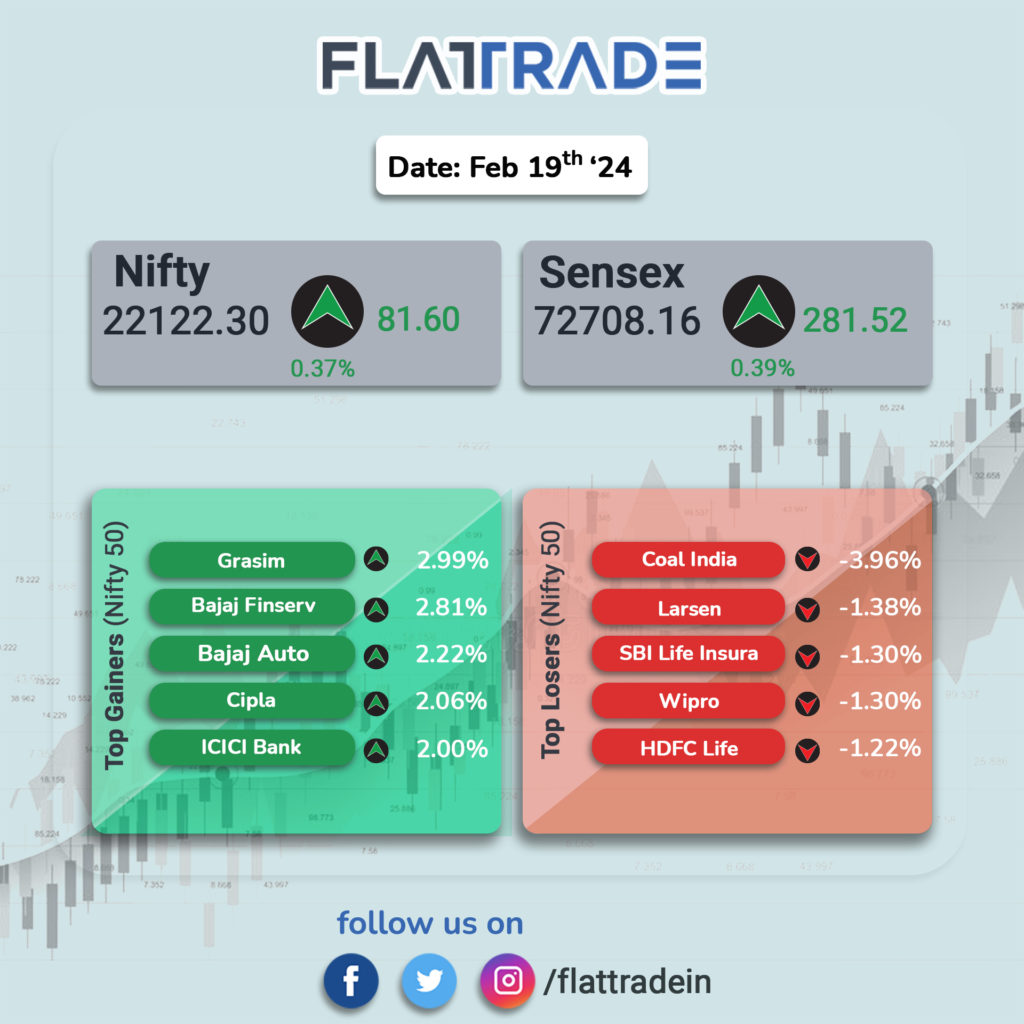

The market went on to trade higher for the fifth consecutive session and closed near the day’s high with Nifty hitting a fresh all-time intraday high of 22,186.65. At close, the Sensex was up 281.52 points or 0.39 percent at 72,708.16, and the Nifty was up 81.60 points or 0.37 percent at 22,122.30.

The top gainers on the Nifty were Grasim Industries, Bajaj Finserv, Bajaj Auto, ICICI Bank and Cipla, while the losers were Coal India, SBI Life Insurance, L&T, Wipro and HDFC Life.

Among sectors, capital goods, IT metal, and realty ended in the red, while auto, bank, FMCG, healthcare, oil & gas, power up 0.3 -1 percent. BSE Midcap index added 0.3 percent and Smallcap index rose 0.7 percent

The Indian Rupee stands at 83.03 per US dollar

STOCKS TODAY

Yes Bank: The shares were down by 4.58 percent after 0.86 percent of the bank’s equity changed hands during the trading session. Global investment firm Carlyle Group on February 15 pared a 1.3 percent stake in Yes Bank for Rs 1,057 crore through an open market transaction. The US-based Group, through its affiliate CA Basque Investments, offloaded 39 crore shares of Yes Bank on the Bombay Stock Exchange. on the same day, Morgan Stanley Asia Singapore PTE via a bulk deal bought 30 crore shares of Yes Bank for Rs 27.1 apiece. The deal transaction amounted to Rs 830 crore, which made up 1.06 percent of the total equity of Yes Bank.

Schaeffler India: The stock of Schaeffler India sank 1.44 percent in trade after the motion technology company recorded a 9.25 percent on-year decline in consolidated profit. Revenue from operations grew by 4.5 percent to Rs 1,875 crore compared to the year-ago period. The board has recommended a dividend of Rs 26 per share, marking a payout ratio of 45 percent.

RVNL: The RVNL stock surged 5.84 percent after the company said its order book grew to Rs 65,000 crore. The state-run company is looking out for projects in off-shore markets, including Central Asia the UAE, and Western Asia, it said in an investors call.

LIC: Shares of Life Insurance Corporation of India closed 1.36 percent higher after the insurer announced that it received refund orders worth Rs 21,740 crore. The refund was for the 2012-2019 period. The total refund value is Rs 25,464 crore and the company was pursuing the balance with the Income Tax Department, the company said in a regulatory filing.

CRISIL: The CRISIL stock zoomed nearly 10 percent after the rating agency reported a 33 percent on-year increase in consolidated net profit in the December quarter. The net profit came in at Rs 210.1 crore, driven by healthy operating numbers. Revenue jumped 11.6 percent year-on-year to Rs 917.7 crore.

Dr Reddy’s Laboratories: Shares of Dr Reddy’s Laboratories gained 1.55 percent following reports that the company is in the race to acquire Novartis AG’s stake in Novartis India. The management of Dr Reddy’s has also repeatedly hinted at its interest in acquiring a domestic-focused portfolio.

PB Fintech: The PB Fintech stock rallied 7.81 percent after the company announced that its wholly-owned subsidiary, Policybazaar Insurance Brokers, obtained approval from the Insurance Regulatory and Development Authority of India (IRDAI) to upgrade its license from a direct insurance broker to a composite insurance broker.

NHPC: The stock gained 4.52 percent after Prime Minister Narendra Modi laid the foundation for the 300 MW solar power plant in Rajasthan being set up by NHPC. According to the exchange filing, the project is being set up by NHPC under the CPSU Scheme, Phase-II, Tranche-III with a total investment of over Rs 1,732 crore and is to be commissioned by September.