Data center (DC) capacity is expected increase six times to 5,100-5,200 MW in the next six years, helped by significant data explosion and favourable regulatory policy initiatives, according to rating agency ICRA. Consequently, India’s share in global installed capacity is likely to rise 15-17% by 2028 from around 4% (19 GW) as of 2022.

The rating agency further said that the industry is estimated to receive an investment of about Rs 1.6 lakh crore in the next six years. The majority of upcoming investments are directed at meeting the strong demand for co-location services. The high demand is likely to be driven by hyperscalers and segments which require strict data confidentiality like BFSI, IT/ITES etc.

Hyperscalers, also known as hyperscale cloud providers or hyperscale data centers, are companies that operate enormously huge data centers and cloud computing infrastructure to deliver cloud services to a vast number of users and businesses.

“While cloud, 5G roll-out, machine learning and internet of things (IoT) are expected to generate enormous data and storage requirements, Generative AI-led high computing requirements present a new wave of demand for DC capacity and a significant opportunity for DC operators,” said Anupama Reddy, Vice-President and Co-Group Head, Corporate Ratings, ICRA.

ICRA further said that the rise in data will be fuelled by adoption of new technologies, increased consumption of digital content, the ongoing emphasis by the Government on e-Governance, higher penetration of e-commerce and digital financial transactions.

In addition, favourable regulatory policies like the Digital Data Protection Bill, awarding infrastructure status to data centers, exclusive policies and incentives by various state governments, are expected to boost investments in data centers across the country.

Favourable locations for setting up data centers

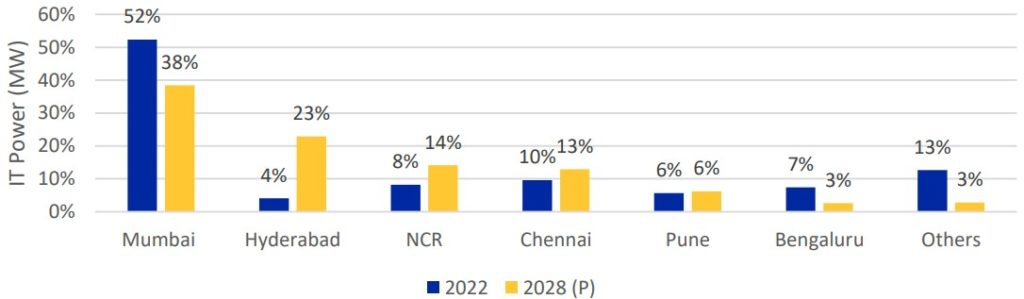

According to ICRA, some of key parameters for setting up data centers were location, proximity to landing stations, fibre connectivity, uninterrupted power supply and high scoring on disaster proofing. Given these requirements, and proximity to tenant headquarters, Mumbai has emerged as the most sought after data center destination in the country.

Source: ICRA Research

Chennai also has presence of landing stations, but its reputation as one of the important data center location took a hit due to the floods of 2017 and 2018, the rating agency noted. The other key emerging locations are Hyderabad and Pune, wherein some of the large hyperscalers are setting up huge data centers closer to their operational bases in India. Overall, Mumbai, Hyderabad, NCR and Chennai are likely to account for 85% of the installed data center capacity by 2028.

Revenue forecast

ICRA said that the revenue of its sample set is projected to grow at a compound annual growth rate (CAGR) of 19-20% between FY2024 and FY2025, driven by heightened utilization of rack capacity and the expansion of new data centers. With higher revenues and better absorption of fixed costs, the operating margins are expected to remain in the range of 43-44%.

“The RoCE is expected to be modest as the DC players are in continuous capex mode and the ramp-up of new DCs will happen over a period of time,” Reddy said.

The rating agency noted that pricing flexibility of DC players may be constrained due to intense competition affecting the margins for incremental business. Additionally, the ongoing large debt-funded capital expenditure would weigh on the credit metrics of DC companies.