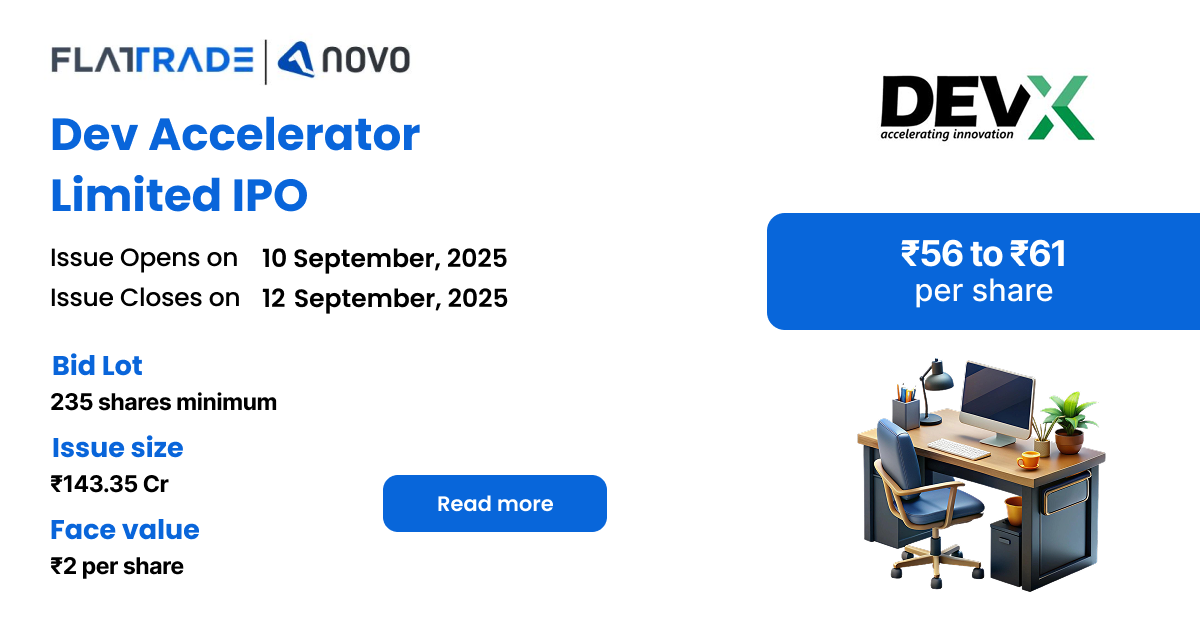

Dev Accelerator IPO is a bookbuilt issue of Rs 143.35 crore. This issue is entirely a fresh issue of 2.35 crore shares with no offer for sale.

The IPO opens for subscription on September 10, 2025, and closes on September 12, 2025. The allotment is expected to be finalized on Monday, September 15, 2025. The price band for the IPO is set at ₹56 to ₹61 per share, and the minimum lot size for an application is 235 shares.

Company Summary

Established in 2017, Dev Accelerator Limited, commonly known as DevX, provides flexible office spaces, including coworking environments. The company has expanded its presence to 15 centers across India, encompassing major cities such as Delhi-NCR, Hyderabad, Mumbai, and Pune.

The company’s business model focuses on providing flexible workspace solutions tailored to the evolving needs of modern businesses. This includes offering customizable desks and suites, accommodating remote work trends, and providing flexible lease options.

As of May 31, 2025, the company serves over 250 clients and has 28 centres across 11 cities in India, with 14,144 seats covering a total area under management of 860,522 square feet.

The company has signed Letters of Intent (LOIs) for three new centers, including the company’s first international centre in Sydney, Australia. Additionally, we have leased space for a new center in Surat. These upcoming centers will offer 11,500 seats across a total area of 897,341 sq. ft.

Dev Accelerator Limited provides flexible office space solutions, including managed offices and coworking spaces, to large corporates, MNCs, and SMEs. The company’s subsidiary, Neddle and Thread Designs LLP, also offers design and execution services.

Company Strengths

- Expansion into new and existing markets with strong financial and operational metrics.

- Customer-centric business model with an integrated platform approach for long-term customer relationships.

- The company offers fully customisable office spaces with quality designs and assured delivery within 90 to 120 days.

- Experienced promoters and management team with deep industry expertise.

Company Financials

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 540.38 | 411.09 | 282.42 |

| Total Income | 178.89 | 110.73 | 71.37 |

| Profit After Tax | 1.74 | 0.43 | -12.83 |

| EBITDA | 80.46 | 64.74 | 29.88 |

| Net Worth | 54.79 | 28.79 | 1.22 |

| Total Borrowing | 130.67 | 101.05 | 33.2 |

| Amount in ₹ Crore | |||

Objectives of IPO

- Capital expenditure for fit-outs in the new Centres and for security deposits of the new Centres.

- Repayment and/or pre-payment, in full or part, of certain borrowings availed by our Company, including redemption of NCDs

- General corporate purposes

Promoters of the company

Parth Shah, Umesh Uttamchandani, Rushit Shah, and Dev Information Technology Limited are the company promoters.

IPO Details

| IPO Date | September 10, 2025 to September 12, 2025 |

| Listing Date | September 17, 2025 |

| Face Value | ₹2 per share |

| Price Band | ₹56 to ₹61 per share |

| Lot size | 235 shares |

| Total Issue size | 2,35,00,000 shares (aggregating upto ₹143.35 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 6,66,87,515 shares |

| Share Holding Post Issue | 9,01,87,515 shares |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 235 | ₹14,335.00 |

| Retail (Max) | 13 | 3,055 | ₹1,86,355.00 |

| S-HNI (Min) | 14 | 3,290 | ₹2,00,690.00 |

| S-HNI (Max) | 69 | 16,215 | ₹9,89,115.00 |

| B-HNI (Min) | 70 | 16,450 | ₹10,03,450.00 |

Allotment Schedule

| Basis of Allotment | Mon, 15 Sep, 2025 |

| Initiation of Refunds | Tue, 16 Sep, 2025 |

| Credit of Shares to Demat | Tue, 16 Sep, 2025 |

| Tentative Listing Date | Wed, 17 Sep, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 12, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Issue |

| Retail Shares Offered | Not more than 10% of the Issue |

| NII Shares Offered | Not more than 15% of the Issue |

To check allotment, click here