POST-MARKET REPORT

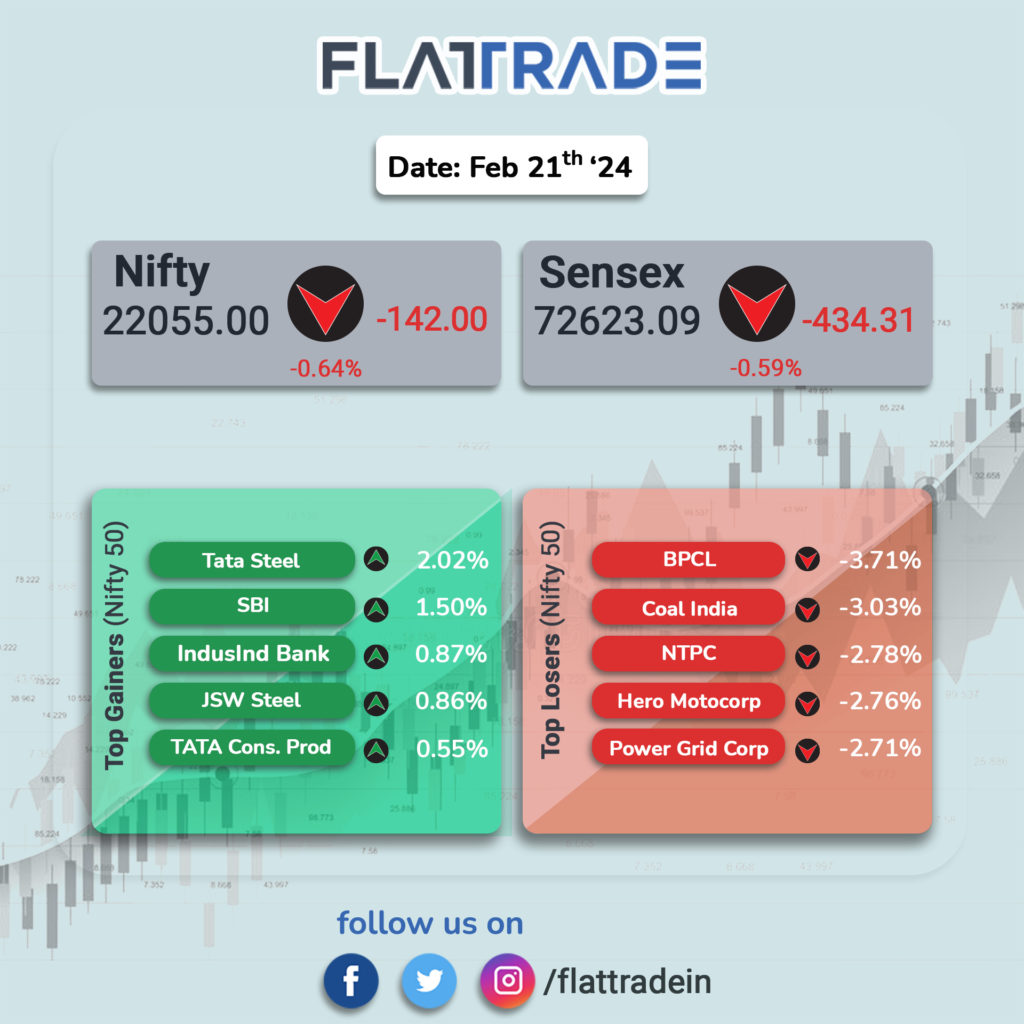

Domestic benchmark indices broke their winning run as traders booked profits. IT and oil & gas stocks were the biggest drags on the indices. The Sensex ended 434.31 points or 0.59 percent down at 72,623.09 and the Nifty closed 142 points or 0.64 percent lower at 22,055.

The top Gainers were Tata Steel, SBI, and JSW Steel, and BPCL, Coal India, NTPC, Power Grid Corp., and HDFC Life, were the top losers on Nifty.

Most sectors closed in the red. Nifty Media was the biggest loser, closing 4.91 percent down, Nifty Realty gained 2 percent and was the biggest sectoral gainer

The rupee consolidated in a narrow range and appreciated 1 paisa to close at 82.96 (provisional) against the US dollar.

STOCKS TODAY

Tata Steel: Shares of Tata Steel and other steel companies gained following the rise in coking coal prices. Coking coal is a key raw material used in the manufacture of steel through the blast furnace route. In September 2023, industry executive Bimlendra Jha said that steel prices in India are registering an upward trend due to “rapidly” increasing rates of coking coal.

Paytm: The One 97 Communications stock, the parent company of Paytm, surged 5 percent and was locked in an upper circuit for the third straight session after the RBI extended the deadline for Paytm Payments Bank to March 15, a deal with Axis Bank and “outperform” call from Bernstein.

HFCL: The HFCL stock rose 3 percent intraday and hit a 52-week high after the company announced a strategic expansion into Europe by establishing an optical fiber cable manufacturing facility in Poland. The stock lost some of the gains and closed at 0.77 percent higher.

DLF: Shares of DLF rallied 2.73 percent after the company’s wholly-owned subsidiary DLF Home Developers entered into a private agreement with Axis Trustee Services and IREO Private to acquire a land parcel in Gurugram for Rs 1,241 crore.

Zee Entertainment: Shares of Zee Entertainment plunged 14.02 percent after Bloomberg reported that Sebi found about $241 million might have been diverted from the company. According to the report, the Securities and Exchange Board of India has been in conversation with senior officials at Zee, including its founders Subhash Chandra and his son Punit Goenka, and some board members to explain their stance.

Union Bank of India: Shares of Union Bank of India rose nearly 3 percent after the PSU lender announced a Rs 3,000-crore qualified institutional placement at a floor price of Rs 142.78 a share. The floor price is at a marginal premium to the last closing price of Rs 141.10.

Hero Motocorp: Shares of Hero Motocorp fell 2.65 percent after CLSA predicted a single-digit volume growth for two-wheelers in February. The firm added that the competition in the space is escalating, especially in the electric vehicle space and premium motorcycle segment. This could potentially affect the margins of original equipment manufacturers.